1. The Stagecoach Era & Gold Rush (1852–1905)

Wells Fargo was born out of the chaos of the California Gold Rush to fill a vacuum in banking and transport.

- 1852 Founding: Henry Wells and William G. Fargo (founders of American Express) established the company to provide “express” and banking services to California.

- The Stagecoach Icon: They operated the legendary stagecoach lines, transporting gold, mail, and passengers across the dangerous Western frontier.

- Pony Express: In 1861, Wells Fargo took over the management of the western leg of the Pony Express.

Core Strategy: Safety and Speed. The goal was to provide the most reliable physical network for transporting gold and information in a lawless frontier. They built “trust” as a brand asset by ensuring that gold reached its destination despite stagecoach robberies.

Revenue & Scale: While modern SEC-style reporting didn’t exist, they dominated the Western market. By 1866, after the “Grand Consolidation” of stage lines, they held a near-monopoly on express transport in the West, with capital stock valued at $10million (a massive sum at the time).

2. Transition to Modern Banking (1905–1960s)

The company evolved as technology rendered the stagecoach obsolete.

- Separation of Services: In 1905, the banking operations were formally separated from the express delivery business.

- End of Express: In 1918, during World War I, the U.S. government consolidated all domestic express businesses into a single agency, forcing Wells Fargo to focus exclusively on commercial and retail banking.

- Regional Dominance: Through a series of mergers, such as with American Trust Company in 1960, it became a powerhouse in Northern California.

Core Strategy: Commercial Specialization. After splitting from the express business, the strategy shifted to serving the growing industrial and agricultural economy of California. They moved away from logistics to focus on traditional lending and deposit-taking.

Revenue & Scale: Steady regional growth. Following the 1960 merger with American Trust Company, the bank’s assets reached approximately $2.4billion, making it the 11th largest bank in the U.S. and a dominant force on the West Coast.

3. Innovation and Rapid Expansion (1970s–1998)

Wells Fargo became a pioneer in how Americans interacted with their money.

- Digital Firsts: They were among the first to introduce ATMs and, in 1995, became the first major U.S. bank to offer online banking.

- Retail Strategy: The bank treated branches like “stores,” focusing heavily on “cross-selling”—the practice of selling multiple products (credit cards, mortgages, insurance) to a single customer.

- The Norwest Merger (1998): Minneapolis-based Norwest Corporation acquired Wells Fargo. Although Norwest was the survivor, they kept the Wells Fargo name due to its iconic history.

Core Strategy: The “Financial Store” & Cross-Selling. Led by CEOs like Dick Cooley and Carl Reichardt, the bank pioneered the idea that banking is a retail business. They focused on “cross-selling”—pushing multiple products to every customer—and utilized technology (ATMs and Online Banking) to drive down costs.

Revenue & Scale: Massive acceleration. By the time of the Norwest merger in 1998, the combined entity had total assets of $191billion and an annual net income of approximately $2.9billion.

4. The Wachovia Acquisition & National Giant (1998–2016)

This era saw the bank transform from a Western regional player into a truly national institution.

- 2008 Financial Crisis: While other banks were failing, Wells Fargo remained relatively stable. It acquired Wachovia Bank, which was on the brink of collapse, doubling its size and gaining a massive footprint on the East Coast.

- Market Leader: For several years following the crisis, it was often ranked as the world’s most valuable bank by market capitalization.

Core Strategy: Coast-to-Coast Dominance. The strategy was to achieve unmatched scale through the 2008 acquisition of Wachovia. They aimed to be the “neighborhood bank” for all of America, leveraging a massive branch network to sell mortgages, credit cards, and wealth management services.

