The history of Visa is a story of how a localized experiment by a single bank transformed into the world’s leading digital payment network. Its evolution can be broken down into the following key phases:

Phase 1: The Origins and the Fresno Drop (1958-1970)

- 1958: Bank of America launched the BankAmericard program in Fresno, California. This was the first “revolving credit” card, where 65,000 residents were mailed a paper card with a pre-approved credit limit.

- 1966: To expand outside California, Bank of America began licensing the BankAmericard program to other banks across the US and eventually internationally (e.g., Barclaycard in the UK).

Revenue and Financials: This was an experimental phase characterized by high initial losses. Bank of America faced millions of dollars in losses due to credit defaults and fraud shortly after the 1958 launch.

Core Milestones: The creation of the first “revolving credit” mechanism. In 1966, the program moved beyond California as Bank of America began licensing BankAmericard to other banks, establishing the foundation for a global network.

Phase 2: Decentralization and Birth of the Brand (1970-1976)

- 1970: Under the leadership of Dee Hock, the licensee banks formed a cooperative called National BankAmericard Inc. (NBI) to take control of the program from Bank of America.

- 1973: The launch of BASE I, the first computerized system for electronic credit authorizations, revolutionized transaction speed.

- 1974: International Bankcard Company (IBANCO) was formed to manage the international business.

- 1976: The brand was officially renamed Visa. The name was chosen because it sounds the same in almost every language and represents a document that allows for international travel and acceptance.

Revenue and Financials: As the number of member banks grew, transaction volume scaled significantly. However, the organization operated as a non-profit membership corporation where profits were largely retained by individual member banks.

Core Milestones: In 1970, National BankAmericard Inc. (NBI) was formed as an independent entity. In 1973, Visa launched BASE1, the first centralized electronic authorization system. In 1976, the brand was officially renamed Visa to ensure global recognition.

Phase 3: Product Expansion and Technology (1975-2006)

- 1975: The launch of the first debit card, allowing consumers to pay directly from their bank accounts.

- 1980s: Visa introduced the first global ATM network and launched the Visa Gold card in 1986.

- 1990s-2000s: Visa focused on security and the rise of e-commerce, introducing “Verified by Visa” to protect online transactions and implementing EMV chip technology.

Revenue and Financials: Transaction fee revenue grew exponentially with the mass adoption of debit cards. By the late 1990s, Visa became the world leader in payment volume and card issuance.

Core Milestones: Launch of the first debit card in 1975. During the 1980s, Visa established a global ATM network. In the 1990s, the company co-developed the EMV (chip card) global security standard, significantly reducing physical card fraud.

Phase 4: Global Consolidation and IPO (2007-2016)

- 2007: To increase efficiency, several regional Visa entities (Visa USA, Visa Canada, Visa International) merged to form Visa Inc.

- 2008: Visa Inc. went public on the New York Stock Exchange (NYSE). The IPO raised 17.9 billion USD, making it one of the largest IPOs in US history at the time.

- 2016: Visa Inc. completed its acquisition of Visa Europe, which had remained a separate entity, finally uniting the brand globally under one company.

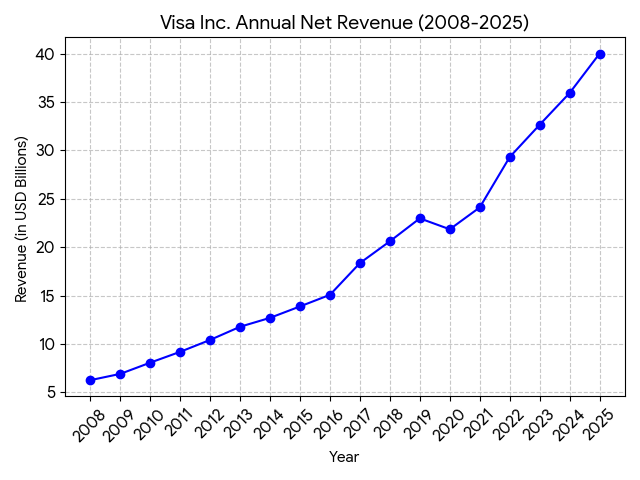

Revenue and Financials: Annual net revenue surpassed 10 billion USD in the early 2010s. The 2008 IPO raised 17.9 billion USD, which was the largest in US history at that time.

Core Milestones: In 2007, regional Visa entities merged to form Visa Inc. (except Visa Europe). The 2008 listing on the NYSE marked the transition from a bank-owned association to a public corporation. In 2016, Visa Inc. acquired Visa Europe to unify the brand globally.

Phase 5: Digital Transformation and Future Tech (2017-Present)

- Modern Era: Visa has shifted from being a “card company” to a “network of networks.” It now focuses on contactless payments, mobile wallets (Apple Pay/Google Pay), and B2B payments.

- 2021-2025: The company began integrating blockchain technology, supporting stablecoin (USDC) settlements, and heavily investing in AI for real-time fraud detection.

Revenue and Financials: Annual revenue has grown to over 30 billion USD with operating margins consistently around 60%. Profitability is now driven heavily by cross-border transaction fees and data processing services.

Core Milestones: Implementation of Tokenization technology to secure mobile payments like Apple Pay. In 2021, Visa began supporting stablecoin (USDC) settlements. By 2024-2025, the company integrated generative AI for advanced fraud detection and real-time risk management.

Sources:

- Visa Official Website: History of Visa

- Britannica: Visa Inc. Company Profile

- New York Times: Visa’s 2008 IPO Archive