1. Foundation and the Punched Card Era (1880s-1944)

IBM’s roots date back to the late 19th century with the Computing-Tabulating-Recording Company (CTR). In 1914, Thomas J. Watson Sr. took leadership, instilling the famous THINK motto and a rigorous sales culture.

- Key Milestone: Renamed International Business Machines (IBM) in 1924.

- Focus: Mechanical tabulators, scales, and time recorders.

- Achievement: Scaled operations by processing massive data for the U.S. Social Security Act in the 1930s.

Core Technology: Mechanical Tabulators, Punched Cards, and Scales.

Revenue Level: Millions to low hundreds of millions.

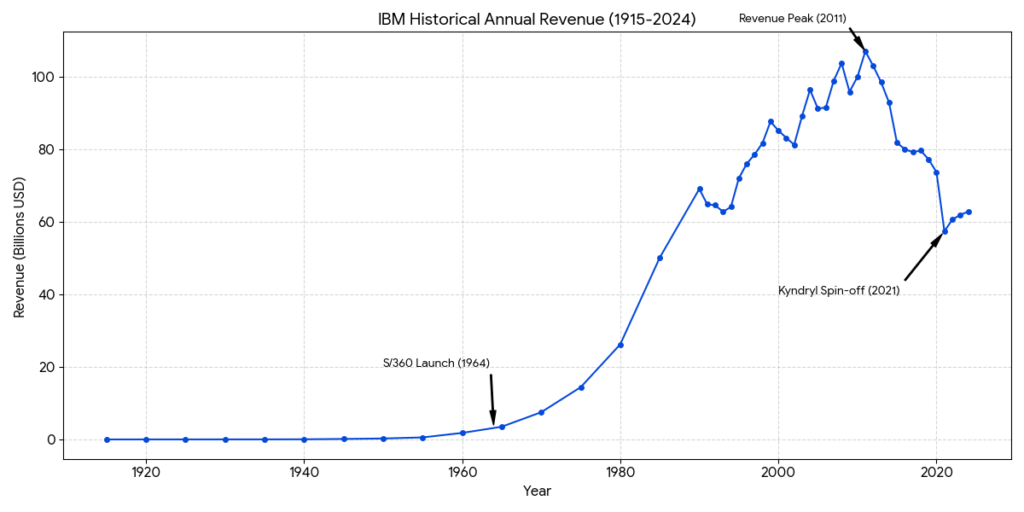

- 1914: Approximately $4 million.

- 1940: Reached $46 million.

- 1945: Surpassed $100 million due to wartime contracts and Social Security data processing.

2. The Mainframe Dominance (1945-1970s)

Post-WWII, IBM pivoted to electronic computers. This era defined IBM as the “Blue Giant,” dominating the corporate and government data sectors.

- System/360 (1964): A $5 billion gamble that revolutionized the industry by creating the first family of computers with compatible software.

- Technical Innovations: Invention of the Hard Disk Drive (RAMAC), Floppy Disk, and the programming language FORTRAN.

- Market Position: IBM held such a massive market share that it faced decade-long antitrust litigation.

Core Technology: System/360 Architecture, Magnetic Disk Storage (RAMAC), FORTRAN, and DRAM.

Revenue Level: Billions.

- 1957: Hit $1 billion.

- 1964 (S/360 Launch): $3.2 billion.

- 1970: $7.5 billion.

- 1979: $22.9 billion. This era saw exponential growth as IBM became the global standard for enterprise computing.

3. The PC Revolution and Near-Collapse (1980s-1992)

IBM launched the IBM PC in 1981, setting the industry standard. However, by outsourcing the OS to Microsoft and the chip to Intel, IBM lost its competitive edge to “PC clones.”

- Crisis: By the early 1990s, IBM suffered the largest corporate losses in U.S. history as the world shifted from mainframes to client-server networks.

- The Turnaround: Lou Gerstner was hired in 1993. He famously decided not to break up the company, shifting the focus from selling hardware to providing IT services and software.

Core Technology: IBM PC (Open Architecture), OS/2 Operating System, RISC Processors.

Revenue Level: High tens of billions but collapsing profits.

- 1984: $45 billion (Peak profitability era before “PC Clones” eroded margins).

- 1990: $69 billion.

- 1993 (The Crisis): Reported a $8.1 billion net loss, the largest in American corporate history at the time.

4. Smarter Planet and the Shift to Software (1993-2018)

Under Gerstner and later Sam Palmisano, IBM divested low-margin hardware (selling its PC division to Lenovo in 2005) and pivoted toward high-value business consulting.

- Smarter Planet: A strategic initiative to integrate technology into global infrastructure (power grids, water systems, traffic).

- Watson AI: In 2011, IBM’s Watson won Jeopardy!, signaling a massive investment in cognitive computing.

- Acquisition: In 2019, IBM acquired Red Hat for $34 billion to anchor its future in the cloud.

