The history of Exxon is a defining narrative of the global energy industry. It evolved from a dominant monopoly into one of the world’s largest publicly traded energy companies. Here is the breakdown by stages:

Stage 1: The Rockefeller Era and Standard Oil (1870–1911)

The company’s roots lie in the mid-19th century oil boom in the United States.

- 1870: John D. Rockefeller and his partners incorporated Standard Oil in Ohio.

- 1882: The Standard Oil Trust was formed, consolidating various holdings into a massive entity.

- 1882: Standard Oil Co. of New Jersey (Jersey Standard) was incorporated. This entity would eventually become Exxon.

- Monopoly: By the late 1800s, Rockefeller controlled nearly 90% of the oil refining and pipelines in the U.S.

On the business side, John D. Rockefeller built the Standard Oil Trust through horizontal integration of refineries and vertical integration of transportation. The primary business strategy was achieving total market dominance through scale and cost control.

In terms of technology, the main product was kerosene for lamps rather than gasoline. Technical milestones included improving kerosene purification and the development of massive pipeline networks. The construction of long-distance pipelines was a revolutionary engineering feat at the time, allowing the company to bypass expensive rail transport and solidify its market position.

Stage 2: The Great Breakup and Rise of Jersey Standard (1911–1972)

In 1911, the U.S. Supreme Court ordered the dissolution of the Standard Oil Trust under the Sherman Antitrust Act.

- Separation: The trust was split into 34 independent companies. Jersey Standard emerged as the largest successor.

- The Esso Brand: The company used the brand name Esso (the phonetic pronunciation of “S.O.” for Standard Oil).

- Global Growth: During this period, the company expanded heavily into South America, the Middle East, and Southeast Asia.

- 1919: Acquired a 50% interest in Humble Oil & Refining Co., a key producer in Texas.

Business development during this phase focused on independence and international growth following the1911 breakup. In1919, Jersey Standard acquired a stake in Humble Oil, securing its own domestic crude oil supply.

Technological development saw two massive breakthroughs: 1.Fluid Catalytic Cracking (FCC): Commercialized in1942, this technology allowed the company to convert heavy oil into high-quality aviation fuel and gasoline, which was critical for the Allied effort in World War II and the post-war automotive boom. 2.Chemical Synthesis: The company created the first commercial petrochemical (isopropyl alcohol) in1920 and invented butyl rubber in1937, essentially launching the modern synthetic materials industry.

Stage 3: The Birth of Exxon (1972–1998)

Legal restrictions prevented Jersey Standard from using the “Esso” name in many U.S. states where other “Standard” companies operated.

- 1972: The company officially changed its name to Exxon Corporation and unified its U.S. brands (Esso, Enco, and Humble) under the Exxon name.

- Energy Crises: The 1970s brought immense profitability but also political challenges as Middle Eastern nations nationalized their oil fields.

- 1989: The Exxon Valdez oil spill in Alaska occurred, leading to decades of legal battles and a major shift in the company’s focus toward environmental safety protocols.

In business, the company unified its identity under the Exxon name in1972 to solve trademark disputes. As Middle Eastern nations began nationalizing oil assets in the1970s, Exxon shifted its business strategy toward non-OPEC regions, investing heavily in the North Sea and the Gulf of Mexico.

The technological focus shifted to frontier exploration. Exxon became a leader in deepwater drilling and 3D seismic imaging. These technologies allowed the company to find and extract oil from beneath thousands of feet of water and rock, reaching reservoirs that were previously inaccessible.

Stage 4: The ExxonMobil Merger and Modern Era (1999–Present)

Faced with falling oil prices and the need for massive scale to compete globally, two descendants of the original Standard Oil trust reunited.

- 1999: Exxon and Mobil (formerly Standard Oil of New York) merged to form ExxonMobil, the largest corporate merger at the time.

- Technological Shift: The 2010s saw a pivot toward “unconventional” oil, including the 2010 acquisition of XTO Energy to dominate the U.S. shale gas market.

- Energy Transition: In recent years, the company has faced pressure to address climate change.

- 2021: Launched ExxonMobil Low Carbon Solutions to focus on carbon capture and storage (CCS) and hydrogen production.

The1999 merger with Mobil created a “super-major” capable of handling multi-billion dollar projects. In2010, the acquisition of XTO Energy signaled a major business move into the unconventional shale gas market.

Modern technological development is defined by two tracks: 1.Unconventional Extraction: Refining hydraulic fracturing and horizontal drilling to maximize output from shale formations in the Permian Basin. 2.Low Carbon Solutions: The company is now focusing on Carbon Capture and Storage (CCS) and hydrogen production. They currently capture more carbon dioxide than any other company and are developing proprietary membranes to reduce energy consumption in chemical refining.

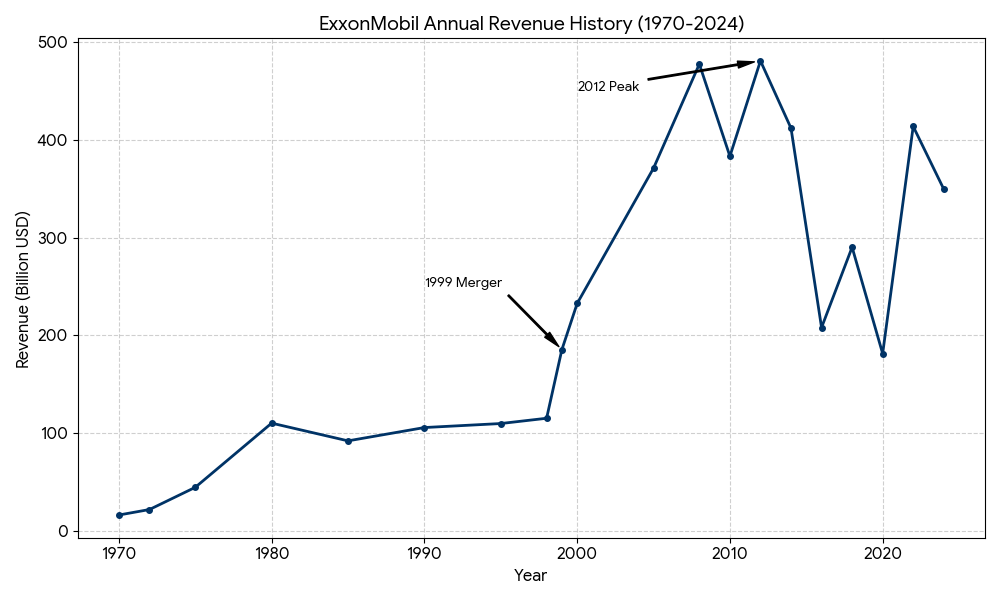

The significant revenue volatility since 1999 is primarily due to the fact that ExxonMobil operates in a highly cyclical industry where the top line is directly tied to the global price of crude oil and natural gas. Unlike consumer tech or retail, energy companies have little control over the market price of their primary products.

Below are the key factors and events that shaped this volatility:

1. The Super-Cycle and Emerging Market Demand (1999-2012)

Following the merger in1999, the company entered a period of unprecedented growth driven by the rapid industrialization of China and India.

- Rising Demand: Global consumption outpaced supply, pushing oil prices from under 20 dollars per barrel in1999 to a peak of nearly 147 dollars in2008.

- Impact: This created the massive upward slope in revenue, peaking at over 480 billion dollars in2012.

2. The US Shale Revolution and Oversupply (2014-2016)

Technological breakthroughs in horizontal drilling and hydraulic fracturing (fracking) allowed the US to flood the market with shale oil.

- Price War: In late 2014, OPEC chose not to cut production despite the US surplus, leading to a price crash.

- Impact: ExxonMobil’s revenue fell from 411.9 billion dollars in2014 to 208.1 billion dollars in2016. This was a supply-side shock that decoupled revenue from traditional demand metrics.

3. The COVID-19 Demand Collapse (2020)

The pandemic represented the single greatest demand shock in the history of the modern oil industry.

- Negative Prices: In April 2020, WTI crude oil futures briefly traded at negative prices because there was nowhere left to store the excess oil.

- Impact: With global travel at a standstill, revenue dropped to 181.5 billion dollars, the lowest level since the early 2000s.

4. Geopolitical Conflicts and Energy Security (2022-Present)

Geopolitics remains a primary driver of revenue spikes.

- Russia-Ukraine War: The invasion in February 2022 led to sanctions and the loss of Russian supply to Western markets.

- Impact: Global energy prices skyrocketed, pushing ExxonMobil’s revenue back above 400 billion dollars in2022. This highlighted the continued global dependence on fossil fuels despite the ongoing energy transition.

Summary of Volatility Drivers

- Commodity Correlation: Every 10 dollar change in the price of a barrel of oil results in billions of dollars of revenue difference for a company of this scale.

- Operating Leverage: Because the costs of running massive oil fields and refineries are relatively fixed, any change in market price flows directly and dramatically to the top and bottom lines.

- Capital Intensity: Decisions to invest in multi-billion dollar projects (like the Guyana offshore finds) take years to bear fruit, often coming online during different market cycles than when they were approved.

Sources:

- ExxonMobil Official History: https://corporate.exxonmobil.com/who-we-are/our-global-organization/our-history

- Britannica – Exxon Mobil Corporation: https://www.britannica.com/topic/Exxon-Mobil-Corporation

- Library of Congress – Standard Oil Monopoly: https://guides.loc.gov/oil-and-gas-industry/history/standard-oil