Here is the history of Home Depot, broken down into key developmental stages:

1. The Vision and Foundation (1978-1980)

The company was born out of a crisis that turned into an opportunity.

- 1978: Bernie Marcus and Arthur Blank were fired from Handy Dan Home Improvement Centers. At a Los Angeles coffee shop, they sketched out the concept of a “one-stop shop” for the do-it-yourself (DIY) consumer.

- 1979: The first two stores opened in Atlanta, Georgia. These stores were massive (60,000 square feet), dwarfing the competition and stocking over 25,000 different items.

- Culture: They hired specialized tradespeople to teach customers how to complete projects themselves, establishing the “You can do it. We can help” philosophy.

Core Competencies: Warehouse retail concept (high volume/wide selection), EDLP (Everyday Low Price) strategy, and “Expert Service” (hiring tradespeople to teach DIY skills).

Revenue Level: Approximately $7 million in 1979. The primary goal was proving the viability of the big-box model.

2. Rapid Growth and Public Listing (1981-1990)

During this decade, Home Depot redefined the retail landscape.

- 1981: The company went public on the NASDAQ, raising $4 million.

- 1984: It moved to the New York Stock Exchange (NYSE) and began aggressive geographic expansion, including the acquisition of Bowater Home Centers.

- 1989: Home Depot officially became the largest home improvement retailer in the United States, surpassing its rival, Lowe’s.

Core Competencies: Efficient inventory management, aggressive geographic expansion, and high bargaining power with suppliers due to increasing volume.

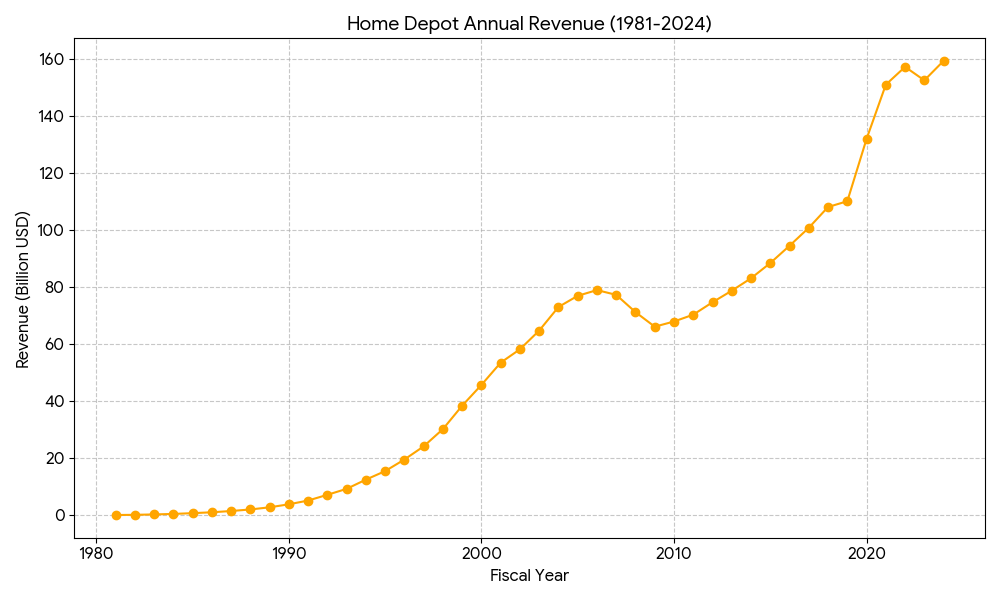

Revenue Level: Revenue skyrocketed from roughly $118 million in 1981 to $3.8 billion by 1990.

3. Diversification and International Entry (1991-2000)

The company began exploring new formats and global markets.

- 1991: Launched the EXPO Design Center, focusing on high-end interior design and showroom experiences.

- 1994: Entered the international market by acquiring Aikenhead’s Hardware in Canada.

- 1990s Late: Established The Homer Fund to support employees in need, reinforcing a culture of taking care of their own.

Core Competencies: International supply chain integration, multi-format operations (e.g., EXPO Design Center), and adapting the “Orange Box” culture to international markets like Canada.

Revenue Level: By the end of fiscal 2000, revenue reached approximately $45.7 billion.

4. Strategic Pivot and Modernization (2001-2010)

This era was marked by leadership changes and a shift toward technology.

- 2001: Expanded into Mexico by acquiring Total HOME.

- 2007: After years of centralized management under CEO Bob Nardelli, Frank Blake took over and implemented a “Back-to-Basics” strategy, refocusing on customer service and store morale.

- Digital Birth: In 2010, the company became one of the first major retailers to launch apps across all major smartphone platforms, signaling the start of its digital transformation.

Core Competencies: Centralized distribution systems (moving away from direct-to-store delivery), digital transformation (launching mobile apps), and refining the “Back-to-Basics” customer service model.

Revenue Level: Revenue peaked at $90.8 billion in 2006, then contracted to approximately $68 billion by 2010 due to the U.S. housing market crash and the Great Recession.

5. Interconnected Retail and Professional Focus (2011-Present)

The modern era focuses on “One Home Depot,” blending physical and digital shopping.

