The Evolution of Hermès: Key Eras

The history of Hermès is a masterclass in maintaining heritage while adapting to the modern world. Here is the breakdown of their journey:

The Golden Age of Saddlery (1837–1880)

In 1837, Thierry Hermès opened a harness workshop in Paris. His goal was simple: create the finest harnesses and bridles for the European noblemen. By 1867, the brand won the First Class Medal at the Universal Exhibition, proving that their hand-stitched leatherwork was unrivaled in durability and elegance.

Core Products: Custom harnesses, bridles, and saddles for the European elite.

Core Strategy: Technical Excellence & Reputation. Focused on the “Saddle Stitch” to provide unmatched durability. The goal was to secure awards at World’s Fairs to build authority among royal and aristocratic clients.

Revenue Level: High-end artisanal workshop scale. Revenue was limited by the number of master craftsmen but established a premium brand foundation.

The Shift to Travel and Leather Goods (1880–1950)

Thierry’s son, Charles-Émile Hermès, moved the shop to 24 Rue du Faubourg Saint-Honoré, where the flagship remains today. As the automobile replaced the horse, the third generation (Émile-Maurice Hermès) realized the brand had to pivot.

- The Zipper Revolution: Émile-Maurice introduced the “Hermès Fastener” (the zipper) to France, using it for the first leather golf jacket made for the Prince of Wales.

- The First Handbags: They launched the Haut à Courroies (the ancestor of the Birkin) and eventually the Sac à Dépêches (later known as the Kelly).

Core Products: Early travel bags (Sac à Dépêches), silk scarves (Carrés), and leather jackets with zippers.

Core Strategy: Pivoting to Lifestyle. As automobiles replaced horses, the brand transitioned leather expertise from horse gear to travel luggage. Introduced the zipper to France to gain a functional competitive edge.

Revenue Level: Transitioned into a retail-oriented family business. Moved to the flagship 24 Rue du Faubourg Saint-Honoré to increase visibility and sales volume.

Icons and Global Recognition (1950–1978)

Under Robert Dumas, the brand’s identity became legendary.

- The Silk Scarf (Carré): The production of the first Hermès scarf, Jeu des Omnibus et Dames Blanches, began in 1937 but became a global obsession in this era.

- The Kelly Bag: In 1956, a photo of Grace Kelly using her Hermès bag to hide her pregnancy from paparazzi made the bag an international sensation.

Core Products: The Kelly Bag (officially renamed in 1956), silk ties, and fragrances (Eau d’Hermès).

Core Strategy: Celebrity Endorsement & Category Expansion. Leveraged Grace Kelly’s image to create global desire. Expanded into “accessible luxury” categories like ties and perfumes to broaden the customer base.

Revenue Level: Steady international growth. The brand became a household name in luxury, though production remained strictly artisanal and controlled.

The Dumas Era & Modern Luxury (1978–2006)

Jean-Louis Dumas took over and transformed Hermès from a traditional house into a global powerhouse.

- The Birkin (1984): Born from a chance meeting between Dumas and Jane Birkin on a flight, this bag became the ultimate status symbol due to its extreme scarcity.

- Expansion: He expanded the brand into watches, tableware, and ready-to-wear, all while refusing to compromise on the “one craftsman, one bag” rule.

Core Products: The Birkin Bag (1984), luxury watches, and high-fashion ready-to-wear.

Core Strategy: Veblen Goods Management. Formalized the “waiting list” system to manufacture extreme scarcity. Went public (IPO) in 1993 to fund the acquisition of top-tier tanneries and secure the supply chain.

