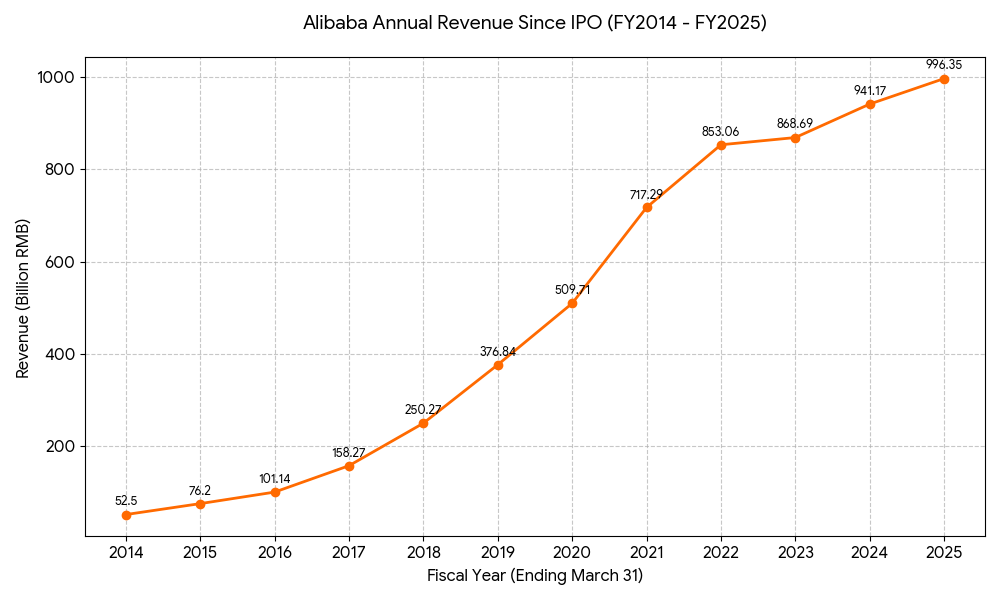

The history of Alibaba Group is a remarkable narrative of how a small B2B marketplace transformed into a global technology empire. We can categorize its evolution into four distinct eras:

1. The Founding & Survival (1999 – 2003): The B2B Era

This stage was defined by Jack Ma and the “18 Founders” building a bridge between Chinese manufacturers and global buyers.

- 1999: https://www.google.com/search?q=Alibaba.com was launched in Jack Ma’s apartment in Hangzhou.

- 2000: Secured a $20 million investment from SoftBank, led by Masayoshi Son. This capital was crucial for surviving the “dot-com bubble” burst.

- Key Milestone: Established the mission “To make it easy to do business anywhere.”

Core Technology: Web Indexing & Search. The tech was relatively basic, focusing on directory listings and a search engine for B2B leads. The goal was to solve “Information Asymmetry” between Chinese factories and global buyers.

Revenue Level: Break-even Mode.

- Revenue: Estimated in the millions to hundreds of millions of RMB.

- Financial State: The company was burning venture capital (from SoftBank/Goldman Sachs) and only achieved its first “1 RMB profit” in 2002.

2. Expansion & Ecosystem Building (2003 – 2011): Defeating Giants

Alibaba pivoted toward the domestic consumer market, taking on international competitors like eBay.

- 2003: Launched Taobao, a C2C marketplace. By offering it for free to sellers, they successfully forced eBay out of the Chinese market.

- 2004: Alipay was created to solve the “trust gap” in online payments, utilizing an escrow system.

- 2008: Tmall (originally Taobao Mall) was launched to capture the high-end B2C brand market.

- 2009: The first “Double 11” (Singles’ Day) shopping festival was held. Alibaba Cloud was also established this year.

Core Technology: Digital Trust & Scalability.

- Escrow System (Alipay): A revolutionary technical/legal framework that held funds until buyers confirmed receipt.

- De-IOE Initiative: Alibaba realized that traditional high-end hardware (IBM servers, Oracle databases, EMC storage) was too expensive and rigid for massive traffic. They began building their own Distributed Systems using low-cost commodity hardware.

Revenue Level: High Growth.

- FY2011 Revenue: Approximately 6.4 Billion RMB.

- Growth Driver: The massive adoption of Taobao and the commission/advertising revenue from the “Alimama” marketing platform.

3. The Golden Era & Global Dominance (2012 – 2020): Mobile & IPO

During this period, Alibaba became a “Digital Economy” and one of the world’s most valuable companies.

- 2014: Alibaba went public on the New York Stock Exchange (NYSE), raising $25 billion—the largest IPO in history at the time.

- 2016: Introduced the “New Retail” strategy, merging online and offline shopping (e.g., acquiring Freshippo/Hema).

- 2019: Jack Ma officially stepped down as Chairman, handing the reins to Daniel Zhang. The company completed a secondary listing in Hong Kong.

- Ecosystem: Expanded into logistics (Cainiao), local services (Ele.me), and entertainment (Youku).

Core Technology: Cloud Computing & Big Data Algorithms.

- Apsara (Apsara Operating System): Alibaba Cloud’s self-developed system capable of clustering millions of servers to process the “Double 11” traffic spikes (handling over 500,000 orders per second).

- Recommendation Engines: Transitioned from “search” to “discovery” using AI to create a personalized feed for every user (“A Thousand People, A Thousand Faces”).

Revenue Level: Hyper-Expansion.

- FY2020 Revenue: 509.7 Billion RMB.

- Financial State: Net income soared as Alibaba Cloud turned profitable and Tmall became the dominant B2C platform in China.

4. Regulatory Shift & Restructuring (2020 – Present): The “1+6+N” Era

Following increased regulatory scrutiny and fierce competition from rivals like Pinduoduo (PDD) and Douyin (TikTok), the group entered a phase of radical transformation.

- 2020-2021: The Ant Group IPO was suspended, and Alibaba faced significant anti-monopoly fines.

- 2023: Announced the “1+6+N” restructuring, splitting the company into six business groups (Cloud, Taobao Tmall, Local Services, Cainiao, Global Digital Commerce, and Digital Media) to increase agility.

- 2024 & Beyond: New leadership under Joe Tsai (Chairman) and Eddie Wu (CEO). The focus has shifted back to “User First” and “AI-driven” growth to combat market share erosion.

Core Technology: Generative AI & LLMs.

- Tongyi Qianwen (Qwen): Alibaba’s proprietary Large Language Model. Technology is no longer just for “hosting” websites but for “intelligence”—AI-driven customer service, automated marketing assets, and global translation.

- Agentic AI: By 2025/2026, Alibaba integrated “AI Agents” into its B2B and B2C platforms, allowing AI to negotiate prices, manage inventory, and handle cross-border logistics autonomously.

Revenue Level: The 1-Trillion RMB Milestone.

- FY2025 Revenue: Reached approximately 996.3 Billion RMB (~$137 Billion USD).

- Financial State: While revenue growth has slowed compared to the 2010s, the focus has shifted to Operational Efficiency and high-margin AI Cloud services.

Summary of Alibaba’s Strategic Focus

| Segment | Current Strategic Role |

| Taobao Tmall | The “Cash Cow”—focusing on price competitiveness and retention. |

| Cloud Intelligence | The “Growth Engine”—leveraging Generative AI and public cloud. |

| AIDC (International) | The “Expansion Frontier”—growing AliExpress and Lazada globally. |

| Cainiao | The “Backbone”—enhancing global delivery speeds (e.g., 5-day global delivery). |