Here is the detailed summary of the United Health Group (UNH) 2025 results and 2026 outlook:

2025 Financial Performance and Operating Results

UnitedHealth Group reported full-year 2024 revenue of 421.1 billion, representing a 13.3% increase compared to 371.6 billion in the previous year. This growth was driven by a consistent increase in the number of people served across both Optum and UnitedHealthcare. Despite the strong top-line growth, net earnings for the year were 21.6 billion, a decrease from 22.4 billion in 2024. The full-year medical care ratio stood at 85.2%, influenced by the impact of the Change Healthcare cyberattack and higher medical utilization patterns.

Business Segment Highlights

The UnitedHealthcare segment recorded revenues of 311.5 billion, an increase of 10.9% year-over-year. This growth was primarily fueled by an increase in the number of consumers served through community-based and senior programs. Meanwhile, the Optum segment saw revenue rise by 15.8% to 262.4 billion. Optum Health led this growth by expanding its value-based care models, while Optum Rx benefited from new client wins and the expansion of its pharmacy services.

Cash Flow and Capital Allocation

The company maintained a strong financial position with 2025 cash flows from operations totaling 30.7 billion, which is approximately 1.4 times net income. UnitedHealth Group continued its commitment to shareholder returns, distributing 16.1 billion to shareholders through dividends and share repurchases. The balance sheet remains robust, with total assets growing to 313.4 billion by year-end.

2026 Outlook and Projections

Looking ahead to 2026, UnitedHealth Group established a revenue target range of 450.0 billion to 455.0 billion. The company expects adjusted net earnings to be between 29.50 and 30.00 per share. Furthermore, cash flows from operations are projected to reach between 32.0 billion and 33.0 billion. The company expects to continue its focus on diversifying its service offerings and enhancing the integration of technology within its health services to drive long-term value.

