1. Founding and Visionary Positioning (2003-2004)

Tesla was founded in 2003 by Martin Eberhard and Marc Tarpenning. In 2004, Elon Musk joined as the lead investor for the Series A funding round and became the Chairman. The core focus of this stage was to prove that electric vehicles were not only viable but also possessed potential superior to internal combustion engine cars.

Business Development: Adopted a “Top-Down” strategy. Established a high-end image for electric vehicles through the Roadster, attracting equity investments and technical partnerships from Daimler and Toyota.

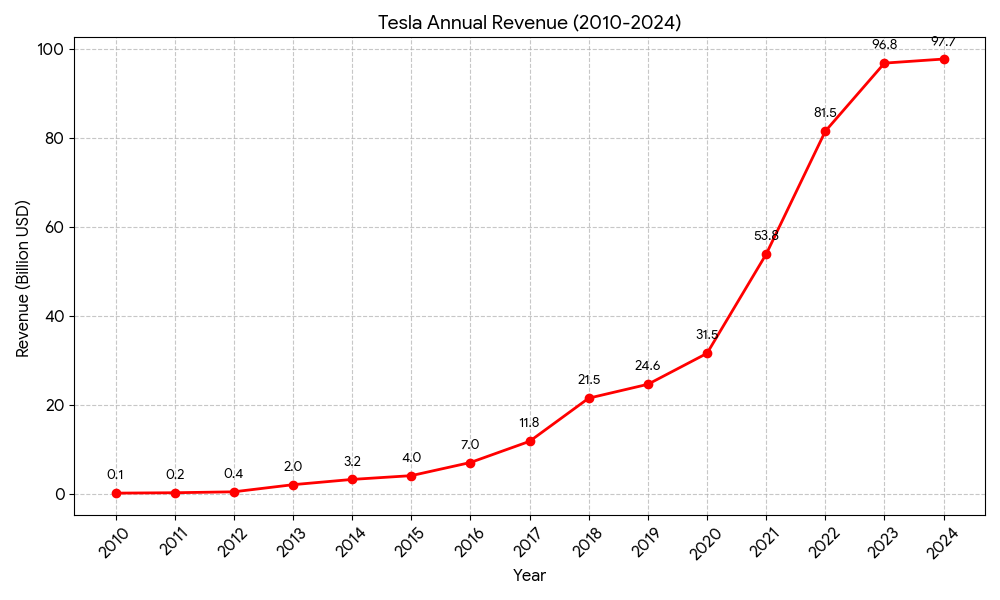

Revenue Status: Revenue in 2008 was approximately 14.74M USD. In 2009, it grew to 112M USD as deliveries increased, though the company remained at a significant loss.

2. Technology Validation and Brand Building (2005-2009)

This marked the first step of Musk’s “Secret Master Plan”: building a high-priced, niche sports car.

- 2006: The Tesla Roadster prototype was unveiled.

- 2008: Deliveries of the Roadster officially began. It was the first production electric sports car to use lithium-ion batteries and achieve a range of over 320km.

- Same year: Elon Musk took over as CEO.

Business Development: Established the proprietary Supercharger network to address range anxiety. Took over the NUMMI plant (now the Fremont factory) through a partnership with Toyota.

Revenue Status: Revenue experienced explosive growth starting in 2012 (413M USD) with the launch of the Model S, reaching 4.046B USD by 2015.

3. Entering the Luxury Mass Market and IPO (2010-2015)

Using the funds earned from the sports car to develop mid-volume, lower-priced models.

- 2010: Tesla went public on the Nasdaq (IPO), becoming the first American automaker to list since Ford in 1956.

- 2012: The Model S was launched, completely redefining the electric sedan and beginning the construction of the Supercharger network.

- 2015: The first SUV, Model X, was launched featuring its signature Falcon Wing doors.

Business Development: Acquired SolarCity, expanding the business scope to solar panels and energy storage systems (Powerwall). Launched the pre-sale model for Full Self-Driving (FSD) software. Giga Shanghai began production in just 10 months in 2019, successfully entering the Chinese market.

Revenue Status: Revenue was 7B USD in 2016 and soared to 24.578B USD by 2019. Despite doubling revenue, annual net income remained negative during these four years due to the Model 3 production ramp-up.

4. Scaling and Energy Transition (2016-2019)

Entering the third step of the plan: creating affordable mass-market vehicles and integrating energy business.

- 2016: Acquired the solar power company SolarCity; the company name was changed to Tesla, Inc. to reflect its transition into an energy company.

- 2017: Deliveries of the affordable Model 3 began.

- 2019: Giga Shanghai broke ground and began production within the same year, initiating global expansion.

Business Development: Optimized manufacturing processes, such as large-scale die-casting (Giga Press), to significantly reduce costs. Beyond vehicle sales, the sale of Regulatory Credits became a major profit driver. Market value surpassed 1T USD in 2021, with a highly vertically integrated business model.

Revenue Status: Achieved first annual profit in 2020 (690M USD net income). Revenue reached 81.462B USD in 2022 and climbed further to 96.773B USD in 2023.

5. Global Leadership and Diversified Expansion (2020-Present)

Tesla entered a phase driven by high-volume production and AI technology.

- 2020: Model Y deliveries began, eventually becoming the world’s best-selling vehicle. The company achieved its first full year of profitability.

- 2021: Market capitalization exceeded 1 trillion USD.

- 2023: The electric pickup Cybertruck officially commenced deliveries.

- Current Trends: The focus has shifted toward Full Self-Driving (FSD), humanoid robots (Optimus), and lower-cost next-generation vehicle platforms.

Business Development: Energy business (Megapack) revenue share exceeded 10% for the first time. The strategy shifted to “volume over price,” maintaining market share through multiple price cuts. Focus moved toward Robotaxi and humanoid robots (Optimus).

Revenue Status: Full-year revenue in 2024 was approximately 97.69B USD, with growth slowing significantly to 0.95%. 2025 Q1 revenue saw a year-over-year decline (-9%), but rebounded in Q3 2025 to 28.095B USD, driven by the energy department and FSD software revenue.