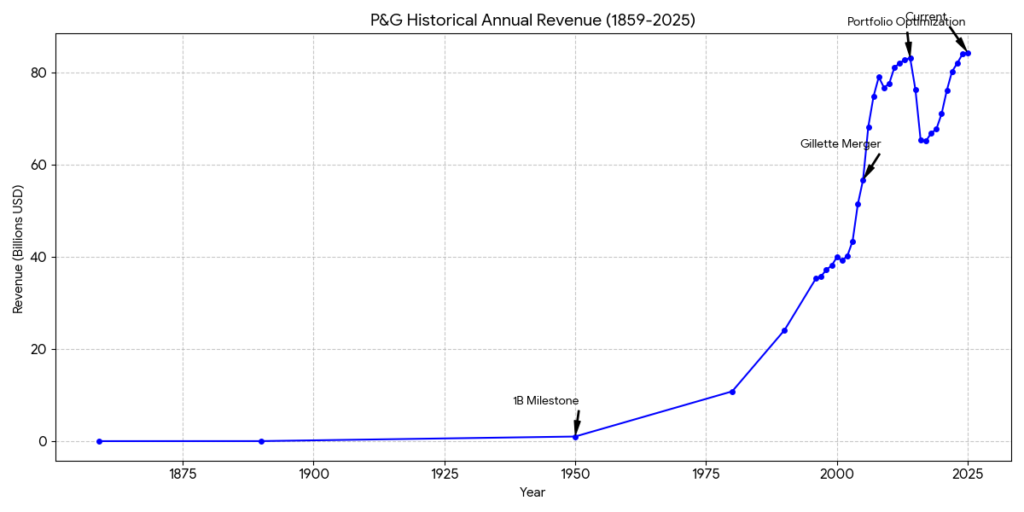

The history of Procter & Gamble (P&G) can be divided into several key eras that reflect its evolution from a small partnership into a global consumer goods powerhouse:

Founding and Early Roots (1837–1890)

In 1837, William Procter (a candle maker) and James Gamble (a soap maker) formed a partnership in Cincinnati, Ohio. At the time, Cincinnati was a major meat-packing center, providing easy access to the animal fats needed for their products.

- 1879 marked a turning point with the introduction of Ivory Soap. Developed by James Norris Gamble, it was famous for being “99 44/100% pure” and its unique ability to float, making it the company’s first major national brand.

Core Products:

- Initial: Candles (Star Candles) and Soap.

- Turning Point: Ivory Soap (1879), the first brand to be marketed nationally with a unique value proposition (it floats).

Revenue Level:

- 1858–1859: Sales reached $1million for the first time, with a workforce of about 80 people.

- Late 1880s: Revenue grew steadily as Ivory Soap gained national distribution.

The Birth of Modern Marketing (1890–1945)

During this period, P&G transitioned from a family business to a managed corporation, pioneering many strategies still used in business today.

- In the 1920s, the company established the Brand Management System. This allowed different P&G brands to compete against each other for market share, fostering internal innovation.

- In the 1930s, P&G began sponsoring radio dramas to market its soap products. These programs became known as Soap Operas, a term that remains in use today.

Core Products:

- Crisco (1911): The first all-vegetable shortening.

- Dreft (1933): The first synthetic detergent for household use.

- Oxydol laundry soap and Camay beauty soap.

Revenue Level:

- Revenue scaled from several millions to the hundreds of millions. By the end of WWII (1945), P&G was the dominant force in the U.S. household products market.

Post-War Innovation and Diversification (1945–1980)

Technological breakthroughs following WWII led to the creation of several “category killers” that defined modern domestic life.

- 1946: Tide was launched. As the first synthetic detergent, it cleaned much more effectively than traditional soaps and revolutionized laundry.

- 1955: Crest was introduced as the first fluoride toothpaste clinically proven to prevent cavities.

- 1961: Pampers created the mass-market disposable diaper industry, fundamentally changing childcare.

Core Products:

- Tide (1946): The “Washday Miracle” synthetic detergent.

- Crest (1955): The first fluoride toothpaste.

- Pampers (1961): The first mass-market disposable diaper.

- Charmin (Acquired 1957) and Pringles (1968).

Revenue Level:

- The $1 Billion Milestone: Annual sales topped $1billion in the 1950s.

- 1980 Revenue: Approximately $10.8billion, entering the “tens of billions” era.

Aggressive Global Expansion and M&A (1980–2005)

P&G focused on becoming a global leader through massive acquisitions and entering new beauty and health categories.

- 1985: Acquired Richardson-Vicks, bringing Pantene and Olay into the fold.

