The history of Mastercard is characterized by its evolution from a cooperative of regional banks into a global leader in payment technology. Here is the breakdown of its history into five key stages:

Stage 1: The Birth of the Interbank Alliance (1966-1968)

Unlike its main competitor, Visa (which started as a program by Bank of America), Mastercard began as a collaborative effort between several regional bank associations to compete with the growing popularity of BankAmericard.

- 1966: The Interbank Card Association (ICA) was formed by a group of banks, including Wells Fargo and Crocker National Bank.

- 1968: The ICA began its international expansion by forming a strategic alliance with Banco Nacional in Mexico and Eurocard in Europe.

Key Business Development: The primary focus was a Membership Growth model. It functioned as a non-profit cooperative where banks joined to share the infrastructure. The “business” was essentially building a multi-sided platform: recruiting enough banks so that merchants would accept the cards, and recruiting enough merchants so that customers would want the cards.

Revenue Level: Very low (estimated under $10 million). Funding came from member dues used strictly to cover the administrative costs of the Interbank Card Association (ICA) and the early telex-based authorization systems.

Stage 2: The Era of Master Charge (1969-1978)

To create a unified national brand, the ICA acquired the rights to the “Master Charge” name and the iconic overlapping red and yellow circles.

- 1969: The brand “Master Charge: The Interbank Card” was officially launched.

- 1973: The Interbank Network for Authorization and Settlement (INAS) was established, moving the industry toward electronic, centralized processing.

- 1974: Magnetic stripe technology was standardized on all cards to improve security and transaction speed.

Key Business Development: Shift to Technical Standardization. With the launch of the INAS (Authorization) and INET (Settlement) systems, the business began charging small fees for processing transactions between banks. The focus was on “Network Effects”—the more transactions that flowed through the central switch, the lower the cost per transaction for the member banks.

Revenue Level: Scaled into the tens of millions of dollars. While still a non-profit entity, the Gross Dollar Volume (GDV) processed by the network exploded as it became a national brand in the US.

Stage 3: Rebranding and Global Reach (1979-2001)

As the company expanded beyond credit cards into other financial services and global markets, a broader brand identity was required.

- 1979: Master Charge was renamed Mastercard.

- 1983: Mastercard became the first card issuer to use holograms on cards as a security feature against fraud.

- 1987: Mastercard entered the Chinese market, becoming the first international payment card issued in mainland China.

- 1991: Launched Maestro, the world’s first global online debit network, in partnership with Europay.

- 1997: Launched the iconic “Priceless” advertising campaign, which became one of the most recognizable marketing efforts in history.

Key Business Development: Product Diversification.

- Cross-Border Fees: As international travel surged, Mastercard began capturing high-margin fees on currency conversion and international settlement.

- Debit & ATM Growth: By acquiring the Cirrus and Maestro networks, the business model expanded from “credit-only” to “everyday spending,” significantly increasing the volume of transactions processed daily.

Revenue Level: Crossed the $1 billion threshold. By the late 1990s, annual revenue reached approximately $1.2 billion to $1.5 billion. Profitability began to emerge as a priority as the organization matured.

Stage 4: Public Offering and Structural Change (2002-2009)

During this period, Mastercard transitioned from a membership organization owned by banks to a publicly traded commercial company.

- 2002: Merged with Europay International to integrate its European operations.

- 2006: Mastercard held its Initial Public Offering (IPO) on the New York Stock Exchange (NYSE) under the ticker symbol MA.

- 2009: Focused on technological acquisitions and established Mastercard Labs to focus on future payment innovations.

Key Business Development: Commercialization and Efficiency.

- The IPO Pivot: Transitioning to a for-profit corporation allowed Mastercard to optimize its pricing for authorization, clearing, and settlement services.

- Acquisition Strategy: The company began buying payment gateways and software firms to own more of the “payment rail” rather than just acting as a switch for banks.

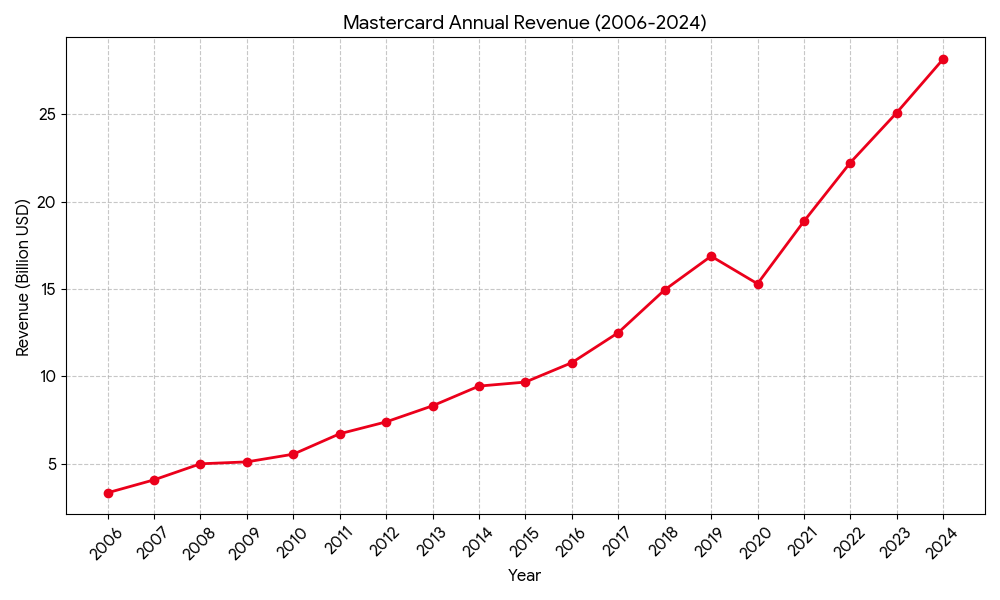

Revenue Level: Significant growth in transparency and scale.

- 2003: $2.2 billion

- 2006 (IPO Year): $3.3 billion

- 2009: $5.1 billion. During this stage, Net Profit Margins began to climb toward 20-30%.

Stage 5: Transition to a Tech Company (2010-Present)

Mastercard has repositioned itself as a technology company in the global payments industry, focusing on digital security and multi-rail payment solutions.

- 2016: Unveiled a new, simplified logo and changed the brand name to lowercase “mastercard” to reflect a digital-first approach.

- 2019: Removed the word “mastercard” from its logo entirely, joining a select group of brands recognized by symbol alone.

- 2024: Mastercard NetsUnion (a joint venture) officially began processing domestic payments in China, a major milestone for foreign payment networks.

- Current Focus: Investing heavily in blockchain, AI-driven fraud detection, biometrics, and contactless “Tap on Phone” technologies.

Key Business Development: Value-Added Services (VAS) and Data.

- Services over Volume: Mastercard moved beyond transaction fees. Today, nearly 40% of revenue comes from “Services,” including AI-driven fraud prevention, cybersecurity, data analytics, and consulting.

- B2B and New Flows: Expanding into Business-to-Business (B2B) payments and government disbursements, moving away from just “consumer cards.”

Revenue Level: Massive scale-up with high-tech margins.

- 2015: $9.6 billion

- 2020: $15.3 billion

- 2024: $28.1 billion

- 2025 (Estimated): $31.4 billion. Net Profit Margins now sit at an industry-leading 40% to 45%.

Sources: