Novartis has a rich history originating from three Swiss companies in Basel, evolving through several distinct stages:

1. The Roots: Three Independent Pioneers (1758–1970)

Novartis traces its lineage to three chemical and pharmaceutical firms:

- Geigy: Founded in 1758 by Johann Rudolf Geigy, it is the oldest of the three, originally trading in chemicals and dyes.

- Ciba: Established in 1859 by Alexander Clavel to produce silk dyes, it expanded into pharmaceuticals by 1900.

- Sandoz: Founded in 1886 by Alfred Kern and Edouard Sandoz, it became famous for its medical department established in 1917, producing early psychotropic drugs and immunosuppressants.

Core Products:

- Primarily synthetic dyes and basic chemicals.

- Sandoz: Calcium Sandoz (1929), and early psychotropic drugs like Hydergine.

Core Strategy:

- Diversification from textile dyes into fine chemicals and specialized pharmaceuticals.

Revenue Level:

- Moderate revenue, mostly localized to European markets and specific chemical sectors.

2. Mergers and the Birth of Novartis (1970–1996)

This period marked the transition from chemicals to life sciences:

- 1970: Ciba and Geigy merged to form Ciba-Geigy, a massive chemical and pharmaceutical conglomerate.

- 1996: Ciba-Geigy and Sandoz merged in a deal worth approximately $30 billion, one of the largest corporate mergers at the time. The name Novartis was chosen, derived from the Latin novae artes, meaning “new skills.”

Core Products:

- Sandimmun (Cyclosporine): A revolutionary immunosuppressant for organ transplants.

- Voltaren (Diclofenac): A global leader in non-steroidal anti-inflammatory drugs (NSAIDs).

Core Strategy:

- Ciba-Geigy/Sandoz Merger: Aimed at achieving “Life Sciences” dominance, combining R&D resources to compete with rising American and British pharma giants.

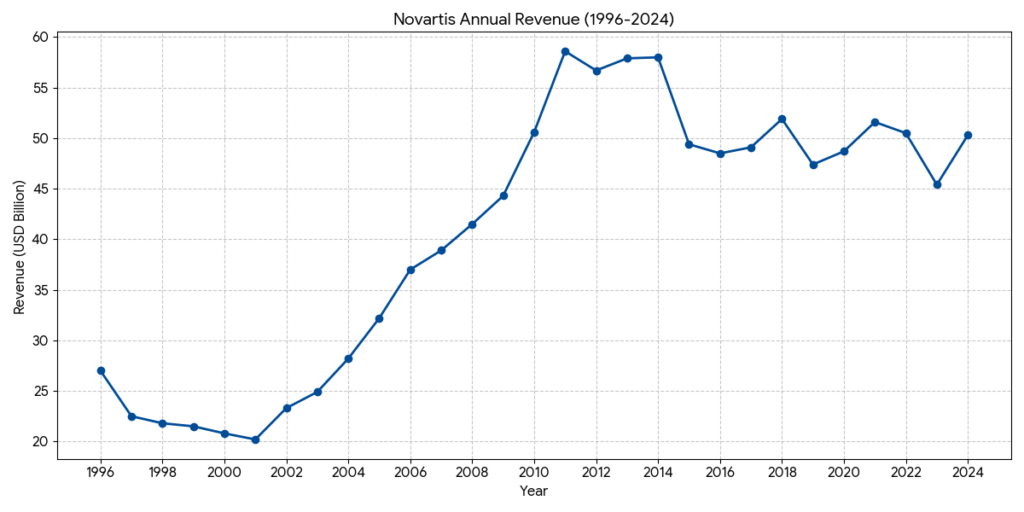

Revenue Level:

- At the time of the 1996 merger, combined annual revenue was approximately CHF36 billion, creating one of the largest pharmaceutical entities in the world.

3. Diversification and R&D Globalistation (1996–2018)

After the merger, the company streamlined its focus by divesting non-core assets:

- Divestments: Novartis spun off its specialty chemicals (Ciba Specialty Chemicals) in 1997 and its agribusiness (Syngenta) in 2000. It also sold its food and beverage brands (like Ovaltine) in 2002.

- Expansion: In 2005, it acquired Hexal and Eon Labs to make Sandoz a global leader in generics. In 2010, it completed the acquisition of Alcon, a global leader in eye care.

- Scientific Focus: In 2002, the Novartis Institutes for BioMedical Research (NIBR) was established in Cambridge, Massachusetts, shifting the R&D center of gravity to the US.

Core Products:

- Gleevec (Imatinib): The first targeted therapy for chronic myeloid leukemia (CML).

- Diovan (Valsartan): A blockbuster hypertension medication.

- Cosentyx (Secukinumab): For psoriasis and autoimmune diseases.

- Lucentis: For age-related macular degeneration (AMD).

