The History of Apple: The Fusion of Hardware Aesthetics and Ecosystem Hegemony

I. The Founding and Personal Computer Revolution (1976 – 1996)

Core Technology:

-

1977: Apple II: The first commercially successful personal computer, featuring color graphics and expansion slots.

-

1984: Macintosh: The world’s first personal computer to commercialize the Graphical User Interface (GUI) and the mouse, defining the way modern computers operate.

Business Development:

-

Apple went public in 1980. However, Steve Jobs left in 1985 due to internal power struggles. This was followed by a decade of product line confusion and declining profits, bringing the company to the brink of bankruptcy.

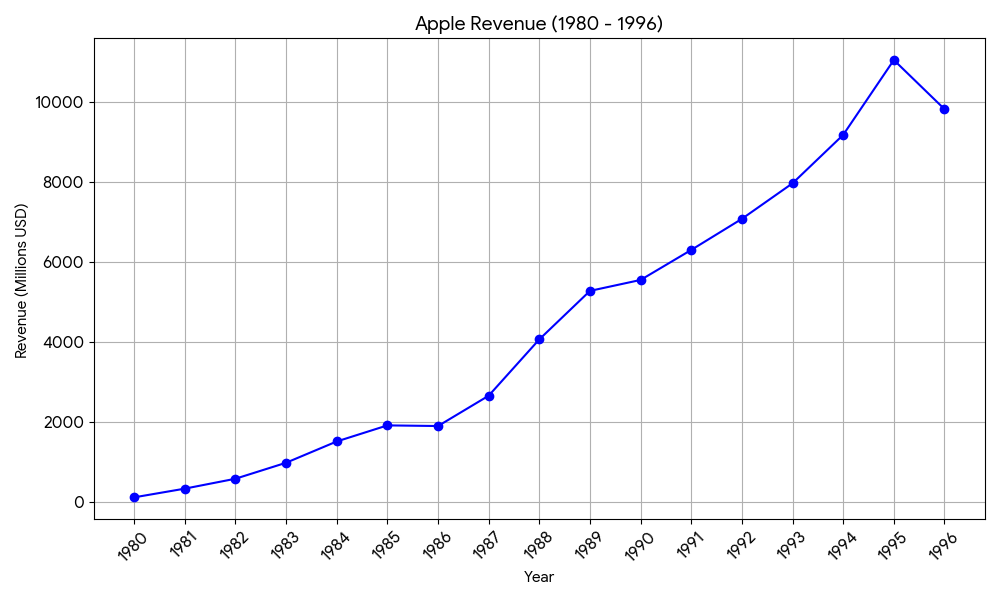

Revenue Levels:

-

1980 (IPO year): Revenue was approximately 117 million USD.

-

1995: Revenue reached a peak of 11 billion USD, but subsequently suffered massive losses due to product failures and management issues.

II. The Return of Steve Jobs and the Peak of the “i” Series (1997 – 2010)

Upon the return of Steve Jobs, Apple reshaped the music and communication industries through minimalist design and a robust content ecosystem (iTunes).

Technological Core

-

2001: iPod: Put 1,000 songs in your pocket and established a digital content revenue-sharing model in conjunction with the iTunes Store.

-

2007: iPhone: A revolutionary product that integrated a widescreen iPod, a mobile phone, and an internet communicator, leading the smartphone era.

-

2010: iPad: Pioneered the tablet computer market.

Business Development

-

Renamed from Apple Computer to Apple Inc., marking the transformation from a computer manufacturer to a consumer electronics giant.

-

Established the “Walled Garden” ecosystem characterized by the high integration of hardware (iPhone), software (iOS), and services (App Store).

