The history of Agricultural Bank of China (ABC) is unique among China’s “Big Four” state-owned banks. It is often described as a journey of “Three Ups and Three Downs” (due to being abolished and reinstated multiple times) before eventually evolving into a global financial powerhouse.

Here is the historical breakdown of ABC by stage:

1. Early Instability: The “Three Ups and Three Downs” (1951–1978)

During the planned economy era, the bank’s existence was unstable, as its functions were frequently merged into the People’s Bank of China (PBOC).

- 1st Establishment (1951–1952): Founded as the Agricultural Cooperation Bank to support post-revolution land reforms. It was soon merged into the PBOC.

- 2nd Establishment (1955–1957): Formally named “Agricultural Bank of China” to support the agricultural collectivization movement. It was dissolved again due to institutional restructuring.

- 3rd Establishment (1963–1965): Established as a direct agency under the State Council to manage rural funds. It was abolished at the onset of the Cultural Revolution.

2. Restoration & Specialized Banking (1979–1993)

With the “Reform and Opening-up” policy, China needed a specialized financial pillar to support rural economic reforms.

- The 4th Restoration (1979): In February 1979, the State Council officially restored ABC for the fourth time. This marked the end of its “on-again, off-again” history.

- Mandate: It functioned as a State Specialized Bank, managing rural credit cooperatives (RCCs) and distributing state-allocated funds for agricultural development.

Key Policy Reforms:

- Unified Rural Credit Management (1979): The State Council’s “Notice on Restoration” gave ABC the monopoly over managing all state funds earmarked for agriculture.

- Retention of Profits System (1984): A shift from a “total handover” of funds to a “profit-sharing” model. This gave ABC its first incentive to manage its own balance sheet and seek operational efficiency.

- Initial Modernization (1980s): The World Bank provided its first agricultural credit project in China via ABC, introducing international accounting standards.

Revenue/Asset Levels:

- Early 1980s: There was no modern “Operating Income” concept. In 1980, interest income was roughly RMB 1.46 billion.

- Assets: Total assets in 1979 were approximately RMB 40 billion.

3. Commercial Transformation (1994–2002)

As China moved toward a market economy, the government sought to separate “policy-based lending” from “commercial banking.”

- Policy Separation (1994): The Agricultural Development Bank of China (ADBC) was created to handle policy-mandated loans (e.g., poverty alleviation, grain reserves). ABC began its transition into a state-owned commercial bank.

- Decoupling (1996): ABC ceased its administrative management of Rural Credit Cooperatives, allowing it to focus on its own market-oriented operations.

- Asset Cleanup (1999): To address high Non-Performing Loan (NPL) ratios, billions in bad debt were transferred to the newly formed Great Wall Asset Management Company.

Key Policy Reforms:

- Establishment of ADBC (1994): The most vital reform. By transferring “policy-mandated” loans (loss-making loans for grain/cotton reserves) to the Agricultural Development Bank of China, ABC was finally allowed to pursue commercial profit.

- Commercial Banking Law (1995): Legally redefined ABC as an independent legal entity responsible for its own profits and losses.

- Bad Debt Disposal (1999): The government created Asset Management Companies (AMCs). ABC transferred RMB 311.6 billion in non-performing loans (NPLs) to Great Wall AMC to clean its books.

Revenue/Asset Levels:

- This was a period of “painful recovery.” Operating income began to rise with China’s GDP growth, but net profits were suppressed by massive historical bad debt (NPL ratios reached 30%–40% at their peak).

4. Joint-Stock Reform & IPO (2003–2010)

This was the most critical “leap” in ABC’s history, transforming it from a state department into a modern corporation.

- The “Sannong” Strategy (2007): The central government defined ABC’s mission: “Serving Sannong (Agriculture, Rural Areas, and Farmers), overall restructuring, commercial operation, and seeking a listing.”

- Incorporation (2009): The bank was restructured into a joint-stock limited company (Agricultural Bank of China Limited), receiving a capital injection from Central Huijin.

- Record-Breaking IPO (2010): In July 2010, ABC completed a dual listing in Shanghai and Hong Kong. It raised approximately $22.1 billion, which was the world’s largest IPO at that time.

Key Policy Reforms:

- Sannong Financial Business Division (2007): A unique policy for ABC. It created a “bank within a bank” for rural areas, allowing independent accounting and tax incentives for rural lending.

- Central Huijin Capital Injection (2008): Received a $19 billion capital injection from the state, solving the capital adequacy crisis and preparing the bank for the public market.

- Differential Reserve Requirement: The PBOC allowed ABC to maintain lower reserve ratios than other big banks, provided they maintained a specific volume of rural lending.

Revenue Levels:

- 2006: Operating Income was approx. RMB 121.2 billion.

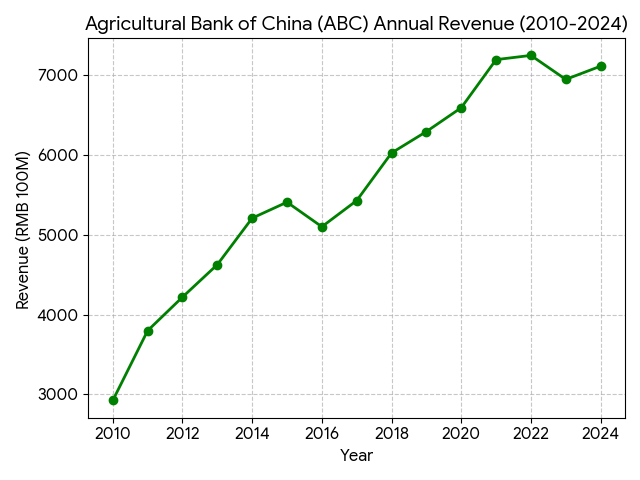

- 2010 (IPO Year): Revenue jumped to RMB 292.3 billion, with a net profit of RMB 94.9 billion.

5. Modern Era: Global Systemic Importance (2011–Present)

Post-listing, ABC has focused on digital transformation and maintaining its status as one of the world’s largest banks.

- Global Ranking: ABC is consistently ranked in the Top 4 globally by total assets and Tier 1 Capital (alongside ICBC, CCB, and Bank of China).

- Digital & Green Pivot: The bank now emphasizes Fintech and “Green Finance,” balancing its traditional rural mandate with sophisticated urban and international corporate banking.

Key Policy Reforms:

- Rural Revitalization Strategy (2017): National policy prioritized credit for “modern seed industries” and “smart agriculture,” giving ABC a massive growth engine in high-tech farming.

- Interest Rate Liberalization: Policies forced banks to move away from “interest margin dependency” toward fee-based income and digital wealth management.

- “i-Agri” Digital Strategy (2015+): A policy to bring mobile banking to remote villages, solving the “last mile” problem of rural finance.

Revenue Levels:

- 2020: Revenue crossed the RMB 600 billion mark to reach RMB 659.3 billion.

- 2023–2024: Revenue stabilized above RMB 700 billion (approx. $100 billion), with total assets exceeding RMB 40 trillion.

Summary Table

| Stage | Period | Key Characteristic |

| Early Turmoil | 1951 – 1978 | Frequent mergers and abolishments under the planned economy. |

| Professionalism | 1979 – 1993 | Re-established as a specialized bank for rural development. |

| Commercialization | 1994 – 2002 | Separation from policy-based lending; focus on market efficiency. |

| Corporate Reform | 2003 – 2010 | Restructuring into a joint-stock company and record-breaking IPO. |

| Global Giant | 2011 – Present | Focus on digitalization, green finance, and global systemic stability. |