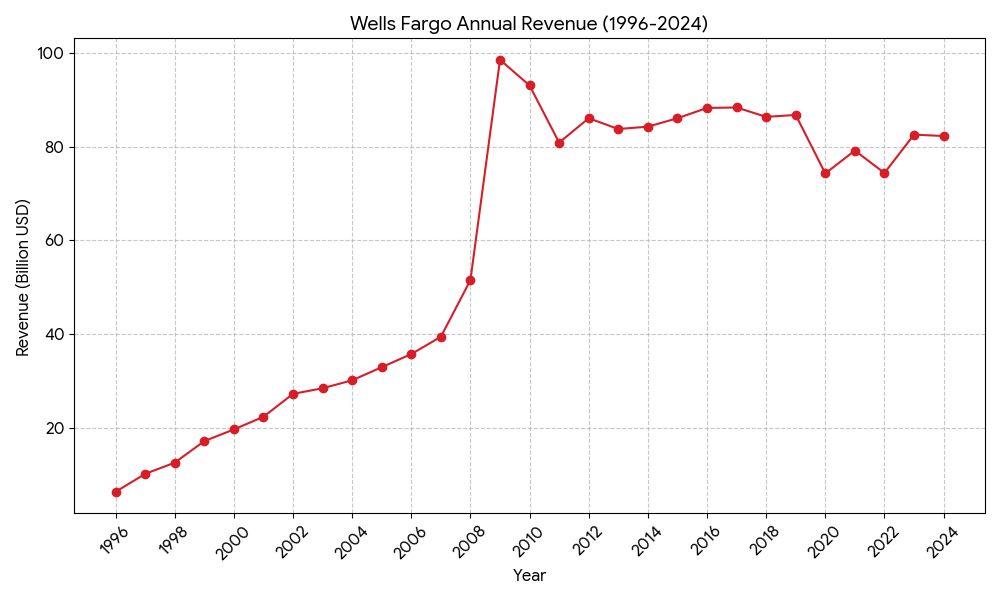

Revenue & Scale: Peak profitability.

- Revenue: Annual revenue climbed past $80billion by 2011.

- Net Income: Consistently generated over $20billion in annual profit between 2013 and 2015.

- Market Cap: It became the world’s most valuable bank, with a market capitalization exceeding $280billion.

5. Sales Scandal & Regulatory Reckoning (2016–Present)

The “cross-selling” culture eventually led to a massive corporate crisis.

- Fake Accounts Scandal: In 2016, it was revealed that employees had opened millions of unauthorized accounts to meet impossible sales quotas.

- Asset Cap: The Federal Reserve imposed an unprecedented “asset cap,” preventing the bank from growing larger until it proved it had fixed its internal culture and risk management.

- Current Status: The bank is currently undergoing a multi-year turnaround plan under new leadership, focusing on streamlining operations, resolving legal issues, and regaining public trust.

Core Strategy: Efficiency & Remediation. Under the Fed’s “Asset Cap” (limiting assets to $1.95trillion), the bank can no longer grow by simply getting bigger. The strategy has shifted to “Simplifying the Bank”—selling off non-core businesses (like asset management), cutting billions in costs, and fixing regulatory compliance.

Revenue & Scale: Stagnation under pressure.

- Revenue: Has fluctuated between $72billion and $83billion in recent years (2024 revenue was approximately $82.3billion).

- Constraints: Profitability is currently driven by interest rate margins and cost-cutting rather than asset growth, as they wait for the Federal Reserve to lift the growth restrictions.

Wells Fargo is currently in a “turnaround” phase, transitioning from a period of intense regulatory restriction to one of offensive growth. In 2026, its competition with the other members of the “Big Four”—JPMorgan Chase, Bank of America, and Citigroup—is focused on regaining market share in the U.S. domestic market.

1. Competitive Landscape: The Big Four

| Competitor | Core Strength | Conflict with Wells Fargo |

| JPMorgan Chase | Dominant scale and technology leadership ($4T+ assets). | Competition for digital-first retail customers and mid-market corporate banking. |

| Bank of America | Excellence in integrated wealth management (Merrill) and ESG. | Direct battle for the “Main Street” consumer and physical branch dominance. |

| Citigroup | Global institutional network and high-end credit card presence. | Overlap in credit card rewards and corporate treasury services. |

| Fintech/Regional | High agility (e.g., PNC, Truist, or SoFi). | Eroding the mortgage and small business loan base through faster digital UX. |

2. SWOT Analysis

Strengths

- Massive Physical Footprint: With roughly 4,200 branches, it maintains one of the largest networks in the U.S., which is a goldmine for capturing low-cost deposits.

- Middle-Market Leadership: Wells Fargo has historically been the top lender to U.S. mid-sized businesses, a sector with high loyalty and healthy margins.

- Leaner Operations: Having spent years under cost-cutting mandates, the bank has significantly improved its efficiency ratio compared to its 2018-2020 levels.

Weaknesses

- Regulatory Legacy: Compliance costs remain higher than peers due to the long-standing oversight required to fix past systemic issues.

- Domestic Concentration: Unlike Citi or JPMorgan, Wells Fargo is almost entirely dependent on the U.S. economy. This lacks geographic diversification during local downturns.

- Underdeveloped Investment Bank: While growing, its Corporate and Investment Banking (CIB) unit still lags significantly behind the “bulge bracket” firms in M&A advisory fees.

Opportunities

- The “Asset Cap” Exit: As the $1.95 trillion asset limit is fully lifted in 2025-2026, the bank can finally outpace peers in loan growth, particularly in credit cards and auto loans.

- Credit Card Offensive: Recent launches of the “Signet” and “Journey” card lines (and others) indicate a strategy to aggressively take market share from American Express and Chase.

