The history of UnitedHealth Group (UNH) is a story of a small regional company transforming into a global healthcare powerhouse through relentless vertical integration and data-driven diversification.

The evolution can be broken down into four distinct phases:

1. The Foundation & HMO Innovation (1974–1984)

During this period, the company pioneered the Managed Care model, shifting away from traditional fee-for-service medicine.

- 1974: Richard Burke founds Charter Med Inc. in Minnetonka, Minnesota.

- 1977: United HealthCare Corporation is established to reorganize the company and manage the newly formed Physicians Health Plan of Minnesota (a network-based HMO).

- 1984: The company goes public, providing the capital necessary for national expansion.

Core Strategy: Pioneered the Health Maintenance Organization (HMO) model. The focus was on disrupting traditional claim models by establishing initial physician networks and developing early computerized claim processing systems to improve operational efficiency.

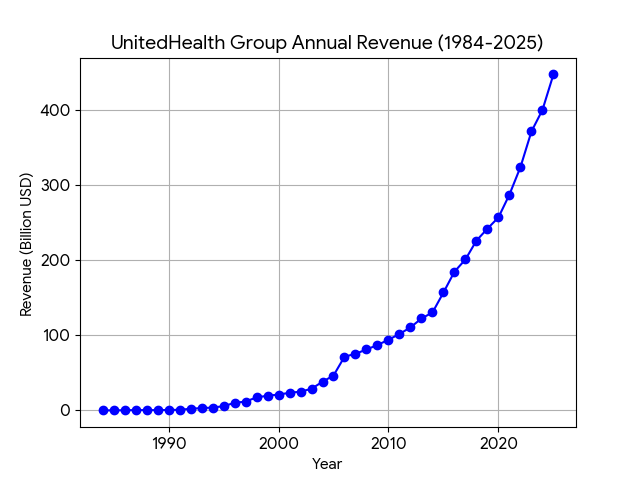

Revenue Level: At the time of its initial public offering (1984), revenue was below $500 million, identifying it as a local medical service provider.

2. National Expansion & Structural Evolution (1984–2000)

This era was defined by massive acquisitions that turned UNH into a nationwide insurance provider.

- 1995: The acquisition of MetraHealth for $1.65 billion (a combination of Travelers and MetLife’s group health businesses) instantly made UNH the largest manager of employer-sponsored healthcare in the U.S.

- 1998: The company undergoes a major restructuring into a holding company format and renames itself UnitedHealth Group.

- Segment Diversification: UNH begins segmenting its business into specialized units, including specialized health services and international markets.

Core Strategy: Achieved “economies of scale” through large-scale horizontal acquisitions. By acquiring major insurance businesses like MetraHealth, the company expanded its service footprint across the United States. It reorganized into a holding company structure, establishing an employer-sponsored insurance growth model.

Revenue Level: Revenue experienced rapid growth from several billion to approximately $20 billion (about $19.6 billion in 1999).

3. The Birth of Optum & Vertical Integration (2000–2015)

UNH realized that controlling the “payment” (insurance) was not enough; they needed to control the “service” (delivery and data).

- 2004–2005: Major acquisitions of Oxford Health Plans and PacifiCare solidify its presence in the Northeast and West Coast.

- 2011: The launch of Optum. UNH combined its existing pharmacy benefit management (PBM), health analytics, and care delivery businesses under one brand. This created a “double engine” where insurance (UnitedHealthcare) and services (Optum) feed into each other.

- 2012: Acquisition of Amil Participações, Brazil’s largest healthcare company, marking a significant push into international markets.

Core Strategy: Launched the “Insurance + Service” dual-engine strategy. The Optum brand was officially established in 2011, integrating Pharmacy Benefit Management (PBM), health data analytics, and physical clinics. The strategy shifted toward an “internal loop,” allowing premiums from the insurance side to flow into its own service segment, reducing external costs.

Revenue Level: Entered an explosive growth phase, rising from $40 billion to a scale of $150 billion (reaching $157.1 billion in 2015).

