1. Early Origins and the Standard Oil Era (1879-1911)

The history of Chevron began in 1879 with the founding of Pacific Coast Oil Co. This company was later acquired by John D. Rockefeller’s Standard Oil trust. In 1911, the U.S. Supreme Court ordered the breakup of Standard Oil due to monopoly concerns. The California-based operations emerged as the Standard Oil Co. of California (Socal), which is the direct predecessor of Chevron.

Core Strategy: Vertical Integration & Monopolistic Expansion. The focus was on controlling the entire value chain in California—from extraction to refining and distribution—under the Standard Oil trust.

Revenue Level: Precise figures from this era are limited, but as part of the Standard Oil monopoly, it controlled the vast majority of the fuel market on the U.S. West Coast. After the 1911 breakup, it emerged as the largest oil producer in California.

2. Overseas Exploration and Major Discoveries (1911-1945)

Between the World Wars, Socal looked abroad for new resources. A pivotal moment occurred in the 1930s when Socal’s geologists discovered massive oil reserves in Saudi Arabia. To develop these fields, Socal partnered with Texaco to form the California Arabian Standard Oil Company (CASOC), which eventually became Saudi Aramco.

Core Strategy: High-Risk Exploration & Strategic Alliances. Facing intense domestic competition, Socal looked to the Middle East. It secured concessions in Saudi Arabia and partnered with Texaco to form Caltex, leveraging Texaco’s marketing network to sell its massive crude discoveries.

Revenue Level: The discovery of “Dammam No. 7” in 1938 transformed the company’s financial trajectory. Production shifted from local supply to global export, with international sales becoming a primary growth engine.

3. Post-War Expansion and Brand Identity (1946-1983)

Following WWII, Socal expanded its reach across the Americas, Africa, and Asia to meet surging global energy demand. In 1947, the company began using the “Chevron” brand name for its products in various markets. During this era, the company achieved significant breakthroughs in offshore drilling technology, particularly in the Gulf of Mexico.

Core Strategy: Market Penetration & Offshore Innovation. The company focused on expanding the Chevron brand globally and pioneered offshore drilling technologies to tap into the high-potential reserves of the Gulf of Mexico.

Revenue Level: Revenue grew steadily alongside the post-war global economic boom and the rise of consumer automobile culture. By the 1970s, oil price shocks significantly increased the nominal value of its global sales.

4. Corporate Mergers and the Birth of Chevron (1984-2000)

In 1984, Standard Oil of California officially changed its name to Chevron Corporation. That same year, it completed what was then the largest merger in corporate history by acquiring Gulf Oil for 13.3 billion USD. This acquisition doubled the company’s oil and gas reserves and solidified its status as a global “supermajor.”

Core Strategy: Scale & Efficiency. The 1984 acquisition of Gulf Oil was a “scale play” designed to double reserves and production overnight. The strategy shifted toward streamlining operations and cutting costs to compete as a global supermajor.

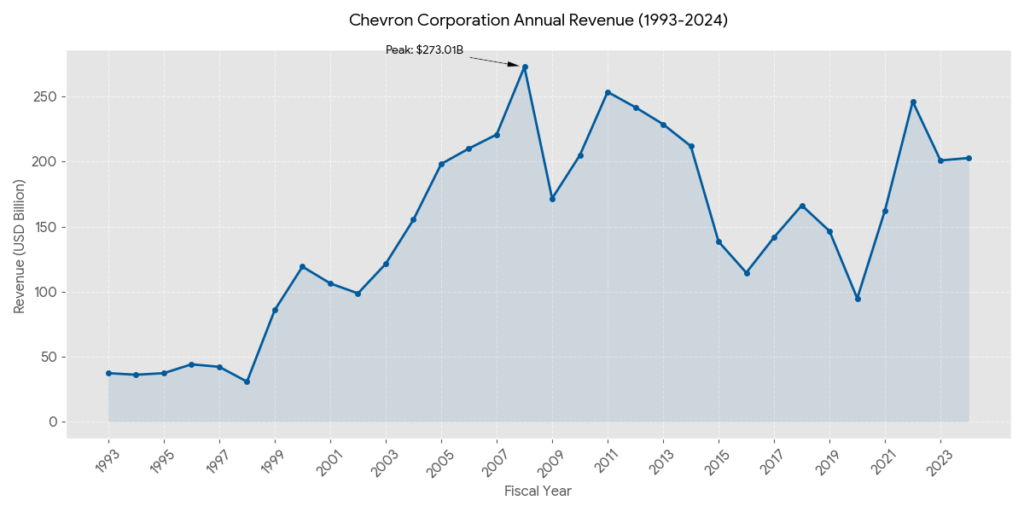

Revenue Level: The Gulf Oil merger caused a quantum leap in revenue. By the 1990s, Chevron’s annual revenue consistently sat in the tens of billions of dollars, firmly placing it among the world’s top energy firms.