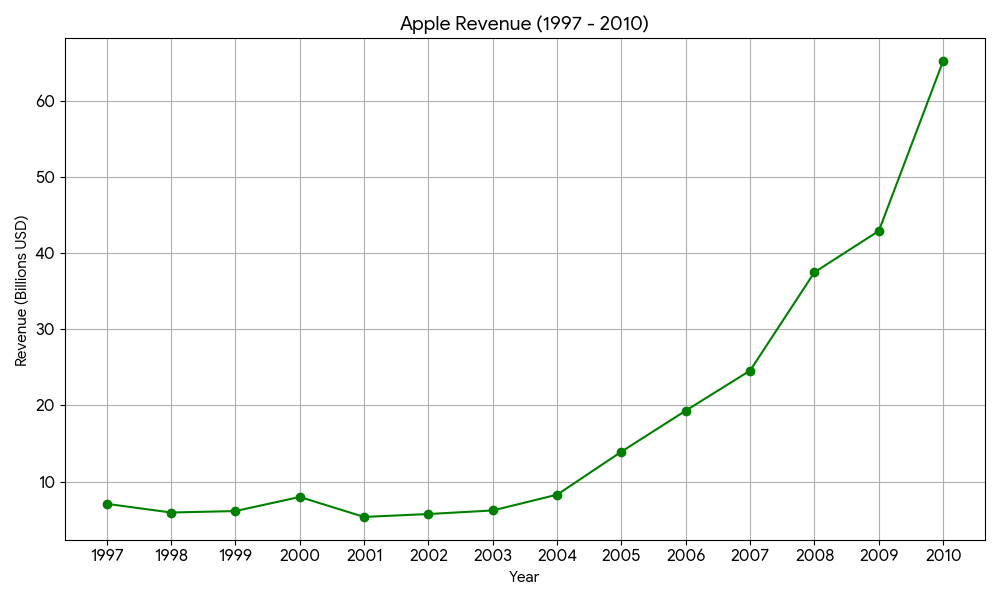

Revenue Levels

-

2004: Approximately 8 billion USD.

-

2010: Jumped significantly to 65.22 billion USD, with the iPhone becoming the primary engine for profit.

III. The Tim Cook Era: Scaling and Service Transformation (2011 – 2023)

Under Tim Cook’s leadership, Apple moved toward peak supply chain management and a business model transformation centered on subscription services.

Technological Core

-

Apple Silicon (2020): Launched the self-developed M1 chip, breaking reliance on Intel and achieving underlying technical unification across Mac, iPad, and iPhone.

-

Wearables: Apple Watch and AirPods became entirely new multi-billion-dollar business segments.

Business Development

-

Strategic Acquisitions: Instead of massive mergers, Apple acquired hundreds of small AI companies to strengthen image processing and Siri functionality.

-

Service Revenue Explosion: Shifted strategic focus toward iCloud, Apple Music, and Apple Pay.

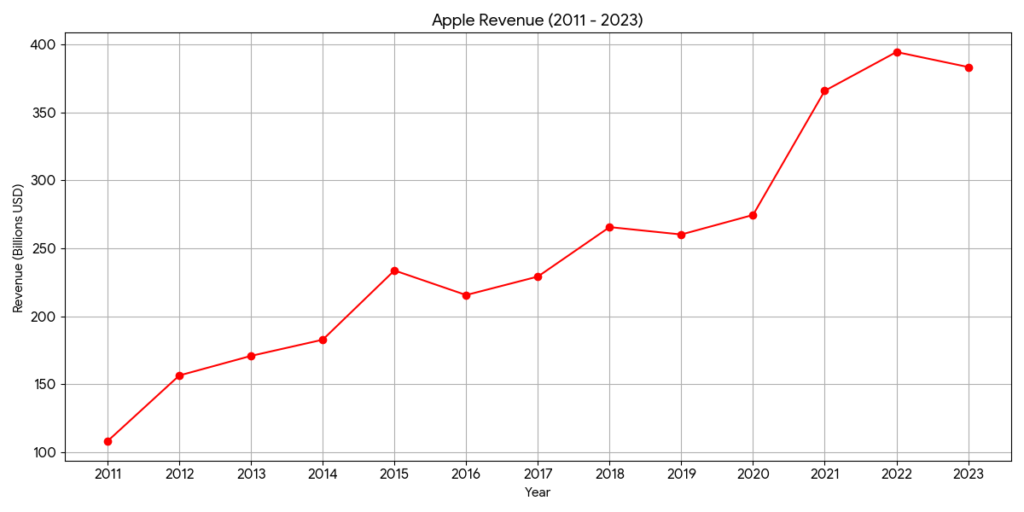

Revenue Levels

-

2011: Approximately 108.2 billion USD.

-

2022: Reached a peak revenue of 394.3 billion USD.

IV. Apple Intelligence and Spatial Computing (2024 – Present)

Apple has officially entered the AI era, emphasizing privacy-first on-device AI and Spatial Computing.

Technological Core

-

Apple Intelligence (2024-2025): Powered by the Apple Silicon Neural Engine, it provides cross-app contextual understanding. It includes a partnership with OpenAI while emphasizing Private Cloud Compute (PCC).

-

Vision Pro: The first spatial computing device, attempting to define the post-smartphone era.

Business Development

-

Sovereign Privacy: Positioning privacy as the primary premium value proposition in the AI age.