- Wealth Management Synergy: Better integrating its Wealth and Investment Management (WIM) clients with its retail banking base to increase “wallet share.”

Threats

- Interest Rate Sensitivity: Wells Fargo is highly sensitive to the net interest margin (NIM). A rapid decline in rates by the Fed could squeeze its profits more than its fee-heavy competitors.

- Digital Displacement: If the bank fails to match the AI-driven personalization of fintech apps, it risks losing the Gen Z and Alpha demographic.

3. Strategic Outlook for 2026

The bank is currently executing a “Back to Basics” strategy but with modern tools:

- Talent Acquisition: Over the past 24 months, Wells Fargo has aggressively poached senior bankers from Goldman Sachs and JPMorgan to bolster its investment banking and trading divisions.

- Digital Modernization: Significant investment in “Fargo,” their AI virtual assistant, to close the gap in mobile banking user experience.

- Capital Return: With the lifting of restrictions, analysts expect Wells Fargo to be one of the most aggressive banks in returning capital to shareholders through buybacks and dividends in 2026.

The Wells Fargo Fake Accounts Scandal is widely considered one of the most significant corporate ethics failures in financial history. It fundamentally altered the U.S. regulatory landscape and destroyed a century-old brand reputation for “conservative stability.”

1. The Root Cause: “Cross-Selling” Gone Wrong

For years, Wells Fargo was the darling of Wall Street (and Warren Buffett) because of its legendary ability to sell multiple products to a single customer.

- “Going for Gr8”: Management set a goal for every customer to have eight financial products (checking, savings, credit card, mortgage, etc.).

- Toxic Culture: Branch employees were under extreme daily pressure to meet impossible sales quotas. Failure to meet these goals often resulted in public shaming, threats of termination, or actual firing.

2. The Mechanism of Fraud (2002–2016)

To survive, employees began “gaming” the system. They used customer data to open unauthorized accounts without the customers’ knowledge or consent.

- Sandbagging: Delaying the processing of an application until the next reporting period to meet future goals.

- Pinning: Assigning PINs to customer accounts without authorization to “activate” them.

- Simulated Funding: Moving money from a customer’s real account into a fake one to make it appear active (sometimes causing customers to be hit with overdraft fees).

- Credit Card Fraud: Applying for credit cards in customers’ names, which damaged their credit scores and led to unauthorized annual fees.

3. The Scale of the Damage

- 3.5 Million Accounts: Investigations eventually revealed that roughly 3.5 million unauthorized accounts were opened over a 14-year period.

- 5,300 Employees Fired: Initially, the bank tried to blame “rogue” low-level employees, firing thousands. However, it was later proven that the problem was systemic and driven by top-down pressure.

- Executive Downfall: CEO John Stumpf was forced to resign and was later barred for life from the banking industry. Retail banking head Carrie Tolstedt also faced severe legal and financial penalties.

4. Financial and Regulatory Consequences

The fallout was catastrophic for the bank’s growth:

- $3 Billion Settlement: In 2020, Wells Fargo reached a deal with the DOJ and SEC to settle criminal and civil investigations.

- The Federal Reserve Asset Cap: In 2018, the Fed imposed a growth ban, limiting the bank’s assets to $1.95 trillion. This is the harshest penalty ever given to a major U.S. bank, effectively “freezing” Wells Fargo while competitors like JPMorgan grew significantly.

5. Recovery and The “New” Wells Fargo (2026 Status)

Under current CEO Charlie Scharf, the bank has spent the last several years undergoing a massive cleanup:

- Scrapping Sales Goals: Product-based sales goals for branch employees were completely eliminated.

- Centralized Compliance: The bank moved from a decentralized model (where each business unit policed itself) to a centralized, independent risk management structure.

- The Path to Exit: As of early 2026, the bank has successfully completed several “consent orders” (legal agreements to fix issues), and markets are closely watching for the final removal of the asset cap.

Source:

- https://www.britannica.com/topic/Wells-Fargo-and-Company

- https://www.wellsfargo.com/about/corporate/history/https://www.macrotrends.net/stocks/charts/WFC/wells-fargo/revenue

- https://companiesmarketcap.com/wells-fargo/revenue/

- https://www.wellsfargo.com/about/investor-relations/

- https://www.justice.gov/opa/pr/wells-fargo-agrees-pay-3-billion-resolve-criminal-and-civil-investigations

- https://www.federalreserve.gov/newsevents/pressreleases/enforcement20180202a.htm

- https://www.sec.gov/news/press-release/2020-38https://www.reuters.com/business/finance/

- https://www.cnbc.com/wells-fargo/https://www.forbes.com/companies/wells-fargo/

Back to Wells Fargo page