5. Integration and Technological Innovation (2001-2019)

Chevron merged with its long-time partner Texaco in 2001, briefly becoming ChevronTexaco before reverting to Chevron in 2005. The company focused on deepwater exploration, massive Liquefied Natural Gas (LNG) projects like Gorgon in Australia, and unconventional resources such as shale oil. The acquisition of Unocal in 2005 further strengthened its natural gas presence in Asia.

Core Strategy: Mega-Project Execution. Following the merger with Texaco (2001) and Unocal (2005), Chevron focused on “unconventional” and “ultra-large” projects, including deepwater drilling and massive Liquefied Natural Gas (LNG) plants in Australia.

Revenue Level: During the commodity super-cycle (2008-2014), revenue reached historic peaks, exceeding 200 billion USD annually as oil prices soared above 100 USD per barrel.

6. Energy Transition and Low-Carbon Strategy (2020-Present)

In response to climate change and the shifting energy landscape, Chevron has adopted a dual-track strategy. It acquired Noble Energy in 2020 to bolster its shale and Mediterranean gas assets. More recently, Chevron established a “New Energies” division focusing on hydrogen, Carbon Capture (CCUS), and renewable fuels. In 2023, the company announced a 530 billion USD deal to acquire Hess Corp to secure high-growth assets in Guyana and the Permian Basin.

Core Strategy: Higher Returns, Lower Carbon. The current strategy emphasizes capital discipline—prioritizing high-margin, low-carbon intensity assets like the Permian Basin and Guyana. It is also investing in New Energies (Hydrogen, CCUS).

Revenue Level: Despite market volatility, Chevron has maintained strong financial performance. In 2022, revenue reached 246.3 billion USD due to high energy prices. For the full year 2024, revenue stabilized at approximately 202.8 billion USD, with production reaching a record 4.08 million barrels per day.

In 2026, the competitive landscape for Chevron (CVX) is defined by its battle with the “Supermajors” and its focus on capital efficiency. Below is a competitive analysis of Chevron in English:

1. Peer Comparison: The Global Supermajors

Chevron competes primarily with ExxonMobil, Shell, BP, and TotalEnergies. While European peers have historically leaned faster into renewables, Chevron and ExxonMobil have doubled down on oil and gas advantage.

| Competitor | Strategic Focus (2026) | Competitive Edge vs. Chevron |

| ExxonMobil | Massive scale; dominance in Guyana & CCS | Larger balance sheet; higher degree of vertical integration in chemicals. |

| Shell | Global LNG leadership; Integrated Power | Stronger footprint in European and Asian natural gas markets. |

| BP | Fast-tracked energy transition; EV charging | More advanced portfolio in non-hydrocarbon energy sources. |

| TotalEnergies | Diversified energy (Solar/Wind) in EM | Better positioned for aggressive “Net Zero” regulatory environments. |

2. Chevron’s Competitive Advantages (The “Chevron Way”)

- Lowest Cost of Supply: Chevron maintains one of the lowest portfolio breakeven prices in the industry, estimated at approximately $30 per barrel. This makes it more resilient to oil price volatility than peers with higher-cost legacy assets.

- Capital Discipline: Chevron is widely regarded as the most disciplined spender among the supermajors. Its Net Debt-to-Capital ratio remains industry-leading (approx. 12%), allowing for consistent dividend growth even during downturns.

- Permian Basin Leadership: Chevron holds a massive, royalty-advantaged position in the Permian Basin. Unlike competitors who acquired their way in at high prices, much of Chevron’s land was held for decades, resulting in superior margins.

3. SWOT Analysis (2026 Outlook)

Strengths

- Financial Fortitude: Best-in-class balance sheet and cash flow generation.

- Strategic Acquisitions: The integration of Hess Corp (finalized/integrated by 2026) provides a world-class growth engine in Guyana alongside the Permian.

- Operational Excellence: High utilization rates in refining and industry-leading safety records.

Weaknesses

- Downstream Scale: Smaller refining and chemical footprint compared to ExxonMobil, meaning less “natural hedge” when crude prices are low but refining margins are high.

- Geographical Concentration: High reliance on the U.S. (Permian) and Australia (LNG), making it sensitive to local regulatory changes in those two regions.

