The history of Tencent can be divided into several key stages that track its evolution from a small startup to a global technology and investment conglomerate.

1. The Early Years and Survival (1998-2004)

This period focused on building the user base and finding a sustainable business model.

- 1998: Pony Ma and four co-founders established Tencent in Shenzhen.

- 1999: Launched OICQ (later renamed QQ), which quickly became the dominant instant messaging tool in China.

- 2001-2003: Struggling for revenue, the company launched “Mobile Monternet” (SMS services) and “QQ Show,” introducing the concept of virtual avatars and “Q-Coin” currency.

- 2004: Tencent listed on the Main Board of the Hong Kong Stock Exchange (HKG: 0700).

Core Technology:

- IM Protocol: Developed a robust, low-bandwidth instant messaging protocol (OICQ/QQ) capable of supporting millions of concurrent users on unstable networks.

- Virtual Goods Infrastructure: Built the backend system for QQ Show and the Q-Coin virtual currency system.

Revenue Level:

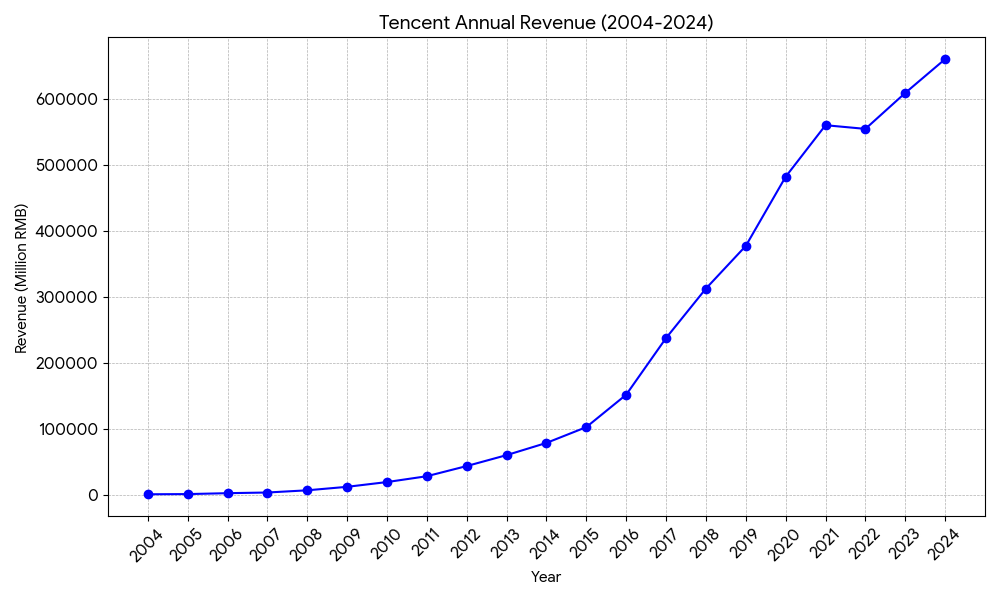

- Annual Revenue: Grew from near-zero to 1.14 billion RMB by 2004.

- Revenue Mix: Heavily reliant on “Mobile Monternet” (SMS partnerships with carriers, accounting for over 80% at times) and basic value-added services like QQ memberships.

2. Diversification and Expansion (2005-2010)

Tencent leveraged its massive IM traffic to enter nearly every sector of the Chinese internet.

- 2005: Launched Qzone, entering the social networking space.

- 2008: Tencent Games became a powerhouse by licensing titles like “Dungeon & Fighter” and “CrossFire.”

- 2010: QQ reached 100 million concurrent users. This era was marked by aggressive expansion, culminating in the “3Q War” (a legal and PR battle with 360 Security), which forced Tencent to rethink its closed ecosystem.

Core Technology:

- Distributed Storage: Developed large-scale data storage and content delivery networks (CDN) to support Qzone, which became one of the world’s largest social photo-sharing platforms.

- Game Server Architecture: Mastered the server-side stability required for Massive Multiplayer Online Games (MMOGs) like CrossFire and Dungeon & Fighter.

Revenue Level:

- Annual Revenue: Reached 19.65 billion RMB by 2010.

- Revenue Mix: Online games and virtual item sales became the primary drivers (80%), while online advertising began to contribute significantly.

3. The Mobile Revolution and Open Ecosystem (2011-2018)

This stage was defined by the internal “self-disruption” and the transition to mobile.

- 2011: Launched WeChat (Weixin), which secured Tencent’s leadership in the mobile era.

- 2013-2014: Introduced WeChat Pay and Red Packets, sparking the mobile payment revolution in China.

- 2017: WeChat launched “Mini Programs,” creating an app-within-an-app ecosystem.

- During this time, Tencent shifted its strategy to “Connection and Content,” investing heavily in companies like JD.com, Meituan, and Pinduoduo rather than competing with them directly.

Core Technology:

- Mobile Communication Stack: WeChat’s core architecture, optimized for asynchronous messaging, voice compression, and low battery consumption.

- FinTech and Encryption: High-concurrency payment processing for WeChat Pay, capable of handling billions of transactions during “Red Packet” events.

- Recommendation Algorithms: Early deployment of AI for content distribution in Tencent News and social advertising.

Revenue Level:

- Annual Revenue: Surpassed 300 billion RMB by 2018 (312.7 billion RMB).

- Revenue Mix: Games remained a major pillar, but Social Advertising and FinTech (Payment & Cloud) grew rapidly, making the revenue stream more balanced.

4. Industrial Internet and AI Transformation (2019-Present)

The current focus is on the Business-to-Business (B2B) sector and advanced technology.

- 2018: The “930 Reform” established the Cloud and Smart Industries Group (CSIG), marking a shift toward the Industrial Internet.

- 2021: Announced the “Sustainable Social Value Innovation” strategy, integrating social responsibility into the core business.

- 2023-2024: Released “Hunyuan,” Tencent’s self-developed Large Language Model (LLM), to compete in the global AI race and integrate generative AI across its product suite.

Core Technology:

- Cloud and Big Data: Development of proprietary servers (StarHai), distributed databases (TDSQL), and high-performance computing clusters.

- Hunyuan LLM: Tencent’s proprietary Large Language Model, integrated across its entire ecosystem for AI-driven search, advertising, and coding.

- Digital Twin and IoT: Technologies for smart cities, industrial automation, and healthcare digitalization.

Revenue Level:

- Annual Revenue: Reached 660.3 billion RMB (approx. 92 billion USD) in 2024.

- Revenue Mix: FinTech and Business Services (Cloud) emerged as the largest revenue contributor (over 30%), surpassing Games in certain quarters. AI-enhanced advertising also showed significant growth.

Sources: