The history of American Express (Amex) is a fascinating journey of a company that evolved from a regional freight forwarder into a global symbol of financial prestige. Here is the breakdown of its history by key stages:

I. The Express Freight Era (1850–1880s)

American Express was born not as a bank, but as a logistics company.

- 1850 Founding: It was formed through the merger of three express mail companies owned by Henry Wells, William G. Fargo, and John Warren Butterfield in Buffalo, New York.

- The “Express” Business: During the American westward expansion, Amex specialized in the rapid and secure transport of valuables, gold, and currency. It built a reputation for trust that the U.S. Postal Service at the time could not match.

- The Wells Fargo Split: In 1852, when the Amex board refused to expand into California, Wells and Fargo co-founded Wells Fargo & Co. to capture the Gold Rush market.

Core Products/Services: Physical transport of gold, currency, bank drafts, and high-value parcels.

Core Strategy: Trust-based Logistics. In a period without a central bank or secure postal system, Amex leveraged a vast network of stagecoaches and railroads to provide a “safe passage” for wealth.

Revenue Level: Regional to national scale; revenue was primarily derived from shipping fees. Profits grew in tandem with the American westward expansion.

II. Pivot to Financial Services (1882–1910s)

The company realized that moving “money information” was more profitable than moving heavy cargo.

- 1882 Money Orders: Amex launched its own money order to compete with the U.S. Post Office, marking its first major step into financial products.

- 1891 Invention of the Traveler’s Cheque: After Amex President James C. Fargo found it difficult to get cash in Europe, employee Marcellus Berry invented the Traveler’s Cheque. This product revolutionized international travel and made Amex a global household name.

Core Products/Services: Money Orders (1882) and the Traveler’s Cheque (1891).

Core Strategy: Asset-Light Financial Innovation. Transitioning from moving physical goods to moving “financial credit.” The Traveler’s Cheque solved the pain point of currency exchange and theft for international travelers.

Revenue Level: Significant margin improvement. Income shifted from labor-intensive shipping fees to high-margin financial service fees and the “float” (interest earned on uncashed cheques).

III. The Travel & Service Transition (1915–1957)

World War I forced the company to abandon its roots and redefine its identity.

- 1915 Travel Department: Amex officially entered the travel agency business, providing ticketing and tour services.

- 1918 Exit from Freight: During WWI, the U.S. government nationalized all private express companies into the American Railway Express Agency. Forced out of logistics, Amex pivoted entirely to banking, travel, and financial services.

Core Products/Services: Ticketing, tour planning, and international banking services.

Core Strategy: Targeting the Global Elite. After its domestic freight business was nationalized during WWI, Amex pivoted to serve the emerging class of international business and leisure travelers, building a global service infrastructure.

Revenue Level: Steady growth; established Amex as the world’s largest travel service organization, with diversified income from travel commissions and financial services.

IV. The Charge Card & Prestige Era (1958–1990s)

This period defined Amex as a status symbol through its “closed-loop” payment network.

- 1958 First Card: Amex launched its first purple-colored paper charge card to compete with Diners Club.

- 1959 Plastic Innovation: It became the first company to issue plastic cards instead of paper or cardboard.

- Tiered Membership:

- 1966: Introduced the Gold Card.

- 1969: Introduced the iconic Green Card.

- 1984: Introduced the Platinum Card, cementing its position in the luxury market.

- Financial Supermarket Attempt: In the 1980s, Amex tried to become a one-stop financial shop (acquiring firms like Shearson Lehman), but eventually spun them off in the 1990s to refocus on cards and travel.

Core Products/Services: The Green Card (1958/69), Gold Card (1966), and Platinum Card (1984).

Core Strategy: The “Closed-Loop” Network and Status Symbol. Amex acted as both the card issuer and the merchant acquirer. By charging high annual fees and high merchant commissions, they curated a high-spending customer base that merchants were desperate to access.

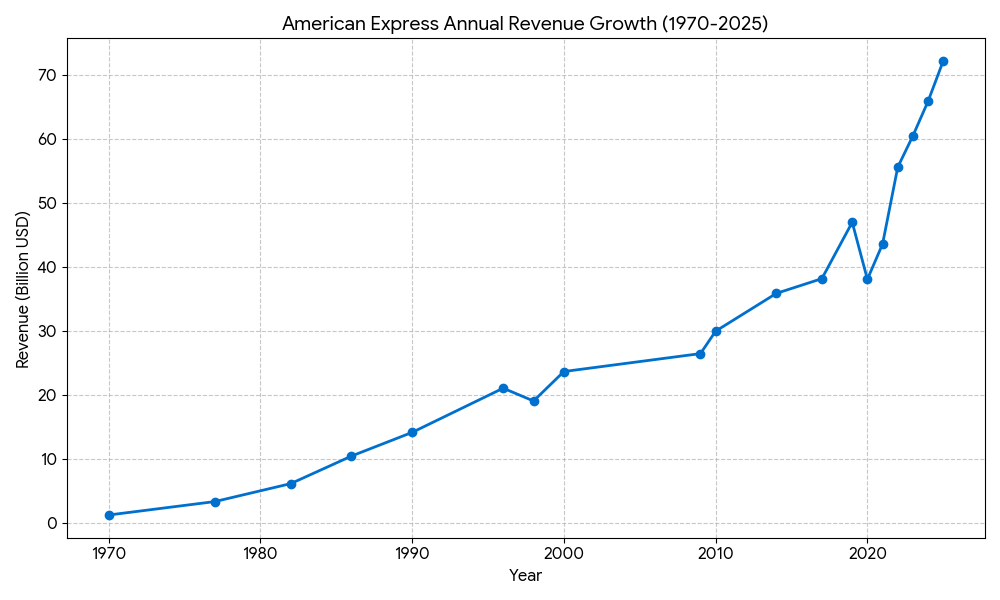

Revenue Level: Explosive growth. Annual revenues reached the multibillion-dollar level. The business model became heavily reliant on “Discount Revenue” (fees paid by merchants).

V. Global Digital Ecosystem & The Centurion (1999–Present)

Amex evolved into a high-tech payment processor while maintaining its “exclusive club” image.

- 1999 The Black Card: The invitation-only Centurion Card was launched, becoming the ultimate global symbol of wealth and mystery.

- Digital Transformation: Amex shifted focus toward digital payments, mobile apps, and premium airport lounges (Centurion Lounges) to justify its annual fees.

- Modern Expansion: Under recent leadership, the company has successfully expanded into the “Millennial and Gen Z” segments by refreshing its rewards programs (e.g., dining and lifestyle credits) and acquiring fintechs like Kabbage to serve small businesses.

Core Products/Services: Centurion (Black) Card, digital payment apps, Centurion Lounges, and SME (Small/Medium Enterprise) lending.

Core Strategy: Data-Driven Lifestyle Branding. Utilizing its “closed-loop” data to provide personalized rewards and luxury experiences. Amex shifted from being just a “card” to a comprehensive digital platform for payments and high-end lifestyle management.

Revenue Level: Modern financial titan. By 2024, total revenue reached approximately $60.5 billion. Revenue is diversified across merchant fees (over 50%), card member annual fees, and interest income from lending.

In 2026, American Express (Amex) operates as a “premium fortress,” maintaining a distinct business model that combines a payment network with a banking license. While it lacks the sheer scale of Visa or Mastercard, its “Closed-Loop” system provides a significant data and margin advantage.

1. Competitive Landscape & Market Share (2025-2026)

American Express remains the leader in the “Premium and Commercial” sectors, but it faces intensifying pressure from vertically integrated mega-banks.

- The Network Giants (Visa & Mastercard):

- Market Position: Visa (approx. 50%) and Mastercard (approx. 30%) dominate global transaction volume. Amex maintains a smaller but more profitable share (approx. 8-10%) by focusing on high-ticket spenders.