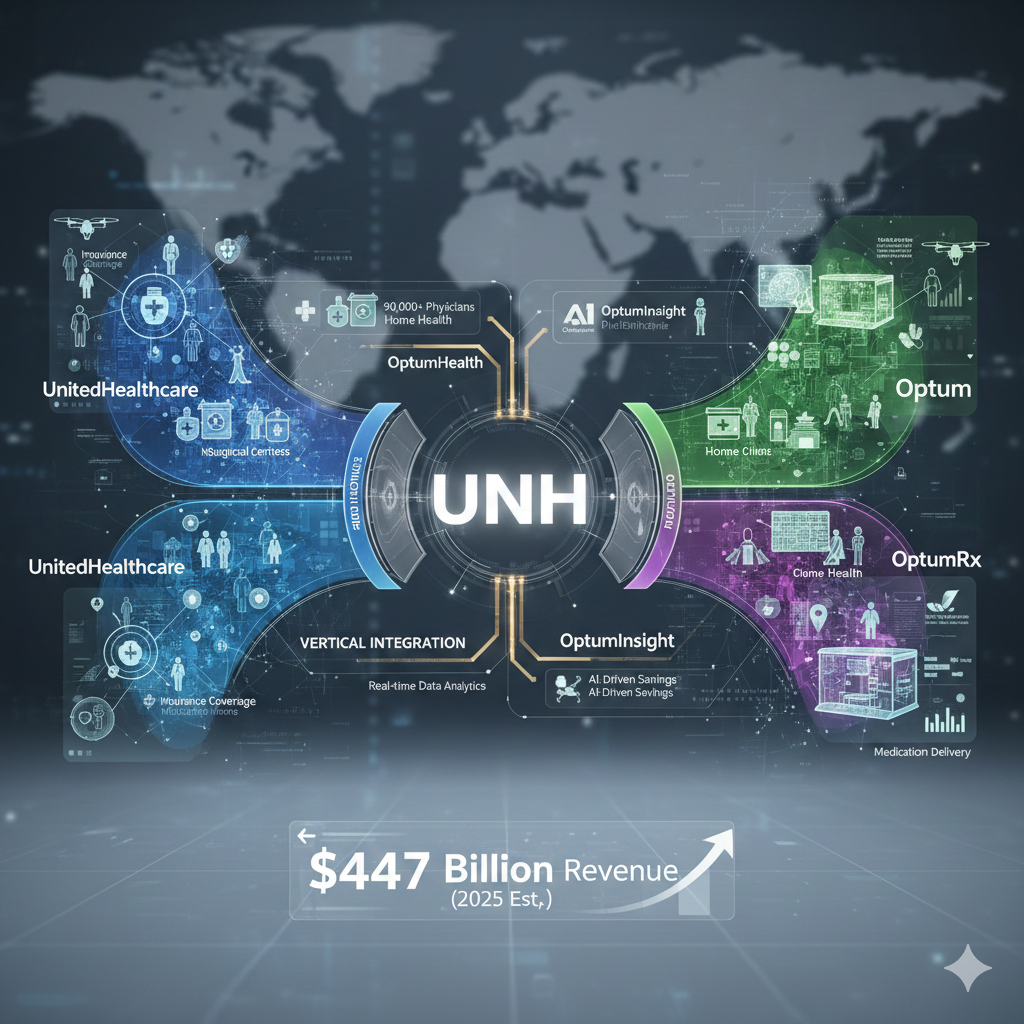

UnitedHealth Group (UNH) operates through two primary platforms: UnitedHealthcare (Health Benefits) and Optum (Health Services). Their core strategy revolves around a “Vertical Integration” model that synergizes insurance and care delivery.

UnitedHealthcare (Health Benefits)

Business Composition

- Employer & Individual: Provides health benefit plans for large employers, small businesses, and individuals.

- Medicare & Retirement: Serves seniors through Medicare Advantage and supplemental plans; this is currently the strongest growth engine.

- Community & State: Manages Medicaid plans for state governments and beneficiaries.

- Global: Provides health insurance and medical services internationally.

Core Strategy

- Scale and Reach: Leveraging a massive member base to negotiate better rates with providers and pharmacy chains.

- Consumer-Centric Innovation: Focusing on simplifying the member experience through digital tools and personalized benefit designs to improve retention and health outcomes.

Optum (Health Services & Technology)

Business Composition

- Optum Health: One of the largest physician groups in the US, providing primary, specialty, surgical, and home-based care.

- Optum Insight: Provides data analytics, technology infrastructure, and research services to hospitals, government agencies, and other insurers.

- Optum Rx: A Pharmacy Benefit Manager (PBM) managing drug procurement, clinical programs, and home delivery pharmacy services.

Core Strategy

- Value-Based Care (VBC): Moving from “fee-for-service” to “fee-for-value.” Optum takes on the clinical and financial risk for patient populations, profiting by keeping patients healthier and out of expensive hospital settings.

- Data-Driven Clinical Insights: Using Optum Insight’s data to guide clinical decisions in Optum Health, reducing medical waste and improving treatment efficacy.

Group-Wide Strategy: The Integrated Ecosystem

1. The Flywheel Effect

UnitedHealthcare directs its members toward Optum’s clinics and pharmacies. This allows the group to capture a higher percentage of total healthcare spend internally, turning an insurance “expense” into a service “revenue” for the same corporation.

2. Controlling the Medical Care Ratio (MCR)

By utilizing Optum’s preventative care and home-based services, the group can lower the overall cost of care for UnitedHealthcare members. This effectively reduces the payout (claims) from the insurance side, directly boosting the group’s consolidated bottom line.

3. Diversified Growth and Resilience

When the insurance segment faces regulatory headwinds or high utilization (as seen in 2025), the service-oriented Optum segments provide a hedge. This diversification ensures stable earnings growth across different economic and policy cycles.