-

Market Capitalization Breakthrough: In 2025, Apple’s market cap fluctuated around 4 trillion USD, maintaining its position as one of the world’s most valuable companies.

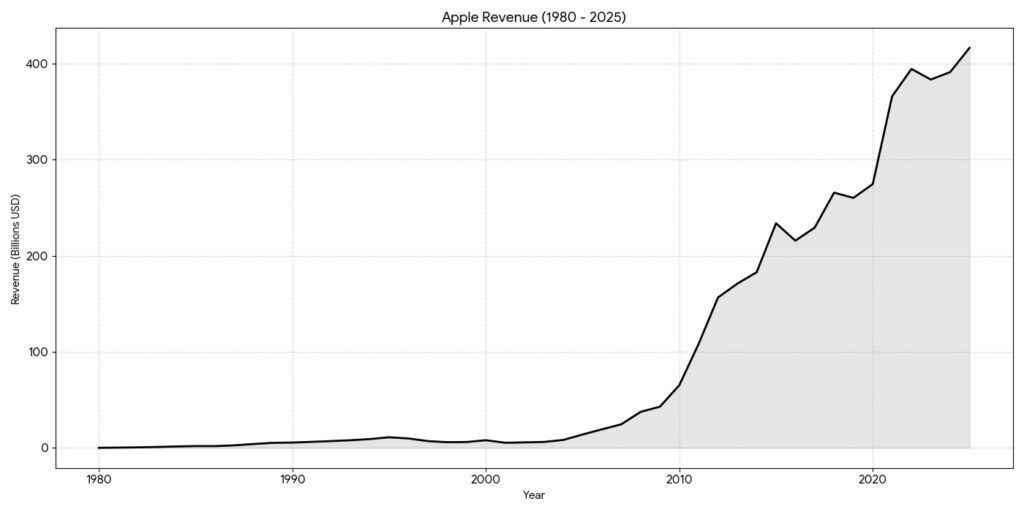

Revenue Levels (Latest 2025 Financial Report)

-

Fiscal Year 2025 (FY25): Total revenue reached approximately 416.2 billion USD.

-

Revenue Mix: iPhone accounts for roughly 50%, while Services grew to 26% of total revenue (surpassing 25 billion USD in a single quarter with extremely high gross margins).

Current Industry Trends (2025 – 2030)

As of late 2025, Apple is navigating a landscape defined by the convergence of high-performance local AI, shifting global manufacturing footprints, and rigorous regulatory oversight.

1. AI at the Edge (On-Device Intelligence)

AI is moving from the cloud to the device. Apple leverages its proprietary Silicon (NPU) to handle most AI requests locally, prioritizing speed and privacy.

-

Impact: This creates a significant “Supercycle” for hardware upgrades (iPhone 16 and later). It positions Apple as a privacy-centric alternative to cloud-heavy AI models like those powered by NVIDIA in data centers.

-

Technical Fact: On-device Small Language Models (SLMs) now generate approximately 30 tokens per second on the latest iPhone hardware.

2. Supply Chain Diversification (China + 1 Strategy)

To mitigate geopolitical risks and tariff pressures, Apple is aggressively shifting production from China to India and Vietnam.

-

Strategic Shift: By late 2025, a majority of iPhones sold in the US are expected to originate from India, while Vietnam has become the primary hub for iPad, Mac, Apple Watch, and AirPods.

-

Opportunities for Taiwan: Major partners like Foxconn (Hon Hai), Quanta, and Pegatron are essential in this transition, expanding their facilities in Southeast Asia and South Asia to support Apple’s “resilient logistics” goal.

3. From Lockdown to Compliance (Regulatory Challenges)

The EU’s Digital Markets Act (DMA) has forced Apple to dismantle parts of its “Walled Garden,” requiring support for third-party App Stores and USB-C standardization.

-

The New Balance: Apple must now navigate a “Sovereign Privacy” model, attempting to maintain ecosystem security while complying with gatekeeper regulations that demand interoperability.

-

Global Trend: Other major markets are beginning to follow the EU’s lead, pushing Apple toward a more inclusive, albeit legally complex, global platform strategy.

4. Maximization of the Subscription Economy

With the hardware market reaching maturity, Apple’s growth is increasingly driven by the Apple One bundle and financial services.

-

Financial Milestone: The Services segment is targeting an annual revenue run rate of 100 billion USD by the end of 2025.

-

Ecosystem Stickiness: Services like Apple Music, iCloud, and Apple Pay act as “digital glue,” making it difficult for users to leave the ecosystem even as hardware cycles lengthen.