- Omnichannel Leadership: Built a world-class supply chain where over 50% of online orders are fulfilled through physical stores.

- The “Pro” Push: Recognizing the high value of professional contractors, the company made massive investments, including the $18.2 billion acquisition of SRS Distribution in 2024 to dominate the professional trade market.

- Current Status: With revenue exceeding $150 billion, it remains the global leader in the sector, operating over 2,300 stores.

Core Competencies: Interconnected Retail (seamlessly blending digital and physical shopping), sophisticated data analytics for inventory forecasting, and a specialized ecosystem for “Pro” customers (contractors).

Revenue Level: Revenue surged through the pandemic, hitting $151 billion in 2021. For fiscal 2024, revenue stood at approximately $152.7 billion.

Home Depot’s competitive landscape is categorized by the nature of the threat they pose to HD’s business model.

Here is the corrected breakdown of the three primary types of competitors:

Home Depot Competitive Analysis Table

| Category | Competitive Nature | Key Players |

| 1. Direct Competitors | Identical business models; competing for the same DIY and Pro customers in the same physical locations. | Lowe’s, Menards (Regional leader) |

| 2. Indirect/Digital Competitors | Mass retailers and e-commerce giants that dominate smaller home categories like tools, decor, and small appliances. | Amazon, Walmart, Target |

| 3. Specialty & Pro Competitors | Niche players focusing on high-depth inventory in specific categories (flooring, paint, roofing) to lure away Pro customers. | Floor & Decor (Flooring), Sherwin-Williams (Paint) |

Strategic Breakdown of the Three Frontiers

The Battle with Lowe’s (Direct)

This is a “Street Corner” war. While both are big-box retailers, Home Depot wins on Pro-loyalty. By ensuring that a general contractor can find everything from lumber to electrical components in one trip, HD generates higher sales per square foot. Lowe’s has historically leaned more toward the “consumer/decor” side, though they are currently trying to bridge the Pro-gap.

The Moat Against Amazon (Indirect)

Home Depot’s defense against the “Amazon Effect” is Physical Weight and Urgency.

- Bulk: Shipping 50 bags of concrete or 20-foot timber is prohibitively expensive for a standard courier.

- Immediate Need: When a pipe bursts, a plumber needs a replacement now, not in two days. HD’s stores act as localized, instant-fulfillment warehouses.

The Specialist Defense (Specialty)

Specialists like Floor & Decor pose a threat because they offer more variety in a single category than a generalist like HD can. Home Depot’s response has been aggressive acquisition. By buying SRS Distribution (Roofing/Landscaping) for $18.2 billion, HD is building a specialized “store-within-a-store” ecosystem to ensure Pros never have a reason to shop elsewhere.

The competition between Home Depot (HD) and Lowe’s (LOW) in 2026 is a study in divergent strategies. While Home Depot leverages its massive scale and professional moat, Lowe’s is aggressively closing the efficiency gap through store modernization and digital agility.

1. The Strategic Divide: Pro vs. DIY

The most significant competitive differentiator remains their customer mix.

- Home Depot (The Pro Giant): * Market Position: Approximately 50% of revenue comes from Professional contractors (Pros).

- 2026 Focus: Following the $18.2 billion SRS Distribution acquisition in 2024, HD has moved into specialized wholesale (roofing, landscaping, pool supplies), creating a B2B ecosystem that makes it the “infrastructure” of the trade industry.

- Lowe’s (The DIY Specialist): * Market Position: Historically leans toward the DIY segment (approx. 75% of revenue), focusing on aesthetics, lighting, and appliances.

- 2026 Focus: Under the “Total Home” strategy, Lowe’s is targeting “Pro-sumers” and small-to-mid-sized contractors by modernizing stores to be more “service-hub” oriented and improving its “Market Delivery Network” for big-ticket items like appliances.

2. Financial & Operational Metrics (2025-2026 Forecast)

Home Depot remains the leader in total volume, but Lowe’s has shown higher relative stock strength and operational agility in the 2025-2026 period.

| Metric | Home Depot (HD) | Lowe’s (LOW) | Competitive Edge |

| Annual Revenue | ~$163 Billion | ~$86 Billion | HD (Scale & Volume) |

| Operating Margin | ~13.4% | ~12.3% | HD (Higher Efficiency) |

| Pro Penetration | ~50% | ~30% | HD (Contractor Loyalty) |

| Digital Sales Growth | Mid-Single Digits | ~11.4% (Q3 2025) | LOW (Digital Agility) |

| Forward P/E Ratio | ~23-24x | ~19x | LOW (Value Valuation) |

3. Key Battlegrounds in 2026

- The AI Race: Both retailers are integrating AI into their supply chains. Home Depot uses tools like “Magic Apron” for store associates, while Lowe’s utilizes AI to create an “Extended Aisle,” allowing associates to sell specialized inventory not physically present in the store.

- Omnichannel Integration: * Home Depot: Over 50% of online orders are fulfilled in-store (BOPIS). Its “Interconnected Retail” model turns every store into a high-speed distribution center.