- 2005: P&G executed its largest acquisition by buying Gillette for approximately $57 billion. This move gave P&G dominance in the male grooming market and made it the world’s largest consumer products company.

Core Products:

- Pantene & Olay (via 1985 Richardson-Vicks acquisition).

- SK-II (via 1991 Max Factor acquisition).

- Gillette, Braun, and Oral-B (via 2005 Gillette merger).

Revenue Level:

- 2000 Revenue: Approximately $40billion.

- 2005 Revenue: Jumped to approximately $56.7billion following the integration of Gillette.

Brand Streamlining and Digital Transformation (2010–Present)

Facing a more complex retail environment, P&G pivoted from “being big” to “being focused.”

- In 2014, the company announced a massive portfolio cleanup, shedding over 100 non-core brands (including many beauty brands sold to Coty and the Duracell battery business).

- Today, P&G focuses on 10 core categories with about 65 brands that lead their respective markets. The current strategy emphasizes digital supply chains, data-driven advertising, and environmental sustainability.

Core Products:

- Focus on 10 categories and ~65 brands: Tide/Ariel (Fabric), Pampers (Baby), Gillette (Grooming), Head & Shoulders (Hair), and SK-II/Olay (Skin).

Revenue Level:

- 2014 Peak: Revenue reached ~$83billion before P&G began divesting over 100 non-core brands (including Duracell and specialty beauty).

- FY 2024: Revenue stabilized at approximately $84billion.

- 2025 (TTM): Revenue remains in the $84-$85billion range, showing steady, high-margin growth.

P&G (Procter & Gamble) is the global leader in the Consumer Packaged Goods (CPG) industry. As of 2025-2026, its competitive landscape is characterized by a “value-over-volume” strategy, where P&G focuses on premiumization to defend against inflation and low-cost competitors.

1. Core Global Competitors

P&G competes against a mix of diversified conglomerates and specialized category leaders:

| Competitor | Primary Battlegrounds | Competitive Edge |

| Unilever | Beauty, Personal Care, Home Care | Massive presence in emerging markets and a strong focus on “Purpose-led” sustainability. |

| Colgate-Palmolive | Oral Care, Personal Care | Global leader in toothpaste (~40% market share), P&G’s primary rival in Oral Care. |

| Kimberly-Clark | Baby & Child Care, Family Care | Direct rival to P&G’s paper business (Huggies vs. Pampers; Scott vs. Charmin). |

| L’Oréal | High-end Beauty, Hair Care | World leader in cosmetics; dominates the prestige skin and hair segments where P&G seeks to grow. |

| Henkel | Laundry & Home Care | Stronghold in Europe and specialized adhesive technologies. |

2. Segment-Specific Competitive Analysis

P&G’s business is divided into five segments, each facing unique competitive pressures:

Fabric & Home Care (~36% of Revenue)

- Key Brands: Tide, Ariel, Downy, Dawn, Febreze.

- Competitors: Unilever (Persil/Dirt Is Good), Henkel, Church & Dwight (Arm & Hammer).

- Dynamics: P&G uses “Innovation Superiority” (e.g., Tide Pods) to justify higher prices. The biggest threat here is Private Labels (retailer-owned brands) which gain share during inflationary periods.

Baby, Feminine & Family Care (~24% of Revenue)

- Key Brands: Pampers, Always, Charmin, Bounty.

- Competitors: Kimberly-Clark (Huggies, Kotex, Scott), Essity.

- Dynamics: Pampers is the world’s #1 brand. Competition is fierce in the “tiered” market, where P&G must offer both value-tier and premium-tier (Pampers Pure) products to block rivals.

Beauty (~18% of Revenue)

- Key Brands: Pantene, Head & Shoulders, Olay, SK-II.

- Competitors: L’Oréal, Unilever (Dove), Estée Lauder, and J-Beauty/K-Beauty brands.

- Dynamics: P&G is currently facing headwinds in China with SK-II, where local pride and Japanese brand sentiment have shifted the competitive balance.

Health Care (~14% of Revenue)

- Key Brands: Oral-B, Crest, Vicks, Metamucil.

- Competitors: Colgate-Palmolive, Haleon (Sensodyne).

- Dynamics: High growth in the Power Brush (Oral-B) category is P&G’s primary weapon against traditional manual toothbrush dominance by Colgate.

Grooming (~8% of Revenue)

- Key Brands: Gillette, Braun, Venus.

- Competitors: Edgewell (Schick), Harry’s, Dollar Shave Club.