4. The Data & Provider Powerhouse Era (2015–Present)

UNH has evolved from an insurance company into a technology and clinical care giant, focusing on “Value-Based Care.”

- Provider Consolidation: UNH (via Optum Health) began buying thousands of physician practices and surgical centers. Today, they are the largest employer of physicians in the U.S.

- The Data Fortress: In 2022, they completed the $13 billion acquisition of Change Healthcare, a massive claims-clearinghouse, giving them unprecedented access to healthcare data across the entire U.S. system.

- Home Health Pivot: With the acquisitions of LHC Group and Amedisys, the company is moving aggressively into home-based care to reduce hospital costs.

- Current Status: As of 2025, revenue has exceeded $440 billion. While it faces ongoing antitrust scrutiny, its integrated model remains the industry benchmark for profitability and efficiency.

Core Strategy: Established data barriers and a Value-Based Care ecosystem. The acquisition of Change Healthcare secured access to medical payment data across the U.S. By acquiring numerous primary care clinics and home health agencies, the profit center shifted from simple “insurance premiums” to “managing medical outcomes.”

Revenue Level: Revenue surpassed the $200 billion milestone. It reached approximately $370 billion in 2024 and is projected to exceed $440 billion in 2025.

As of early 2026, UnitedHealth Group (UNH) is no longer just competing as an insurance provider; it is competing as a vertically integrated healthcare technology and delivery platform. Its competitive landscape is defined by its “double-engine” model (UnitedHealthcare + Optum).

Here is the competitive analysis of UNH in English:

1. The Competitive Landscape

UNH’s competitors are generally categorized into two groups:

- Vertical Integrators (Direct Rivals): CVS Health (CVS) is the most direct competitor. Following its acquisition of Aetna and Oak Street Health, CVS mirrors UNH’s strategy by combining insurance, pharmacy (CVS Pharmacy/Caremark), and primary care delivery.

- Traditional Payers (Insurance Rivals): Elevance Health (ELV) and Humana (HUM). These companies compete primarily in the Medicare Advantage (MA) and commercial insurance markets. Humana, in particular, is a fierce rival in the senior care space but lacks UNH’s diversified technology arm (OptumInsight).

2. Key Competitive Advantages

- Provider Dominance: UNH is the largest employer of physicians in the U.S. (approx. 90,000 doctors). By owning the clinics (OptumHealth), UNH can direct its insurance members to its own doctors, keeping the “medical spend” within the family.

- The Data Moat (OptumInsight): With the integration of Change Healthcare, UNH processes a vast portion of all U.S. medical claims. This gives them a predictive data advantage that pure insurance companies like Elevance or Humana cannot match.

- Scale and Capital Allocation: UNH’s massive cash flow (2025 revenue exceeded $440B) allows it to outbid competitors for high-growth assets in home health (LHC Group) and ambulatory surgery.

3. Current Market Dynamics (2026 Context)

- Margin Over Volume Strategy: In 2026, UNH has pivoted away from aggressive membership growth to focus on Margin Recovery. Due to lower-than-expected Medicare Advantage (MA) rate increases from the government, UNH plans to exit certain unprofitable markets, which may lead to a membership decline of 2.2 million to 2.8 million people in 2026.

- The Medicare Advantage Battle: Competitors like Humana are struggling more than UNH because they are less diversified. UNH’s Optum segment acts as a financial hedge; when insurance margins are squeezed by policy changes, the service-side (Optum) often captures that value.

- AI Efficiency Gap: UNH is aggressively deploying AI to automate claims processing and clinical documentation, aiming for $1 billion in cost savings in 2026. This creates a cost-structure advantage that smaller insurers find difficult to replicate.

4. SWOT Summary

- Strengths: Unrivaled vertical integration; massive proprietary data sets; strong presence in high-margin home health.

- Weaknesses: High regulatory and antitrust scrutiny (the “too big to fail” of healthcare); vulnerability to Medicare policy shifts.

- Opportunities: Expansion of value-based care (getting paid for outcomes rather than visits); international expansion in Latin America and Europe.

- Threats: Potential “PBM Transparency” legislation that could impact OptumRx margins; rising medical loss ratios (MLR) due to increased utilization by seniors.