- Lowe’s: Closing the gap with a 23.1% 5-year CAGR in online sales, often outpacing HD’s digital growth rate as it captures younger, tech-savvy homeowners.

- Real Estate Sensitivity: HD’s Pro-heavy model makes it slightly more sensitive to large-scale construction trends, while Lowe’s is more sensitive to “discretionary” consumer spending. In the 2026 environment of stabilizing interest rates, Lowe’s has benefited from a rebound in DIY project sentiment.

4. Competitive Moat Analysis

Home Depot’s Moat: Its massive scale allows for a $15B+ net income (vs. Lowe’s ~$7.7B), providing more capital for aggressive tech R&D and massive acquisitions like SRS.

Lowe’s Moat: A more “agile” retail footprint and a stronger appeal to female shoppers and decor-focused DIYers, which provides a buffer when the professional construction market slows down.

While Home Depot remains the “Titan” of the industry, Lowe’s is often viewed as the “Compelling Choice” for 2026 investors due to its lower valuation and sharper execution in closing the operational gap.

In 2026, the rivalry between Home Depot (HD) and Amazon (AMZN) is not a direct price war but a battle between physical logistics and digital convenience. While Amazon dominates in small, high-frequency home items, Home Depot has built a “heavy-duty moat” that is structurally difficult for a pure-play e-commerce giant to cross.

1. The Core Differentiator: “Physicality” vs. “Digitality”

Home Depot’s defense is rooted in the physical constraints of home improvement products, which favor a hybrid store-distribution model over Amazon’s hub-and-spoke system.

- Logistical Physics (Heavy & Bulky): Shipping 50 bags of concrete, 12-foot lumber, or a pallet of shingles is prohibitively expensive for Amazon’s standard parcel network. Home Depot has invested in Flatbed Distribution Centers (FDCs) specifically designed to deliver these heavy materials directly to job sites.

- Immediacy (The “Burst Pipe” Factor): When a plumbing emergency occurs, a customer needs a solution in 30 minutes, not 24 hours. Home Depot’s 2,300+ stores act as instant-fulfillment warehouses. Over 90% of the U.S. population lives within 10 miles of a Home Depot.

2. Strategic Counter-Move: Interconnected Retail

Home Depot leverages its physical footprint to neutralize Amazon’s digital advantage through a strategy called “Interconnected Retail”:

- BOPIS (Buy Online, Pick Up In Store): Over 50% of Home Depot’s online orders are fulfilled through their physical stores. This saves the customer shipping costs and allows Home Depot to capture secondary “add-on” sales when the customer enters the store.

- Store-as-a-Hub: During supply chain disruptions or high-demand periods (like the 2024-2025 “Renovation Boom”), Home Depot uses its stores as shipping points, fulfilling local online orders faster and cheaper than Amazon could from a regional warehouse.

3. The Pro Customer: The Ultimate Moat

The Professional (Pro) segment accounts for nearly 50% of Home Depot’s revenue. This is the area where Amazon has struggled most to gain traction.

- Specialized Ecosystem: Contractors require more than just products; they need credit lines, bulk pricing, and specialized advice. Home Depot’s Pro Xtra loyalty program and dedicated “Pro Desks” provide a human-centric service model that Amazon’s automated platform cannot replicate.

- Strategic Acquisitions: The $18.2 billion acquisition of SRS Distribution (completed in 2024) significantly expanded Home Depot’s reach into the “complex trade” market (roofing, landscaping, pools), moving the competition into B2B wholesale territory where Amazon’s infrastructure is limited.

4. Comparison Table: Who Wins Where in 2026?

| Category / Service | Home Depot’s Edge | Amazon’s Edge | Winner |

| Heavy Materials (Lumber/Steel) | Specialized heavy-truck fleet. | High shipping costs/unsuitable. | Home Depot |

| Small Tools & Fasteners | Immediate pick-up. | Vast variety & customer reviews. | Amazon |

| Home Decor & Textiles | Limited shelf space. | Unlimited “Infinite Aisle.” | Amazon |

| Project Planning & Installation | Licensed pro-referral network. | Lacks service integration. | Home Depot |

| Consumer Electronics (Smart Home) | In-store demos & help. | Deep ecosystem (Alexa/Ring). | Amazon |

5. Emerging Threats & 2026 Trends

- Amazon Business Growth: Amazon is aggressively targeting the MRO (Maintenance, Repair, and Operations) market via Amazon Business, luring away small business owners for office and light-duty supplies.

- AI-Powered Inventory: Both companies are in an arms race. Home Depot uses AI (like its Sidekick app) to ensure high-demand items are always in stock for Pros, while Amazon uses AI to predict consumer decor trends.

Summary: Amazon is winning the “Small Box” home improvement game (decor, smart home, light tools). However, Home Depot remains the king of the “Whole Project,” owning the high-value, heavy-logistics, and professional relationship segments that are essential for major home renovation.

Source:

The Home Depot Investor Relations: https://ir.homedepot.com/

WallStreetZen HD Revenue History: https://www.wallstreetzen.com/stocks/us/nyse/hd/revenue

Macrotrends Home Depot Revenue: https://www.macrotrends.net/stocks/charts/HD/home-depot/revenue