Opportunities

- Carbon Capture & Hydrogen: Chevron is leveraging its subsurface expertise to lead in Carbon Capture, Utilization, and Storage (CCUS).

- Natural Gas Demand: As a “bridge fuel,” global LNG demand favors Chevron’s massive Australian assets (Gorgon and Wheatstone).

Threats

- Regulatory Headwinds: Increasing methane taxes and carbon border adjustments in the U.S. and EU.

- Litigation Risks: Ongoing climate change lawsuits from various state and local governments targeting major oil producers.

Key Financial Metric Comparison (Estimated 2025/2026)

| Metric | Chevron (CVX) | ExxonMobil (XOM) | Industry Average |

| Dividend Yield | ~4.2% | ~3.3% | 3.8% |

| Return on Capital (ROCE) | ~14-16% | ~13-15% | 11% |

| Production Cost/bbl | ~$10.50 | ~$12.00 | $15.00 |

In 2026, Chevron’s technical competition is characterized by a “pragmatic digital” approach, where technology is not just an R&D experiment but a primary driver for its $3 billion cost-reduction target by year-end.

1. AI-Driven Operational Efficiency (The “Apollo” Platform)

While rivals like BP focus on digitalizing the customer experience, Chevron’s AI strategy is “asset-first.”

- Drilling Optimization: Chevron’s proprietary Apollo platform utilizes multivariate machine learning on data from over 50,000 wells. In 2026, this system is credited with reducing drilling costs by 25-50% and increasing drilling speed by 30% compared to traditional methods.

- Triple-Frac Technique: Chevron leads the industry in systematic automation, such as fracturing three wells simultaneously. This technical feat allows for 25% faster well completion, giving it a time-to-market advantage in the Permian Basin.

2. Infrastructure for the AI Era (The “Twin-Engine” Strategy)

A unique technical pivot for Chevron in 2026 is becoming an energy provider for AI.

- Data Center Power: Leveraging its natural gas assets, Chevron is deploying “AI data center power projects.” The first major project in West Texas (targeting 2027) uses natural gas combined with hydrogen-capable turbines and carbon capture to provide low-carbon, 24/7 “firm” power that solar and wind cannot yet match.

- Robotics & Drones: The widespread use of AI-powered drones for methane detection and robotic site inspections has generated over $60 million in direct value by reducing manual labor and environmental compliance risks.

3. Low-Carbon Technology & “Turquoise” Hydrogen

Chevron’s 2026 low-carbon budget (~$1 billion) focuses on scalable, high-barrier-to-entry technologies:

- Subsurface CCUS: Chevron’s technical edge in Carbon Capture and Storage (CCS) comes from its deep understanding of rock physics. It is currently piloting next-generation capture technologies (such as its investment in ION Clean Energy) to solve the “energy penalty” problem that makes traditional carbon capture expensive.

- Novel Hydrogen Pathways: Unlike peers focusing only on Green (electrolysis) or Blue (gas + CCS) hydrogen, Chevron has invested in Methane Pyrolysis (Turquoise Hydrogen). This tech produces solid carbon instead of $CO_2$, potentially creating a secondary revenue stream from carbon black for industrial use.

Technical Competitor Benchmarking (2026)

| Technology Pillar | Chevron (CVX) | ExxonMobil (XOM) | Shell / TotalEnergies |

| Upstream AI | Industry Leader (Apollo/Triple-Frac) | Strong (Global Scale) | Moderate (Transition Focus) |

| CCS Strategy | Focus on Sequestration Safety | Focus on Capture Scale | Focus on Carbon Trading |

| New Energy Tech | Hydrogen & Biofuels | Lithium & Massive CCS | Wind, Solar, & EV Charging |

| Digital Twins | Operational (Predictive Maint.) | Systemic (Global Integration) | Consumer (Customer Apps) |

Summary: The “Execution” Advantage

Chevron’s technical “Moat” in 2026 is its ability to scale innovations across its simplified global structure. By reducing its upstream business units from 20 down to just 3-5 global divisions, Chevron ensures that a technical breakthrough in the Gulf of Mexico is implemented in its Nigeria or Guyana assets within weeks, not years.

Source:

- Trading Economics – Chevron Sales Revenues (Quarterly Historical Data)

- Macrotrends – Chevron Annual Revenue History (1993-2024 Chart)

- MacroMicro – Chevron Quarterly Revenue & Net Income Series

- IndexBox – Chevron 2025 Annual Performance Summary

Bakc to Chevron page