In 2026, the competitive landscape for UnitedHealth Group (UNH) is no longer a simple battle for insurance premiums. UNH has fundamentally detached itself from the “traditional payer” model, creating a widening gap between itself and rivals like Humana (HUM), Elevance Health (ELV), and Centene (CNC).

Here is a detailed comparison of how UNH competes against traditional health insurance models:

1. Revenue Diversification: “Double Engine” vs. “Single Engine”

- Traditional Insurers (The Single Engine): Companies like Humana and Centene are “pure-play” or “near-pure-play” insurers. Their revenue is almost entirely dependent on premiums. If the government cuts Medicare Advantage (MA) rates—as seen in the surprise 2027 rate proposal in early 2026—these companies have no choice but to absorb the loss or cut benefits, leading to massive stock volatility.

- UnitedHealth (The Double Engine): UNH uses Optum as a financial shock absorber. When insurance margins (UnitedHealthcare) are squeezed by regulatory changes or high medical costs, the service side (Optum) often benefits. For example, if a patient requires more care, that “cost” for the insurance arm becomes “revenue” for the Optum clinics and pharmacies.

2. The Physician Mastery (90,000+ Doctors)

- Traditional Insurers: Act as “middlemen.” They negotiate with independent hospitals and doctor groups. They have limited control over how a doctor treats a patient, which makes controlling medical costs (Medical Loss Ratio) difficult.

- UnitedHealth: Is the nation’s largest employer of physicians. As of 2026, UNH employs or manages over 90,000 doctors (roughly 10% of all U.S. physicians).

- The Advantage: UNH pays its own Optum doctors roughly 17% more than independent practices. While this looks like an expense, it is simply moving money from one UNH pocket to another. This “intercompany” transaction makes the insurance side look less profitable (lowering regulatory “excess profit” scrutiny) while enriching the service side.

3. Data as a Weapon: OptumInsight vs. Actuarial Tables

- Traditional Insurers: Rely on historical claims data and actuarial tables to predict risk. They are often reactive to trends in medical utilization.

- UnitedHealth: Through OptumInsight (and the 2022 acquisition of Change Healthcare), UNH processes a massive portion of all U.S. clinical and financial healthcare data.

- The Advantage: UNH can see real-time shifts in healthcare spending months before competitors. In 2025–2026, while rivals were blindsided by a spike in outpatient surgeries, UNH was already adjusting its 2026 pricing and AI-driven cost-saving initiatives ($1 billion in projected savings for 2026) to stay ahead.

4. Strategic Pivot: Margin over Volume

- Traditional Insurers: Often chase “membership growth” to please investors. This led to a crisis for Humana in early 2026 when they had too many members but not enough margin to cover their care.

- UnitedHealth: In 2026, UNH made a bold competitive move by voluntarily shrinking its membership (projecting a decline of up to 2.8 million members). By exiting unprofitable markets and focusing on high-margin segments, UNH is forcing its traditional competitors into a “race to the bottom” where they must either take UNH’s low-margin rejects or suffer their own profit losses.

Summary Comparison Table (2026)

| Feature | UnitedHealth Group (UNH) | Traditional Insurers (ELV, HUM) |

| Primary Identity | Health Tech & Care Conglomerate | Financial Risk Manager (Payer) |

| Control of Care | High (Directly owns the clinics) | Low (Contracts with 3rd parties) |

| Revenue Hedge | Diversified (Optum offsets Insurance) | Highly sensitive to Medicare/Medicaid rates |

| Data Advantage | Predictive (Proprietary clearinghouse) | Reactive (Standard claims data) |

| 2026 Outlook | Stabilizing through Margin Recovery | Struggling with rate cuts and utilization |

In 2026, the primary battleground for UnitedHealth Group (UNH) is not against traditional insurers, but against other “Vertical Integrators”—giants that own the entire value chain from insurance and pharmacy to clinics and data.

While CVS Health (CVS) is the most symmetric rival, tech and retail titans like Amazon (AMZN) and Walmart (WMT) are challenging UNH through different entry points.