- Dynamics: After years of losing share to D2C (Direct-to-Consumer) startups, Gillette has successfully stabilized through high-tech launches like GilletteLabs.

3. P&G Strategic SWOT (2025/26 Perspective)

Strengths

- Unrivaled Scale: $84B+ in revenue provides massive negotiation power with retailers like Walmart and Amazon.

- R&D Engine: Spending ~$2B annually on R&D ensures a constant pipeline of “superior” products that command higher margins.

Weaknesses

- Premium Price Sensitivity: Because P&G targets the mid-to-high end, they are vulnerable when consumers “trade down” to generic brands.

- Portfolio Concentration: Heavy reliance on a few “Daily Use” categories means low growth in stagnant populations.

Opportunities

- Digital Transformation: Using AI for supply chain optimization and personalized marketing to increase ROI on ad spend.

- Emerging Market Premiumization: As middle classes grow in Southeast Asia and Africa, P&G can introduce its premium tiers.

Threats

- Geopolitical Volatility: Trade tensions and currency fluctuations (Strong USD) significantly impact reported earnings as 50% of sales are international.

- The “Clean” Movement: Emerging eco-brands (e.g., Method, Seventh Generation) challenge P&G’s traditional chemical-based formulas.

In the Fabric & Home Care segment, P&G operates its largest and most profitable business unit (approximately 36% of total net sales). This sector is characterized by intense R&D competition, where the battlefield has shifted from simple “cleaning power” to convenience (unit doses), scent longevity, and sustainability.

1. Competitive Landscape by Category

P&G utilizes a “tiered branding” strategy to cover everything from value shoppers to luxury consumers.

| Category | P&G Key Brands | Primary Competitors | Key Battleground |

| Laundry Detergents | Tide, Ariel, Gain | Unilever (Persil, OMO), Henkel (Persil, All, Purex), Church & Dwight (Arm & Hammer) | Cleaning efficacy in cold water and stain removal technology. |

| Fabric Enhancers | Downy, Lenor | Unilever (Comfort), Colgate (Suavitel) | Scent encapsulation and long-lasting freshness. |

| Dish Care | Dawn, Cascade, Fairy | Reckitt (Finish), Unilever (Sunlight/Quix) | Automatic Dishwashing (ADW) tablets and grease-cutting power. |

| Home Care | Febreze, Swiffer, Mr. Clean | S.C. Johnson (Glade, Windex), Reckitt (Lysol, Air Wick) | Air freshness, surface disinfection, and specialized tools. |

2. Strategic Deep Dive: P&G vs. The World

A. The “Pod-ification” Moat

P&G essentially invented the laundry pod category. Single-unit dose (SUD) products carry significantly higher margins than liquid or powder.

- P&G Strategy: Continuous innovation (e.g., Tide Power Pods with “Oxi” or “Hygienic Clean”) to keep the category “premiumized.”

- Competitor Response: Henkel and Unilever have caught up with multi-chamber pods, but P&G maintains the largest market share in North America through superior distribution and heavy advertising spend.

B. The “Cold Water” Sustainability Race

- The Trend: Consumers are washing clothes in cold water to save energy costs.

- P&G Action: P&G has re-engineered Tide’s formula to ensure high performance at low temperatures. This is a strategic defensive move against Unilever, whose “Clean Future” initiative focuses on plant-based ingredients and biodegradable formulas.

- Competitive Pressure: Smaller “eco-friendly” brands like Seventh Generation (owned by Unilever) and Method (owned by S.C. Johnson) compete for the environmentally conscious segment where P&G was historically seen as a “chemical-heavy” incumbent.

C. Private Label & Value Competitors

During periods of high inflation, consumers often “trade down” to retailer brands like Kirkland Signature (Costco) or Great Value (Walmart).

- P&G Defense: Rather than discounting Tide, P&G uses Tide Simply (a mid-tier version) to compete on price, while keeping the flagship Tide as a high-end “Performance” brand.

- Church & Dwight Threat: Their Arm & Hammer brand is the primary “value-for-money” rival. They have successfully stolen share from P&G during economic downturns by emphasizing price-per-load.

3. Financial & Operational Comparison (Estimated)

| Metric | P&G (Fabric Care) | Unilever (Home Care) |

| Operating Margin | ~22% – 26% (High due to SUDs) | ~14% – 17% |

| Key Growth Driver | Premium Pods, Scent Beads | Emerging Market Penetration |

| R&D Focus | Molecular Chemistry Innovation | Biodegradable & Circular Economy |

Summary of Competitive Advantage

P&G’s dominance in this segment relies on its Integrated Media & Retail Power. Because P&G brands like Tide and Dawn are “must-haves” for retailers, they receive the best shelf placement, making it extremely difficult for competitors like Henkel or Church & Dwight to displace them without massive price-cutting.