- The Gap: Amex has successfully expanded its global acceptance to over 170 million locations as of early 2026, significantly closing the “acceptance gap” that once favored Visa/Mastercard.

- The Bank Rivals (JPMorgan Chase & Capital One):

- JPMorgan Chase: The Sapphire Reserve remains Amex’s most direct competitor. Chase’s 2025-2026 strategy has focused on integrating luxury travel portals, challenging Amex’s dominance in the “Travel & Entertainment” (T&E) sector.

- Capital One: Following its $35.3 billion acquisition of Discover (finalized mid-2025) and its 2026 acquisition of fintech giant Brex, Capital One has become the largest U.S. card issuer by receivables (approx. 19% market share). This move creates a third major “Closed-Loop” competitor, directly threatening Amex’s small business (SME) and middle-market dominance.

2. SWOT Analysis: American Express 2026

| Strengths | Weaknesses |

| Brand Equity: The “Platinum” and “Centurion” brands remain the ultimate status symbols in finance. | Acceptance Gap: Despite improvements, still slightly less accepted in rural or international “small ticket” merchant segments compared to Visa. |

| Data Advantage: The Closed-Loop model allows Amex to see both sides of every transaction, fueling superior AI risk-modeling and personalized marketing. | T&E Dependence: Revenues remain highly sensitive to fluctuations in global luxury travel and corporate business spending. |

| Younger Demographic: Over 60% of new consumer accounts in 2025 came from Millennials and Gen Z, ensuring long-term portfolio vitality. | High Cost of Retention: Massive marketing spend (estimated $6.3 billion in 2025) is required to maintain the “exclusive” lifestyle value. |

| Opportunities | Threats |

| B2B Payments: Expanding further into automation of accounts payable/receivable for SMEs. | Regulatory Shifts: Increased government scrutiny on “junk fees” and potential caps on credit card interest rates in the U.S. |

| Agentic Finance: Using AI to automate travel bookings and expense management for cardholders (The “AI Concierge”). | Consolidation: The Capital One-Discover-Brex merger creates a massive rival with a similar data-rich business model. |

3. Financial Snapshot (2025 Performance)

Amex ended 2025 with record-breaking results, proving its resilience despite macroeconomic uncertainty.

- Total Revenue (2025): $72.1 Billion (up 10% YoY).

- Net Card Fees: Reached a record $10 Billion, growing at double digits for over 30 consecutive quarters. This is Amex’s “stickiest” revenue, as members pay upfront for access to the ecosystem.

- Spending Trends: Luxury retail spending was up 15% in Q4 2025, while restaurant spending grew 9%, showing that the “premium” consumer remains largely unaffected by inflation.

4. Strategic Outlook for 2026

Amex’s primary goal for 2026 is “Fortifying the Moat.”

- The AI Core: Deploying predictive models to manage credit risk, keeping loss rates at “best-in-class” levels (projected lowest in the industry).

- Lifestyle Integration: Moving beyond a “payment card” to become a “lifestyle concierge,” expanding its Centurion Lounge network and exclusive dining partnerships.

- SME Defense: Reinvigorating its business card offerings to counter the newly merged Capital One-Brex entity.

Source:

- https://www.americanexpress.com/en-us/newsroom/articles/colleagues-and-culture/175-years-of-american-express–a-look-back-at-our-milestone-anni.html

- https://ir.americanexpress.com/financials/annual-reports-and-proxy-statements/default.aspx

- https://s26.q4cdn.com/747928648/files/doc_financials/2024/ar/v2/American-Express-2024-Annual-Report.pdf

- https://ir.americanexpress.com/news/investor-relations-news/investor-relations-news-details/2026/American-Express-Reports-Full-Year-and-Fourth-Quarter-2025-Financial-Results/default.aspx

- https://www.macrotrends.net/stocks/charts/AXP/american-express/revenue

- https://www.wallstreetzen.com/stocks/us/nyse/axp/revenue

- https://www.britannica.com/money/American-Express-Company

- https://en.wikipedia.org/wiki/American_Express

Back to American Express page