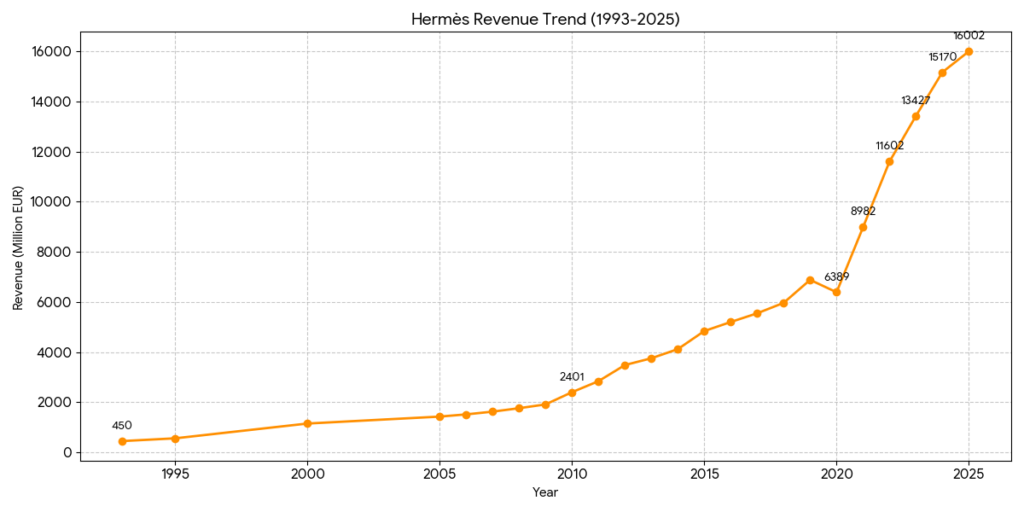

Revenue Level: Significant scaling. Revenue grew from approximately €400 million in 1989 to €1.9 billion by 2006.

Modern Independence and Innovation (2006–Present)

Today, led by Axel Dumas, Hermès remains one of the few luxury houses still largely family-owned.

- Defeating LVMH: The family successfully fought off a hostile takeover attempt by LVMH in the early 2010s to preserve their independence.

- Tech and Sustainability: From the Apple Watch Hermès collaboration to experimenting with mushroom-based leather (Sylvania), the brand continues to bridge the gap between 19th-century craft and 21st-century technology.

Core Products: Leather goods (43% of sales), Apple Watch Hermès, jewelry, and home collections.

Core Strategy: Defending Independence & Direct-to-Consumer. Successfully blocked LVMH’s hostile takeover. Embraced digital platforms while maintaining a high-margin business model (40%+ operating margin).

Revenue Level: Explosive growth. Revenue reached €15.17 billion in 2024, with 2025 estimates exceeding €16 billion, consistently outperforming luxury peers.

Competitive Analysis: Hermès in the 2026 Luxury Landscape

In 2026, Hermès continues to operate in a “category of one.” While luxury conglomerates like LVMH and Kering face headwinds from global economic cooling, Hermès leverages its ultra-high-net-worth (UHNWI) client base and extreme scarcity model to maintain industry-leading growth.

1. Core Competitive Advantages (The “Hermès Moat”)

- Veblen Effect & Financial Utility: Unlike most luxury goods that depreciate, Hermès icons (Birkin, Kelly) often appreciate in value. This gives them a “safe haven asset” status during market volatility.

- Vertical Integration & Craftsmanship: By owning its tanneries and maintaining an internal school of craftsmanship, Hermès controls 100% of its quality and supply. This results in a superior operating margin of approximately 41% to 42%.

- Zero-Marketing Reliance: Hermès spends significantly less on celebrity endorsements compared to peers, reinvesting that capital into store experiences and artisanal training, which preserves long-term brand equity.

