The history of Palantir Technologies can be broken down into four distinct phases, transitioning from a secretive government contractor to a major AI power.

Phase 1: Foundation and Intelligence Roots (2003–2008)

The company was founded in 2003 by Peter Thiel, Alex Karp, and others to apply PayPal’s fraud-detection logic to counter-terrorism.

- CIA Partnership: After being rejected by many Silicon Valley investors, Palantir received early funding from In-Q-Tel, the CIA’s venture capital arm.

- Gotham Release: In 2008, the company launched Palantir Gotham, its first flagship product designed for intelligence analysts to connect disparate data points.

Core Technology: Human-Assisted Link Analysis

- Features: The technology focused on helping human analysts connect “dots” across massive, disparate datasets (e.g., flight manifests, phone records, and bank transfers). It prioritized visualization and manual investigation tools.

Revenue Level: Seed/Pre-Revenue

- The company was largely funded by Peter Thiel and a 2004 investment of approximately $2 million from In-Q-Tel (CIA). Annual revenue remained below $50 million.

Phase 2: Enterprise Expansion (2010–2015)

Palantir began applying its data integration technology to the private sector, specifically targeting financial services.

- Metropolis: Originally called Palantir Finance, this platform helped banks detect fraud and analyze market trends.

- Sky-high Valuation: By 2015, the company reached a private valuation of approximately $20 billion, fueled by its reputation for solving “impossible” data problems.

Core Technology: Semantic Data Modeling (Ontology)

- Features: With Palantir Gotham, the core tech moved toward “Ontology”—translating rows and columns of database code into real-world “objects” (e.g., a “Person,” “Vehicle,” or “Weapon”) that users could interact with without writing code.

Revenue Level: $400M – $600M (Estimated)

- As a private company, revenue was not public, but growth was driven by major defense and intelligence contracts. By 2015, the private valuation hit $20 billion based on these cash flows.

Phase 3: The Foundry Era (2016–2019)

This period marked a shift toward helping massive corporations manage complex supply chains and operations.

- Foundry Launch: Launched in 2016, Palantir Foundry became the primary software for commercial clients like Airbus and BP.

- Breaking Data Silos: Unlike Gotham, Foundry was built to be a central operating system for modern enterprises, focusing on data engineering and decision-making.

Core Technology: Data Operating System & Digital Twins

- Features: Palantir Foundry introduced a centralized data pipeline. It focused on creating a “Digital Twin” of a company’s entire operation. It integrated complex supply chains and manufacturing processes into a single source of truth.

Revenue Level: $600M – $750M

- 2018: $595 million.

- 2019: $743 million. This period saw the commercial sector begin to catch up with government revenue.

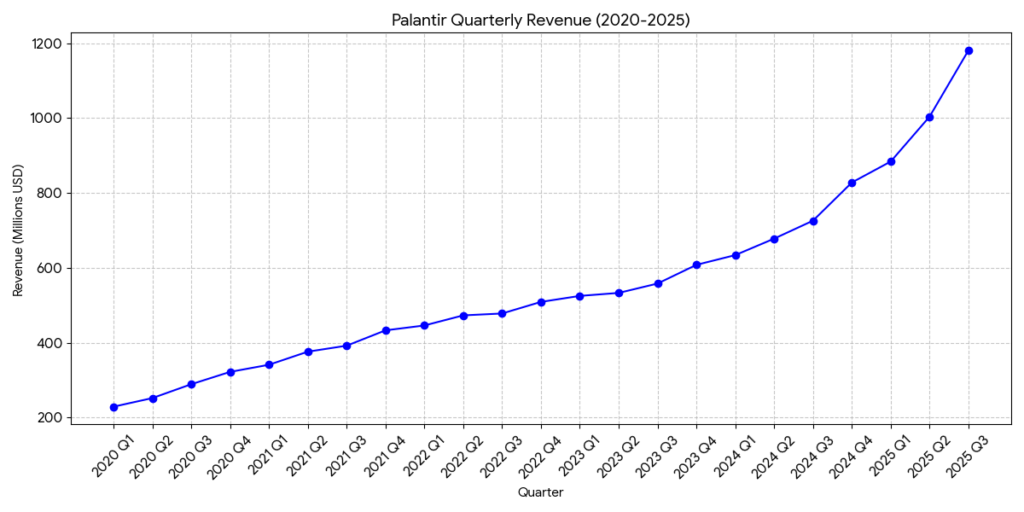

Phase 4: Public Listing and AI Revolution (2020–Present)

Recent years have seen Palantir move into the public eye and capitalize on the Generative AI boom.

- Direct Listing (DPO): In September 2020, Palantir went public on the NYSE and moved its headquarters to Denver, Colorado.

- AIP Development: In 2023, the company launched the Artificial Intelligence Platform (AIP), integrating Large Language Models (LLMs) into its existing software stack.

- Market Milestone: In late 2024, the company was added to the S&P 500, and by 2025, its market capitalization surged past $250 billion.

Core Technology: AI Platform (AIP) & Logic Orchestration

- Features: The Artificial Intelligence Platform (AIP) allows enterprises to deploy Large Language Models (LLMs) safely. Unlike standard chatbots, AIP uses Palantir’s existing Ontology to ensure AI follows strict rules and security protocols, turning insights into automated actions.

Revenue Level: $1.1B – $4.4B (Explosive Growth)

- 2020: $1.09 billion (Public Listing).

- 2022: $1.91 billion.

- 2024: $2.87 billion.

- 2025 (Projected): Approximately $4.4 billion to $5.3 billion. Recent quarterly growth (Q3 2025) showed a massive 63% YOY revenue increase driven by AIP adoption.

Sources: