The history of AbbVie can be categorized into three distinct phases, transitioning from a spinoff to a global pharmaceutical powerhouse.

Phase 1: Independence and the Humira Era (2013-2018)

AbbVie officially separated from Abbott Laboratories on January 1, 2013, to focus on research-based biopharmaceuticals.

- 2013: Listed on the NYSE. The company inherited Abbott’s proprietary drug portfolio, most notably Humira.

- Humira’s Dominance: During this period, Humira became the world’s best-selling drug, driving the vast majority of AbbVie’s revenue and stock performance.

- Strategic Oncology Entry: In 2015, AbbVie acquired Pharmacyclics for 21 billion dollars, gaining the hematological oncology drug Imbruvica to begin diversifying its portfolio beyond immunology.

Core Technologies:

- TNF-alpha Inhibition: Leveraging the world’s first fully human monoclonal antibody (Humira) to treat over 10 inflammatory indications.

- BTK Inhibition: Entering the blood cancer market through the 2015 acquisition of Imbruvica, a first-in-class Bruton’s tyrosine kinase inhibitor.

Revenue Levels:

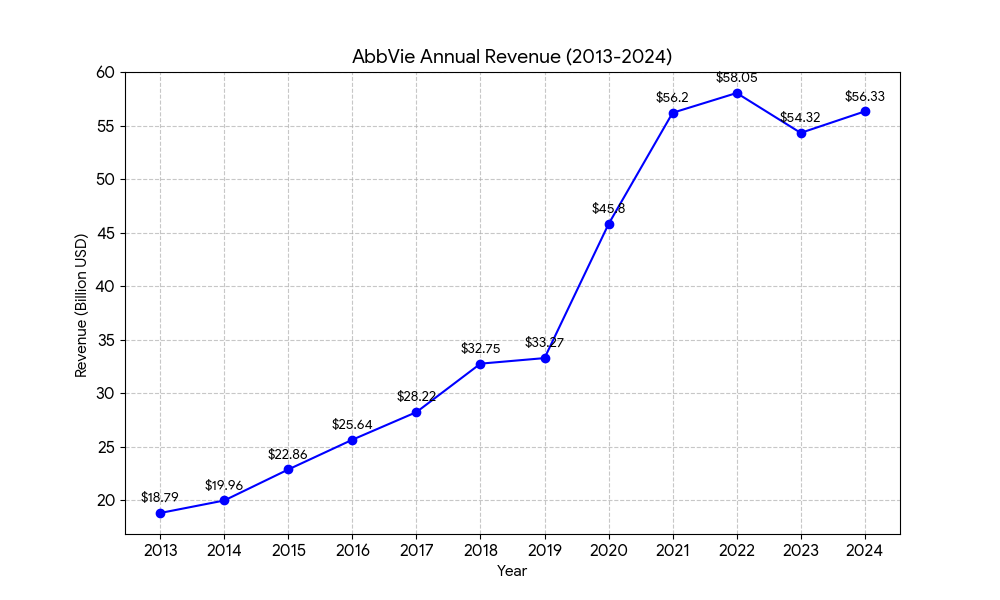

- Revenue grew from 18.8 billion dollars in 2013 to 32.7 billion dollars in 2018.

- Humira accounted for approximately 60% to 70% of total sales during this period.

Phase 2: Massive Diversification (2019-2022)

Anticipating the patent expiration of Humira, AbbVie executed aggressive strategies to secure future revenue streams.

- The Allergan Merger: In 2020, AbbVie completed its 63 billion dollars acquisition of Allergan. This brought Botox (Medical Aesthetics), neuroscience, and eye care into its fold, significantly reducing its reliance on Humira.

- Launching Successors: The company successfully launched Skyrizi and Rinvoq. These next-generation immunology drugs were designed to take over the market share as Humira faced competition.

Core Technologies:

- Selective IL-23 & JAK1 Inhibition: Developing Skyrizi and Rinvoq, which offered superior efficacy and safety profiles compared to older TNF inhibitors.

- Neurotoxins & Fillers: Acquiring Allergan brought Botox (botulinum toxin) and Juvederm (hyaluronic acid) technologies, creating a massive non-cyclical revenue stream.

- Vraylar Platform: Expanding into neuropsychiatry for schizophrenia and bipolar disorder.

Revenue Levels:

- Revenue surged due to the Allergan merger, reaching a peak of 58.1 billion dollars in 2022.

- The “non-Humira” portfolio began contributing nearly half of the total revenue.

Phase 3: Post-Humira Growth and New Frontiers (2023-Present)

This phase focuses on navigating the “Patent Cliff” and establishing leadership in high-growth therapeutic areas.

- 2023: Humira faced its first biosimilar competition in the US, leading to a planned decline in sales.

- M&A Surge (2024-2025): To accelerate growth, AbbVie engaged in multi-billion dollar acquisitions:

- 10.1 billion dollars for ImmunoGen to bolster its Antibody-Drug Conjugate (ADC) oncology platform.

- 8.7 billion dollars for Cerevel Therapeutics to strengthen its position in neuroscience (Schizophrenia and Parkinson’s).

- 1.4 billion dollars for Aliada Therapeutics to target Alzheimer’s disease.

- Leadership Transition: In early 2025, Richard A. Gonzalez transitioned his role, with Robert A. Michael leading the company into its next chapter of innovation.

Core Technologies:

- Antibody-Drug Conjugates (ADC): With the acquisition of ImmunoGen, AbbVie integrated the FRα-targeting ADC platform (Elahere) for ovarian cancer, combining antibody precision with chemotherapy potency.

- Blood-Brain Barrier (BBB) Penetration: Utilizing Aliada’s “MODEL” platform to transport large molecules across the BBB for Alzheimer’s treatments.

- Muscarinic Receptor Agonism: Through Cerevel, developing novel treatments for schizophrenia that target brain receptors more selectively than traditional antipsychotics.

Revenue Levels:

- 2023 revenue dipped to 54.3 billion dollars due to Humira’s patent cliff in the US.

- 2025 revenue is projected to climb back to 60.9 billion dollars.

- Skyrizi and Rinvoq have successfully bridged the gap, with combined sales on track to exceed Humira’s historical peak.