P&G’s second-largest segment is Baby, Feminine & Family Care, accounting for approximately 24% of total net sales.

This segment is highly sensitive to demographic shifts (such as declining birth rates) and commodity costs (like wood pulp and resin). Success in this category depends on “Life-Stage Marketing”—capturing a consumer at a pivotal moment, such as the birth of a first child, to build decades of brand loyalty.

1. Segment Overview & Key Rivals

This division is split into three distinct categories, each facing a different set of global and regional competitors:

| Category | P&G Lead Brands | Primary Competitors | Key Competitive Factor |

| Baby Care | Pampers, Luvs | Kimberly-Clark (Huggies), Unicharm (Moony), Kao (Merries) | Absorbency tech, skin health, and premium “organic” tiers. |

| Feminine Care | Always, Tampax | Kimberly-Clark (Kotex), Edgewell (Playtex), Unicharm (Sofy) | Comfort, leak protection, and brand trust/education. |

| Family Care | Bounty, Charmin | Kimberly-Clark (Scott/Kleenex), Georgia-Pacific (Quilted Northern), Private Labels | Absorption efficiency (sheets per task) and supply chain scale. |

2. Detailed Strategic Competitive Analysis

A. Baby Care: The Premiumization Battle (Pampers vs. Huggies)

Pampers is P&G’s largest single brand. The competition with Kimberly-Clark (Huggies) is a global duopoly in many markets.

- P&G Strategy: Moving away from price wars by focusing on “Skin Health” and the “Premium Tier.” Brands like Pampers Pure target parents willing to pay more for natural materials.

- The Asia Threat: In China and Southeast Asia, P&G faces fierce competition from Kao (Merries) and Unicharm. These Japanese firms are often perceived as superior in “breathability” and “softness,” forcing P&G to constantly upgrade its manufacturing tech in the region.

B. Feminine Care: Dominance through Education (Always)

P&G holds a commanding global market share (~50%) in this category.

- Marketing Moat: P&G uses massive “Purpose-led” campaigns (e.g., “Like a Girl”) to build emotional connections with young consumers early on.

- The “DTC” Challenge: New, agile Direct-to-Consumer (DTC) brands and eco-friendly startups (offering menstrual cups or period underwear) are attacking P&G’s market share among Gen Z. P&G has responded by acquiring smaller brands and launching its own organic lines.

C. Family Care: The “Private Label” Defense (Charmin & Bounty)

This category (Paper Towels and Toilet Paper) is the most vulnerable to Retailer Private Labels (e.g., Costco’s Kirkland or Walmart’s Great Value).

- The Performance Gap: P&G’s defense is “Value through Performance.” They market Bounty as the “Quicker Picker Upper,” arguing that because one sheet of Bounty does the work of two sheets of a generic brand, the higher price is actually a better value.

- Input Cost Volatility: Since paper products are bulky and expensive to ship, P&G competes on logistical scale. Their massive factory network allows them to maintain better margins than smaller regional players like Georgia-Pacific.

3. Financial & Operational Comparison (2025 Estimates)

| Metric | P&G (Baby/Fem/Family) | Kimberly-Clark (Personal Care) |

| Estimated Net Margin | ~19% – 22% | ~14% – 16% |

| Growth Strategy | Product Tiering (Trade-up) | Price Increases & Cost Cutting |

| R&D Focus | Skin Microbiome & Smart Diapers | Sustainability & Fiber Tech |

4. Competitive SWOT for this Segment

- Strengths: Pampers and Always are the #1 global brands in their categories, providing massive leverage with global retailers.

- Weaknesses: High exposure to wood pulp and plastic resin prices makes margins volatile during commodity spikes.

- Opportunities: Adult Incontinence. As global populations age, P&G is aggressively expanding its Always Discreet line to compete with Kimberly-Clark’s Depend.

- Threats: Birth Rate Decline. In developed markets and China, fewer babies mean a shrinking total addressable market (TAM) for diapers.

Source:

- P&G Investor Relations

- P&G 2024 Annual Report

- P&G 2025 Fiscal Year Results

- P&G Heritage & History

- Wikipedia – Procter & Gamble

- Macrotrends – P&G Revenue History

- Statista – CPG Market Share Analysis

- Seeking Alpha – P&G Stock & Analysis

Bakc to global 100: https://titanstockanalysis.com/global-top-100-companies/