1. UNH vs. CVS Health: The Battle of the Ecosystems

CVS is the only competitor with a structural footprint as broad as UNH’s.

- Integrated Architecture:

- UNH: UnitedHealthcare (Insurance) + Optum (Clinics/Data/PBM).

- CVS: Aetna (Insurance) + Caremark (PBM) + CVS Pharmacy (Retail) + Oak Street Health (Primary Care).

- Key Conflict Zones:

- PBM Dominance: OptumRx (UNH) and Caremark (CVS) are roughly equal in scale. However, CVS leverages its physical retail stores for “last-mile” pharmacy convenience, while UNH uses OptumInsight‘s superior data analytics to win complex corporate contracts.

- Primary Care Deployment: UNH employs ~90,000 physicians via Optum, focusing on a high-volume, broad-specialty model. CVS, through Oak Street Health, specifically targets the high-value Medicare Advantage (MA) senior market. As of 2026, UNH has a more mature network of Ambulatory Surgery Centers, which allows them to capture more clinical savings than CVS’s clinic-focused model.

2. UNH vs. Amazon (Health Services): The Digital Disruption

Amazon lacks an insurance arm but is attempting to “disintermediate” the system through technology.

- Architecture: One Medical (Clinics) + Amazon Pharmacy + AWS Health (Cloud/Data).

- Key Conflict Zones:

- User Experience: Amazon’s friction-less digital interface for scheduling and pharmacy delivery is a direct threat to UNH’s legacy platforms.

- Bypassing the Insurer: Amazon is pitching its health services directly to large employers, effectively cutting out the traditional insurance layer. While Amazon’s physical clinic footprint in 2026 remains small compared to Optum, its rapid growth among “digital-native” populations makes it a long-term threat for acquiring younger members.

3. Competitive Comparison (2026 Metrics)

| Dimension | UnitedHealth Group (UNH) | CVS Health (CVS) | Amazon Health |

| Entry Point | Clinical/Hospital Network | Community Pharmacy | Digital App/Prime |

| Vertical Depth | Extreme (Owns payer, data, provider) | Deep (Strong retail-payer link) | Moderate (No insurance engine) |

| 2026 Edge | Largest U.S. clinical database | High physical community presence | Logistics & Cloud AI capabilities |

| Main Challenge | Severe Antitrust scrutiny | Retail staffing & store closures | Lack of deep government integration |

4. The “Winning Move” in 2026: Value-Based Care

The winner among vertical integrators in 2026 is determined by who manages medical costs most effectively under tight government rate caps.

- The Surgical Advantage: UNH’s major 2026 advantage lies in its OptumHealth Surgery Centers. By shifting patients from expensive hospitals to its own surgical centers, UNH saves 30%–50% per procedure—a level of cost control that CVS and Amazon are still struggling to replicate at scale.

- The Data Moat: Through Change Healthcare, UNH processes the majority of all U.S. medical claims. This gives them “early warning” data on medical utilization spikes (e.g., the 2025 surge in outpatient volumes), allowing UNH to adjust its 2026 pricing and strategy faster than its rivals.

Sources:

- UnitedHealth Group 2024 Q4 & Full Year Earnings Remarks (Jan 2026)

- UnitedHealthcare projects membership decline for 2026 | Becker’s Payer Issues

- CVS vs UNH: A Vertical Integration Comparison | Investopedia

- UnitedHealth Group | History & Growth | Britannica Money

- UnitedHealth Group Timeline: 1977-2023 | MyLens AI

- UNH History – DCFmodeling.com

- AHA Statement on UHG Market Dominance (Jan 2026)

- Morningstar: Managed Care Stocks Plunge on Rate Proposal (Jan 2026)

- Becker’s: UHC Pays Optum Doctors 17% More Than Peers

- CVS vs UNH: A Vertical Integration Comparison | Investopedia

- Amazon’s Primary Care Expansion Strategy (2026 Update) | Harvard Business Review

- S&P Global: Vertical Integration in US Healthcare (UNH, CVS, WMT)

Back to United Health page