Core Strategy:

- The Three-Pillar Strategy: Balancing Innovative Medicines, Sandoz (Generics/Biosimilars), and Alcon (Eye Care) to mitigate patent cliff risks and diversify cash flows.

Revenue Level:

- Revenue grew steadily into the $45 billion to $58 billion range, with R&D investment reaching nearly 20% of net sales.

4. Strategic Pivot: A Pure-Play Innovative Medicine Company (2019–Present)

Under recent leadership, Novartis has aggressively simplified its structure to focus solely on high-value, innovative medicines:

- Spin-offs:

- 2019: Spun off Alcon into a standalone eye-care device company.

- 2023: Completed the 100% spin-off of Sandoz, separating the generics business from the innovative medicines core.

- Current Status: Novartis is now a “Pure-Play” innovative medicines company focusing on five core therapeutic areas: Cardiovascular, Immunology, Neuroscience, Solid Tumors, and Hematology. It is heavily invested in next-generation platforms like Radioligand Therapy (RLT) and Cell & Gene Therapy.

Core Products:

- Entresto: The standard-of-care for heart failure.

- Zolgensma: A landmark gene therapy for spinal muscular atrophy (SMA).

- Pluvicto: A leading Radioligand Therapy (RLT) for prostate cancer.

- Kesimpta: For relapsing forms of multiple sclerosis.

Core Strategy:

- Pure-Play Strategy: Exiting non-core businesses by spinning off Alcon (2019) and Sandoz (2023).

- Focus Areas: Cardiovascular, Immunology, Neuroscience, Solid Tumors, and Hematology.

- Technological Leadership: Investing in advanced platforms: Cell & Gene Therapy, RLT, and xRNA.

Revenue Level:

- Following the Sandoz spin-off, pro-forma annual revenue is approximately $45 billion to $50 billion. While the absolute top-line figure adjusted after divestments, operating margins and return on capital have significantly improved.

Entresto (sacubitril/valsartan) is currently navigating a pivotal transition as it faces both intensifying clinical competition from SGLT2 inhibitors and an imminent “patent cliff” that will trigger a wave of generic entrants in 2025–2026.

1. Efficacy and Clinical Trial Comparison

While Entresto remains a foundational therapy for Heart Failure (HF), its dominance is being challenged by SGLT2 inhibitors (Jardiance, Farxiga).

| Feature | Entresto (ARNI) | Jardiance / Farxiga (SGLT2i) |

| Primary Trial | PARADIGM-HF: 20% reduction in CV death/hospitalization vs. Enalapril. | DAPA-HF / EMPEROR-Reduced: ~25% reduction in CV death/hospitalization vs. Placebo. |

| HFrEF Status | Gold Standard: Superior to ACE inhibitors in reducing mortality and promoting cardiac reverse remodeling. | The “New Pillars”: Added to Entresto to provide further protection (Quadruple Therapy). |

| HFpEF Status | PARAGON-HF: Narrowly missed primary endpoint but showed benefit in patients with LVEF below normal (<57%). | EMPEROR-Preserved / DELIVER: Successfully reached primary endpoints across the full spectrum of LVEF. |

| Unique Benefit | Significant improvement in Cardiac Structure (reverse remodeling) and faster NT-proBNP reduction. | Superior Renal Protection and blood sugar control; simpler once-daily dosing. |

2. Safety Profile and Considerations

Entresto has a distinct safety profile compared to its rivals, requiring careful patient monitoring.

- Common Side Effects: Hypotension (low blood pressure), Hyperkalemia (high potassium), and Renal impairment.

- Critical Warnings:

- Black Box Warning: Fetal toxicity (must be discontinued immediately if pregnancy is detected).

- Angioedema: A small but serious risk; contraindicated in patients with a history of angioedema related to ACEi/ARB therapy.

- 36-Hour Washout: Must NOT be taken within 36 hours of an ACE inhibitor to prevent severe reactions.

- Vs. SGLT2i Safety: Unlike Entresto, SGLT2 inhibitors primarily risk genital yeast infections and volume depletion but offer better renal safety.

3. Patent Status and Generic Competition

Novartis has employed aggressive “defensive litigation” to protect Entresto, but the protective wall is officially crumbling.

- The “Combination Patent” (No. ‘659): This key patent expired on January 15, 2025. Pediatric exclusivity, which provided a final shield, ended on July 15, 2025.

- The MSN Victory: In mid-2025, a US federal judge rejected Novartis’ bid to block MSN Pharmaceuticals from launching its generic. This opened the floodgates for competition ahead of the crystalline form patent expiration in November 2026.

- Financial Impact: Novartis reported that Entresto’s US revenue began to decline in late 2025 as generics entered the market. The company is now pivoting to newer blockbusters (like Kisqali and Pluvicto) to fill the multi-billion dollar revenue gap left by Entresto.

Cosentyx (secukinumab), Novartis’ flagship immunology blockbuster, remains a cornerstone therapy for plaque psoriasis, psoriatic arthritis, and axial spondyloarthritis. As of 2026, it faces a highly competitive landscape defined by “efficacy superiority” from newer IL-23 and dual IL-17A/F inhibitors.

1. Clinical Efficacy: Head-to-Head Comparison

Cosentyx primarily inhibits IL-17A. While highly effective, newer competitors have demonstrated superior skin clearance (PASI 90/100) in direct clinical trials.

| Competitor | Mechanism | Clinical Results (PASI 90 @ Week 52) | Strategic Positioning |

| Cosentyx | IL-17A | 57% (IMMerge Trial) | Established safety; rapid onset; broad indications. |

| Skyrizi (AbbVie) | IL-23 (p19) | 87% vs. Cosentyx 57% | Superiority Winner: Higher clearance, more durable, and infrequent dosing (q12w). |

| Bimzelx (UCB) | IL-17A & IL-17F | ~85% (BE RADIANT Trial) | Dual Inhibition: Superior to Cosentyx by blocking both A and F ligands. |

| Taltz (Eli Lilly) | IL-17A | Similar to Cosentyx | High PASI 100 rates; slightly better in PsA quality-of-life studies. |

2. Safety Profile and Risks

The safety profile of Cosentyx is well-documented over a decade of use, which remains its strongest “real-world” advantage over newer agents.

- Infections: All biologics carry a risk of upper respiratory tract infections.

- Candidiasis (Fungal Infection): This is a class-specific risk for IL-17 inhibitors. Cosentyx has a moderate rate (~2-4%), which is significantly lower than the dual-inhibitor Bimzelx (~10-15% oral thrush).

- Inflammatory Bowel Disease (IBD): IL-17 inhibitors like Cosentyx can exacerbate or trigger Crohn’s disease or Ulcerative Colitis. Patients with a history of IBD are generally diverted to IL-23 inhibitors (Skyrizi) or IL-12/23 inhibitors (Stelara).

- Injection Site Reactions: Cosentyx is generally better tolerated than Taltz, which is known for higher rates of injection site pain and erythema.

3. Market Competition & Defensive Strategy (2026)

Novartis is utilizing several strategies to defend Cosentyx’s multi-billion dollar revenue stream:

- Indication Expansion: Cosentyx is a market leader in Ankylosing Spondylitis (AS) and Hidradenitis Suppurativa (HS), where IL-23 inhibitors have historically struggled to show the same level of efficacy as the IL-17 class.

- Convenience Upgrades: The 2024-2025 launch of the 300mg T-Muscle autoinjector and Intravenous (IV) dosing options targets patients who prefer fewer injections or clinical administration.

- Patent Protection: Unlike Entresto, Cosentyx’s core patents in the US are expected to hold until late 2028 or 2029, delaying the impact of biosimilars (like those from Sandoz or Amgen) for a few more years.

Competition Analysis for Kisqali (Ribociclib)

Kisqali is currently the top star in Novartis’ oncology portfolio. Following its late-2024 approval for the adjuvant treatment of Early Breast Cancer (EBC), its market potential has significantly surpassed that of its competitor, Ibrance.

Below is the latest 2026 competitive analysis comparing Kisqali with its primary rivals, Verzenio and Ibrance.

1. Clinical Efficacy: Head-to-Head Analysis

Kisqali’s most powerful competitive weapon is that it is currently the only CDK4/6 inhibitor to demonstrate a statistically significant improvement in Overall Survival (OS) across three separate Phase III clinical trials (the MONALEESA series).

| Competitor | Primary Advantage (Efficacy) | Key Clinical Data (2025/2026 Update) |

| Kisqali (Novartis) | Strongest OS Data & Broadest Label | NATALEE Trial: Reduced risk of recurrence in EBC by 28.4%. Its 5-year iDFS reached 85.5%. It covers a broader patient population than its rivals (including Stage II and node-negative patients). |

| Verzenio (Eli Lilly) | Leader in Early Breast Cancer | monarchE Trial: Demonstrated significant OS benefits for high-risk EBC. Its advantage lies in a continuous dosing schedule (no treatment breaks required). |

| Ibrance (Pfizer) | High Market Share but Fading Momentum | PALOMA Trials: Remains steady in the metastatic setting, but failed in the EBC setting (PALLAS/PENELOPE-B trials), preventing it from entering the lucrative adjuvant market. |

2. Safety Profile and Risk Management

While Kisqali offers superior efficacy, its safety monitoring is more cumbersome than that of its two main competitors, particularly regarding cardiac risks.

- Cardiac Safety (QT Interval Prolongation): This is a risk unique to Kisqali. Physicians must perform multiple Electrocardiograms (ECG) before and during the early stages of treatment. Verzenio and Ibrance do not have this requirement.