Here is the analysis of the Income Statement for UnitedHealth Group (UNH):

Income Statement

| Item | 2025FY | 2024FY | YoY | % of total rev |

| Total Revenue | 421,085 | 371,622 | 13.3% | 100% |

| Segment Revenue | ||||

| UnitedHealthcare | 311,544 | 280,944 | 10.9% | 74.0% |

| Optum | 262,408 | 226,590 | 15.8% | 62.3% |

| Eliminations | -152,867 | -135,912 | – | – |

| Operating Costs | ||||

| Medical costs | 256,193 | 223,541 | 14.6% | 60.8% |

| Operating costs | 58,011 | 54,491 | 6.5% | 13.8% |

| Cost of products sold | 40,337 | 35,595 | 13.3% | 9.6% |

| Depreciation and amortization | 4,534 | 3,882 | 16.8% | 1.1% |

| Operating Earnings | 31,465 | 32,411 | -2.9% | 7.5% |

| Net Earnings | 21,570 | 22,382 | -3.6% | 5.1% |

Financial Analysis

Revenue Growth Drivers

The 13.3% increase in total revenue reflects robust demand across all business segments. Optum led the growth with a 15.8% increase, primarily driven by Optum Health’s expansion in value-based care and Optum Rx’s success in securing new clients and expanding pharmacy services. UnitedHealthcare maintained steady momentum with 10.9% growth, supported by an increase in the number of people served through Medicare Advantage and Medicaid programs.

Cost Management and Profitability

Medical costs grew by 14.6%, outpacing revenue growth. This was largely due to increased medical care utilization and the operational impacts following the Change Healthcare cyberattack, which pressured the Medical Care Ratio. Consequently, operating earnings declined by 2.9% and net margin tightened to 5.1%. However, the company demonstrated strong discipline in administrative expenses, as operating costs increased by only 6.5%, significantly lower than revenue growth, showcasing operational leverage.

Capital Strength and 2026 Outlook

Despite the slight dip in net earnings, the company generated 30.7 billion in cash flow from operations, allowing for 16.1 billion in shareholder returns through dividends and share buybacks. For 2026, the company issued optimistic guidance with a revenue target of 450 billion to 455 billion and adjusted EPS of 29.50 to 30.00, signaling a recovery from 2025’s transient headwinds and continued long-term growth.

Balance Sheet of United Health

| Item | 2025FY | % of total asset | 2024FY | YoY |

| Assets | ||||

| Cash and short-term investments | 33,767 | 10.8% | 29,152 | 15.8% |

| Accounts receivable | 22,810 | 7.3% | 18,920 | 20.6% |

| Other current assets | 31,489 | 10.0% | 24,784 | 27.1% |

| Total current assets | 88,066 | 28.1% | 72,856 | 20.9% |

| Long-term investments | 46,940 | 15.0% | 40,361 | 16.3% |

| Goodwill and intangible assets | 127,906 | 40.8% | 114,800 | 11.4% |

| Other assets | 50,490 | 16.1% | 45,210 | 11.7% |

| Total assets | 313,402 | 100% | 273,227 | 14.7% |

| Liabilities and Equity | ||||

| Medical cash reserves | 41,200 | 13.1% | 33,622 | 22.5% |

| Accounts payable and accrued liabilities | 70,714 | 22.6% | 58,198 | 21.5% |

| Short-term borrowings | 12,143 | 3.9% | 11,283 | 7.6% |

| Total current liabilities | 124,057 | 39.6% | 103,103 | 20.3% |

| Long-term debt | 66,757 | 21.3% | 58,353 | 14.4% |

| Other liabilities | 22,126 | 7.1% | 17,949 | 23.3% |

| Total equity | 100,462 | 32.1% | 93,822 | 7.1% |

Financial Analysis

Asset Composition and Growth

Total assets increased by 14.7%, reaching 313.4 billion. The most significant portion of the balance sheet remains Goodwill and Intangible assets (40.8%), reflecting the company’s aggressive acquisition strategy to expand its health services ecosystem. Current assets grew by 20.9%, with cash and short-term investments rising to 33.8 billion, providing a solid liquidity buffer for operations and strategic investments.