Core Technology: IT Consulting (Global Services), Middleware (WebSphere), DB2 Databases, Watson AI.

Revenue Level: Reached historical peak.

- 1994: $64 billion (Return to profitability under Lou Gerstner).

- 2011: $106.9 billion (All-time revenue peak).

- 2012–2018: Revenue began a steady decline (over 20 consecutive quarters) as the market shifted to public cloud (AWS/Azure) while IBM stayed focused on legacy services.

5. Hybrid Cloud and Quantum Leadership (2020-Present)

Under current CEO Arvind Krishna, IBM has undergone its most significant structural change by spinning off its managed infrastructure unit (Kyndryl) to focus entirely on high-growth tech.

- Strategic Core: Hybrid Cloud and Artificial Intelligence (the watsonx platform).

- Future Frontier: IBM is currently a world leader in Quantum Computing, consistently hitting milestones on its roadmap to build utility-scale quantum systems.

Core Technology: Hybrid Cloud (Red Hat OpenShift), Generative AI (watsonx), Quantum Computing.

Revenue Level: Stabilized around $60 billion (Post-Kyndryl spin-off).

- 2020: $55.2 billion (Restated after divesting managed infrastructure).

- 2024: $61.9 billion.

- Current State: While total revenue is lower than the 2011 peak, profit margins are significantly higher because software and recurring cloud subscriptions now drive the business.

In 2026, IBM’s technical competitive analysis reveals a company that has successfully pivoted from “commodity hardware” to “specialized enterprise infrastructure.” Unlike the “hyperscalers” (AWS, Azure, Google), IBM focuses on Data Gravity—keeping AI and cloud processing where the sensitive data already lives.

1. Hybrid Cloud: Red Hat OpenShift vs. Hyperscalers

IBM’s strategy is built on Red Hat OpenShift, which acts as a “Cloud Operating System” that abstracts away the underlying infrastructure.

- The Difference: While Azure Arc and AWS Outposts attempt to extend their specific public clouds into your data center, IBM allows you to run the same software across any environment (AWS, Azure, or on-prem) with identical security and compliance.

- The Advantage: In 2026, as AI Sovereignty laws tighten globally, IBM’s ability to move workloads across clouds without “Vendor Lock-in” has become a critical technical moat for banks and government agencies.

2. Enterprise AI: Telum II & Spyre vs. NVIDIA GPUs

For AI, IBM isn’t competing with NVIDIA for “Large Language Model (LLM) Training.” Instead, they are winning at Real-time Inference.

- Integrated AI Acceleration: The IBM Telum II processor (featured in the z17 mainframe) includes an on-chip AI accelerator.

- In-Place Inference: Unlike NVIDIA solutions that require sending data from a database to an external GPU cluster (causing latency), IBM performs AI tasks directly on the CPU during the transaction.

- Use Case: This allows a bank to run complex fraud detection models on 100% of its credit card swipes in under a millisecond—a feat currently impossible with external GPU setups.

3. Quantum Computing: IBM Quantum vs. Google “Willow”

As of 2026, the quantum race is a battle of Scale (IBM) vs. Error Correction (Google).

- IBM (The Scaler): Following its “Condor” processor (1,121 qubits), IBM is focused on Quantum Utility. They have built the most robust cloud ecosystem (Qiskit) and are deploying “Quantum-Safe” cryptography to protect current data from future quantum threats.

- Google (The Precisionist): Google’s Willow chip focuses on “surface code” error correction. While having fewer qubits than IBM, Google aims for higher “logical qubit” stability.

- The Verdict: IBM currently leads in accessibility and software ecosystem, while Google remains a formidable rival in fundamental physics breakthroughs.

4. Technical SWOT Summary (2026)

| Technology | IBM Competitive Status | Key Rival |

| Hybrid Cloud | Leader in Portability | Microsoft (Azure Arc) |

| AI Hardware | Best for Low-Latency Inference | NVIDIA (for Training) |

| Quantum | Largest Hardware/Software Scale | Google (Willow) |

| Cybersecurity | Leader in Post-Quantum Crypto | Specialized Security Firms |

Financial Outlook (2026 Forecast)

IBM expects its software segment to grow by 10% this year, with a total projected Free Cash Flow of $15.7 billion. This provides them with a massive “war chest” to continue acquiring high-growth tech firms like HashiCorp and Confluent.

Source:

- https://www.macrotrends.net/stocks/charts/IBM/ibm/revenue

- https://www.wallstreetzen.com/stocks/us/nyse/ibm/revenue

- https://newsroom.ibm.com/2025-01-29-IBM-RELEASES-FOURTH-QUARTER-RESULTS

- https://www.ibm.com/roadmaps/quantum/2026/

- https://en.wikipedia.org/wiki/History_of_IBM

- https://www.ibm.com/history/ctr-and-ibm

- https://quantumcomputingreport.com/ibm-advances-quantum-roadmap-with-nighthawk-processor-and-300mm-wafer-fabrication-shift/

Back to IBM page