2. Peer Comparison (Strategic Landscape)

| Competitor | Strategic Positioning | Competitive Threat to Hermès | 2026 Market Context |

| Chanel | Private Absolute Luxury | Pricing Parity: Chanel’s aggressive price hikes on the Classic Flap aim to position it as a direct alternative to the Birkin. | Competes fiercely for the same “Ultra-Luxury” wallet share. |

| LVMH (Louis Vuitton) | Diverse Luxury Conglomerate | Market Scale: LV’s massive marketing budget and digital reach capture the “aspirational” segment before they graduate to Hermès. | Currently struggling more than Hermès with the slowdown in Chinese middle-class spending. |

| Brunello Cucinelli | Quiet Luxury / Ready-to-Wear | Lifestyle Substitution: Dominates the “Quiet Luxury” apparel niche, competing with Hermès’ silk and cashmere segments. | High growth in 2025/2026 due to the shift away from loud logos. |

| Ferrari (Alternative Luxury) | Ultra-Luxury Hard Goods | Shared Wallet: For the ultra-rich, a rare Hermès bag and a limited-edition Ferrari are seen as similar investment-grade collectibles. | Often cited by analysts as the only other brand with a similar “waiting list” business model. |

3. SWOT Analysis (2026 Outlook)

- Strengths:

- Financial Resilience: Projected 2025/2026 revenue growth of 10%+ while competitors see low single digits.

- Brand Independence: Family control (over 60%) prevents short-term pressure from activist investors.

- Weaknesses:

- Production Bottlenecks: The refusal to automate means demand consistently outstrips supply, leading to potential frustration among younger, “instant-gratification” wealthy segments.

- Concentration Risk: Roughly 43% of revenue remains tied to the Leather Goods and Saddlery division.

- Opportunities:

- Upstream Expansion: Acquisitions of specialized textile and jewelry workshops to diversify beyond leather.

- Hospitality & Home: Leveraging the “Art of Living” to capture more of the consumer’s home environment.

- Threats:

- Regulatory Scrutiny: Increasing environmental regulations regarding exotic skins (crocodile, ostrich).

- Geopolitical Sensitivity: Exposure to the Asian market (nearly 50% of revenue) makes it vulnerable to regional trade tensions.

In 2026, the luxury market is defined by a clear divide between “Absolute Craftsmanship” and “Fashion Forward” aesthetics. Hermès maintains its position as the pinnacle of the “Quiet Luxury” movement, while its competitors utilize more aggressive design languages to capture cultural attention.

Product Style & Aesthetic Comparison (2026)

| Feature | Hermès (The Purist) | Chanel (The Modern Icon) | Louis Vuitton (The Trendsetter) |

| Design DNA | Equestrian Roots: Functional, structural, and minimalist. | Feminine Armor: Quilted textures, chains, and ornate hardware. | Global Nomad: Bold logos, avant-garde shapes, and tech-fusions. |

| Logo Visibility | Discreet: Often hidden or integrated into functional hardware (e.g., the H-lock). | Explicit: The interlocking CC is the center of the design. | Maximalist: The Monogram is used as a dominant visual pattern. |

| Trend Response | Timeless: Ignores seasonal trends to focus on decades-long longevity. | Reinventive: Blends classic codes with high-fashion seasonal themes. | Reactive: High-speed adaptation to street culture and digital trends. |

| Materiality | Leather First: Focus on natural grain, vegetable tans, and structural skins. | Textile & Leather: Heavy use of Tweed, lambskin, and decorative fabrics. | Hybrid: Mixes canvas, exotic leathers, and high-tech synthetics. |

Deep Dive into Design Philosophies

1. Hermès: The Architecture of Leather

Hermès treats leather as an architectural material. In 2026, their style remains focused on Symmetry and Substance.

- Visual Signature: The beauty comes from the quality of the “Saddle Stitch” and the weight of the leather.

- Key Silhouette: Structured (Sellier) vs. Relaxed (Retourné). Even their 2026 innovation—mushroom-based “Sylvania” leather—mimics the thick, durable feel of traditional calfskin to maintain their “built-to-last” aesthetic.

2. Chanel: The Decorative Classic

Chanel’s style is more Ornamental. While Hermès is about the “object,” Chanel is about the “look.”

- Visual Signature: The contrast between soft lambskin and cold metal chains.

- Key Silhouette: The “Classic Flap” remains a decorative accessory meant to complement an outfit, whereas a Birkin is often the centerpiece of the entire look.