Liability and Liquidity Management

Total current liabilities rose by 20.3%, primarily driven by a 22.5% increase in medical cash reserves, which indicates higher anticipated claims and medical care utilization. Long-term debt also increased by 14.4% to 66.8 billion, as the company maintains a balanced capital structure to fund its long-term growth initiatives while managing interest obligations.

Equity and Shareholder Value

Total equity surpassed the 100 billion mark, a 7.1% increase year-over-year. This growth was achieved despite the company returning 16.1 billion to shareholders in 2025, demonstrating strong retained earnings capacity and a commitment to maintaining a robust capital base while rewarding investors.

Here is the analysis of the Cash Flow Statement for UnitedHealth Group (UNH):

Cash Flow Statement

| Item | 2025FY | 2024FY | YoY |

| Cash flows from operating activities | 30,683 | 29,058 | 5.6% |

| Cash flows from investing activities | -21,173 | -13,015 | 62.7% |

| Cash flows from financing activities | -4,932 | -15,861 | -68.9% |

| Net increase in cash and cash equivalents | 4,615 | 182 | 2435.7% |

| Cash and cash equivalents, end of period | 33,767 | 29,152 | 15.8% |

FCF Analysis

| Item | Amount (Million) |

| Net Cash from Operations | 30,683 |

| Less: Capital Expenditures | 3,404 |

| Free Cash Flow (FCF) | 27,279 |

Financial Analysis

Cash Generation and Quality

Operating cash flow reached 30.7 billion in 2025, representing approximately 1.4 times the reported net income. This high conversion rate indicates superior earnings quality and robust liquidity management. Despite the operational headwinds such as higher medical utilization and the Change Healthcare incident, the company maintained a healthy 5.6% growth in cash generation from its core businesses.

Investment in Growth

Cash used in investing activities surged by 62.7%, reflecting UnitedHealth’s aggressive capital deployment into long-term investments and strategic acquisitions to bolster the Optum and UnitedHealthcare ecosystem. Capital expenditures were maintained at 3.4 billion, focused on advancing clinical facilities and digital infrastructure to support long-term scalability.

Shareholder Returns and Capital Allocation

With a strong Free Cash Flow (FCF) of 27.3 billion, the company successfully balanced internal growth requirements with shareholder rewards. UNH returned a total of 16.1 billion to shareholders through dividends and share repurchases in 2025. The net increase in cash balance to 33.8 billion provides the company with significant dry powder as it enters 2026, where it expects operating cash flow to grow further to the 32-33 billion range.

Here is the comprehensive Five-Year Financial Ratio Analysis for UnitedHealth Group (UNH), evaluating profitability, efficiency, solvency, and shareholder returns:

Five-Year Financial Ratio Analysis

| Financial Ratios | 2025FY | 2024FY | 2023FY | 2022FY | 2021FY |

| Profitability | |||||

| Gross Margin | 24.2% | 24.9% | 24.7% | 24.3% | 24.0% |

| Operating Margin | 7.5% | 8.7% | 8.8% | 8.8% | 8.4% |

| Net Margin | 5.1% | 6.0% | 6.0% | 6.2% | 6.0% |

| Returns & Efficiency | |||||

| Return on Equity (ROE) | 21.5% | 23.9% | 24.8% | 24.6% | 23.5% |

| Return on Assets (ROA) | 6.9% | 8.2% | 8.2% | 8.3% | 8.1% |

| Solvency & Liquidity | |||||

| Current Ratio | 0.71 | 0.71 | 0.73 | 0.75 | 0.76 |

| Debt-to-Equity (D/E) | 0.79 | 0.74 | 0.65 | 0.64 | 0.62 |

| Operational Metrics | |||||

| Medical Care Ratio (MCR) | 85.2% | 83.2% | 82.3% | 82.0% | 82.6% |

Deep Dive Financial Trend Analysis

Profitability Pressured by Operational Headwinds

While Gross Margin has remained remarkably stable between 24% and 25%, indicating a strong moat in pharmacy benefit management (Optum Rx), the Operating Margin hit a five-year low of 7.5% in 2025. This compression was primarily driven by the Medical Care Ratio (MCR) climbing to 85.2%, reflecting higher healthcare utilization trends and the temporary operational impact of the Change Healthcare cyberattack.