- Hepatotoxicity: Grade 3/4 elevation of liver enzymes occurs in approximately 8-9% of patients, requiring regular blood tests for monitoring.

- Gastrointestinal (GI) Reactions: The primary side effect of Verzenio is severe diarrhea (occurring in over 80% of patients), whereas Kisqali and Ibrance are relatively mild in this regard.

- Neutropenia (Low White Blood Cell Count): This is a common characteristic of both Ibrance and Kisqali (roughly 60-70%), typically managed via a “3 weeks on, 1 week off” dosing cycle.

3. 2026 Market Position: The Pillar of Novartis Revenue

According to the latest financial data released in February 2026:

- Revenue Explosion: Kisqali’s full-year 2025 revenue reached $4.78 billion, representing a growth rate of 57%.

- Competitive Strategy: Novartis is leveraging Kisqali’s broad label in Early Breast Cancer (EBC) to directly challenge Eli Lilly’s Verzenio. Since Kisqali can cover more low-risk (but still recurrence-prone) patients, such as node-negative cases, it is expected to gain further market share in 2026.

- Patent Moat: Kisqali’s core patents are expected to hold until roughly 2028–2030, making it the primary weapon for Novartis to offset revenue losses from the Entresto patent cliff.

Pluvicto (lutetium Lu 177 vipivotide tetraxetan) has become the global benchmark for Radioligand Therapy (RLT). As of 2026, Novartis has successfully moved Pluvicto from a last-resort treatment to earlier stages of prostate cancer, significantly expanding its market reach.

1. Clinical Efficacy: Expanding the Frontiers (2026 Status)

Pluvicto’s dominance is built on robust data across several lines of treatment for prostate cancer.

| Treatment Stage | Trial | Efficacy Highlights | 2026 Market Status |

| Later-Line (mCRPC) | VISION | 38% reduction in death risk; median OS of 15.3 months. | Established Standard of Care (SoC) post-chemotherapy. |

| Pre-Chemo (mCRPC) | PSMAfore | 59% reduction in radiographic progression (rPFS). | Approved in 2025; now the preferred 2nd-line option after ARPI failure. |

| Early Metastatic (mHSPC) | PSMAddition | 28% reduction in progression or death; 57.1% Complete Response rate. | Approved in early 2026; integrating RLT into 1st-line combination therapy. |

2. Competitive Landscape (2026)

While Pluvicto is the incumbent leader, major pharmaceutical players (Eli Lilly, AstraZeneca) are now entering the RLT space.

- PNT2002 (Eli Lilly / Point Biopharma):

- Direct Rivalry: The most significant competitor in the pre-chemo mCRPC space.

- Data Comparison: The SPLASH trial showed a median rPFS of 9.5 months. While clinically effective, it has not yet demonstrated clear “best-in-class” superiority over Pluvicto.

- Lilly’s Edge: Utilizing a massive logistics and sales network to challenge Novartis’s hospital reach.

- Next-Gen Alpha Emitters (Actinium-225):

- Competitors: BMS (RayzeBio) and AstraZeneca (Fusion).

- The Tech Race: Alpha particles have higher energy and a shorter range than the Beta particles used in Pluvicto. By 2026, these are being positioned as the solution for patients who become resistant to Pluvicto.

- Xofigo (Bayer):

- Limitation: Restricted only to bone metastases and lacks PSMA-targeting. Pluvicto remains superior for patients with soft tissue (visceral) involvement.

3. Safety Profile and Quality of Life

Pluvicto’s safety profile is a key differentiator against traditional chemotherapy (taxanes).

- Common Side Effects:

- Dry Mouth (Xerostomia): The most common side effect (~30–40%) because salivary glands express low levels of PSMA.

- Fatigue & Nausea: Mostly Grade 1–2 (mild).

- Bone Marrow Suppression: Anemia occurs in about 10–15% of patients but is generally manageable.

- Vs. Chemotherapy: Pluvicto offers significantly better Quality of Life (QoL) scores. Patients experience fewer “systemic” toxicities (like hair loss or severe immune suppression) compared to chemotherapy.

- Vs. PNT2002: PNT2002 has shown slightly lower rates of dry mouth in early trials, but the clinical significance of this difference remains debated.

4. The “Moat”: Supply Chain & Infrastructure

In 2026, the RLT war is as much about logistics as it is about biology.

- Manufacturing Power: Novartis has resolved its 2023 shortage issues with massive facilities in Indiana (USA), New Jersey (USA), and Italy.

- The 99% Rule: Novartis currently maintains a >99% on-time delivery rate for doses, which are individually prepared for each patient and have a shelf-life of only a few days.

- Network: With over 500 treatment centers globally, Novartis has a “first-mover” infrastructure that competitors are struggling to replicate.

Sources:

Back to Novartis page