3. Louis Vuitton & Dior: The Narrative Styles

Brands like LV and Dior use their products to tell a story of Contemporary Culture.

- LV Style: Under recent creative directions, LV has moved toward “Industrial Luxury,” combining raw edges with refined Monogram patterns.

- Dior Style: Focuses on Architectural Femininity (e.g., the Lady Dior), which is more sculptural and “ladylike” than the rugged, equestrian-influenced Hermès.

Resale Value & Style Longevity (2026 Data)

The style philosophy directly impacts investment value. According to 2026 market reports:

- Hermès Birkin 25 (Togo): Retention rate of 210% – 250% due to its “anti-trend” design.

- Chanel Classic Flap: Retention rate of 95% – 115%; while iconic, its frequent style iterations can slightly dilute the value of older seasonal versions.

- The Row Margaux: Emerging as the “New Birkin” for those seeking even more extreme minimalism than Hermès.

In the capital markets of February 2026, Hermès (RMS.PA) continues to command a significant valuation premium compared to its luxury peers. Investors often treat Hermès more like a “high-end compounding machine” than a cyclical fashion retailer, reflected in its consistently elevated Price-to-Earnings (P/E) ratio.

2026 Luxury Sector P/E Comparison (As of February 2026)

| Company / Group | Ticker | Current P/E (TTM) | 5-Year Average P/E | Market Cap (Approx.) |

| Hermès | RMS.PA | 49.8x – 52.8x | 55.1x | €230B |

| LVMH | MC.PA | 23.7x – 24.5x | 28.3x | €310B |

| Richemont | CFR.SW | 25.1x | 26.0x | €115B |

| Kering | KER.PA | 43.4x* | 22.0x | €35B |

| Industry Average | N/A | 17.2x – 30.1x | 32.0x | N/A |

*Note: Kering’s elevated P/E in early 2026 is largely due to a sharp decline in earnings (EPS) during the Gucci transition, rather than a premium market valuation.

Why Hermès Commands a Premium (The “Hermès Multiple”)

Investment analysts justify the high P/E of Hermès through several fundamental strengths that differentiate it from LVMH or Richemont:

- Exceptional Revenue Visibility: Due to the multi-year waiting lists for its core leather goods (Birkin/Kelly), Hermès effectively has “pre-sold” inventory. This makes their future earnings far more predictable than competitors who rely on seasonal fashion trends.

- Superior Profitability: As of February 2026, Hermès maintains a recurring operating margin of 41%, surpassing the industry average. Its Return on Equity (ROE) sits at approximately 26.4%, demonstrating highly efficient use of capital.

- Recession Resilience: While the broader luxury sector (LVMH, Kering) reported sales pressure in late 2025 due to a slowdown in aspirational spending, Hermès beat expectations with 9.8% revenue growth in Q4 2025, driven by ultra-high-net-worth clients who are less sensitive to economic cycles.

- Low Volatility (Beta): With a beta often around 0.75, Hermès stock tends to be less volatile than the overall market, making it a “defensive” play within the consumer discretionary sector.

Investment Considerations for 2026

- Valuation vs. Intrinsic Value: Despite its quality, some Discounted Cash Flow (DCF) models suggest the current price of ~€2,150 is significantly above modeled intrinsic value (which some analysts peg closer to €1,100–€1,900), suggesting that investors are paying a high premium for “certainty.”

- Pricing Power: Hermès confirmed a price increase of 5% to 6% for 2026. This ability to raise prices even during a sector-wide slowdown is a primary driver for its high multiple.

- Growth Outlook: The group entered 2026 with high confidence, particularly due to strong double-digit growth in the US (12.1%) and Japan (11.2%) markets.

Source:

- https://finance.hermes.com/en/group-overview/

- https://www.reuters.com/business/retail-consumer/hermes-sales-growth-slows-slightly-q4-2024-02-09/

- https://en.wikipedia.org/wiki/Hermès

Back to Hermes page