Capital Structure and Rising Leverage

The Debt-to-Equity ratio has steadily climbed from 0.62 in 2021 to 0.79 in 2025. This trend aligns with UNH’s aggressive M&A strategy to integrate more clinical care and technology assets into its Optum ecosystem. While leverage is higher, the company’s massive operating cash flow (30.7B in 2025) provides an ample safety net for debt servicing, though the rising interest environment has begun to slightly dampen net margins.

Liquidity and Working Capital Dynamics

A Current Ratio below 1.0 is standard in the health insurance industry, where premiums are collected upfront and held as reserves. However, the 20.6% growth in Accounts Receivable in 2025—outpacing the 13.3% revenue growth—suggests a slight slowdown in payment collections or administrative processing delays following systemic disruptions, which warrants monitoring in 2026.

Shareholder Value Resilience

Despite the dip in ROE to 21.5%, UNH remains a high-return powerhouse. The company demonstrated its commitment to shareholders by returning 16.1 billion via dividends and buybacks in 2025, even while facing earnings pressure. This indicates management’s confidence that the current “margin squeeze” is transient and that the long-term growth trajectory remains intact.

In recent years, UnitedHealth Group (UNH) has pursued an aggressive M&A strategy focused on vertical integration, primarily strengthening Optum in the areas of home-based care, data analytics, and value-based delivery.

Key Strategic Acquisitions

Change Healthcare (Completed 2022)

- Deal Value: Approximately 13.0 billion.

- Strategic Intent: Integrated into Optum Insight, this deal was designed to create a comprehensive platform for clinical, financial, and operational data. Despite the significant 2024 cyberattack, the acquisition solidifies UNH’s position as the backbone of U.S. healthcare payment and data processing infrastructure.

LHC Group (Completed 2023)

- Deal Value: Approximately 5.4 billion.

- Strategic Intent: This marked a massive push into the “Home Health” sector. By adding LHC’s extensive home nursing and therapy services to Optum Health, UNH can treat elderly patients in lower-cost home settings rather than expensive hospitals, directly improving the Medical Care Ratio (MCR) for the insurance segment.

Amedisys (Initiated 2023 / Ongoing Integration)

- Deal Value: Approximately 3.3 billion.

- Strategic Intent: Complementing the LHC acquisition, Amedisys further expands UNH’s capabilities in home health and hospice care. This consolidates UNH’s status as the largest provider of home-based clinical services in the U.S., a critical component of their value-based care strategy.

EMIS Group (Completed 2023)

- Deal Value: Approximately 1.2 billion GBP.

- Strategic Intent: A significant expansion into the UK healthcare market. EMIS provides software and systems for primary care and pharmacy. This move demonstrates UNH’s intent to export its Optum Insight data-driven model to international health systems like the NHS.

Underlying M&A Strategy

Shift to the Home

By acquiring leaders in home health (LHC, Amedisys), UNH is capturing the most efficient segment of the care continuum. Treating patients at home is significantly more cost-effective than institutional care, allowing the company to retain more of the premium dollar.

Data and Technology Moat

Acquisitions like Change Healthcare and EMIS transform UNH from a traditional insurer into a data-dominant technology firm. This grants them unmatched visibility into healthcare spending patterns and the ability to influence industry-wide payment flows.

Hedging Regulatory Pressure

As government reimbursement rates for Medicare Advantage face stricter scrutiny, UNH uses M&A to diversify into fee-based services (Optum), ensuring that even if insurance margins are squeezed, the group can capture profit through its service and technology arms.

back to United Health page