Historical Phases of HSBC

Phase 1: Regional Foundations (1865-1899)

In 1865, Thomas Sutherland founded The Hongkong and Shanghai Banking Corporation in Hong Kong and Shanghai to finance the growing trade between China, India, and Europe.

- Early Strategy: It was the first locally owned and managed bank in Hong Kong, quickly establishing branches in Japan (1866) and across South Asia.

- Government Role: By the late 19th century, it managed the Hong Kong government’s accounts and helped the Qing dynasty issue international bonds.

Core Strategy: Focus on trade finance between Asia and Europe; leveraging local expertise to compete against London-based banks; building government relations by managing customs and issuing sovereign bonds.

Revenue Characteristics: Initial capital of HK$5 million; profits driven by tea, silk, and opium trade settlements and commissions from financing infrastructure in China.

Phase 2: War and Survival (1900-1949)

The early 20th century brought rapid expansion followed by the devastation of World War II.

- Pre-war Prosperity: Under Sir Thomas Jackson, the bank became the leading financial institution in Asia.

- WWII Impact: During the Japanese occupation of Hong Kong, the head office was forced to move to London. Most staff in Asia were interned.

- Post-war Recovery: In 1946, the head office returned to Hong Kong, playing a crucial role in financing the city’s transition from an entrepôt to a manufacturing hub.

Core Strategy: Capital preservation during WWII by shifting assets to London; post-war “Reconstruction Strategy” shifting focus toward financing Hong Kong’s emerging manufacturing and textile industries.

Revenue Characteristics: Massive disruption during WWII with stagnant Asian revenue; rapid post-war recovery as Hong Kong transitioned into an industrial hub.

Phase 3: Diversification in Asia (1950-1979)

With the closure of its China network in the early 1950s, HSBC pivoted to diversify its services and geography.

- Strategic Acquisitions: It acquired the Mercantile Bank and the British Bank of the Middle East.

- Hang Seng Merger: In 1965, HSBC acquired a controlling interest (51%) in Hang Seng Bank during a local banking crisis.

- Merchant Banking: It established Wardley Limited in 1972 to enter the investment banking sector.

Core Strategy: “Regional Deepening” after losing the China market; acquisition of Hang Seng Bank to dominate local retail banking; establishing Wardley Limited to capture the investment banking market.

Revenue Characteristics: Significant growth driven by the “Hong Kong Economic Miracle”; shift from pure trade finance to a balanced mix of retail, commercial, and merchant banking income.

Phase 4: Global Expansion and Restructuring (1980-1999)

HSBC transformed into a global giant by aggressively entering Western markets.

- US Market Entry: It completed the acquisition of Marine Midland Bank in the US by 1980.

- HSBC Holdings plc: In 1991, HSBC Holdings was established as the parent company.

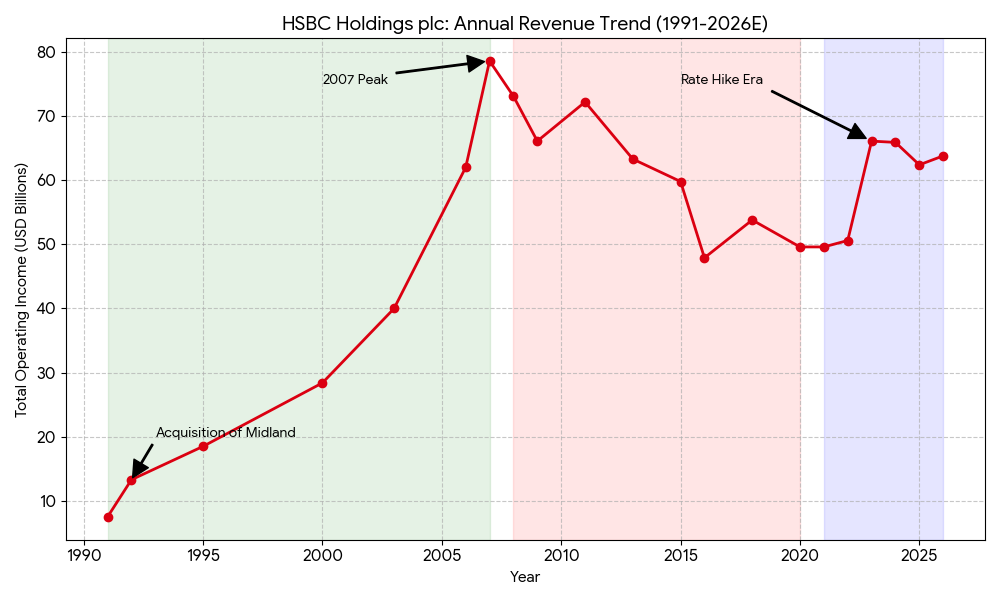

- Midland Bank Acquisition: In 1992, it acquired one of the UK’s “Big Four,” Midland Bank. As part of the deal, HSBC moved its group headquarters from Hong Kong to London in 1993.

- Unified Branding: In 1998, the bank unified all its subsidiaries under the single “HSBC” brand and hexagon logo.

Core Strategy: “Global Balance” strategy to diversify risk away from Asia; aggressive M&A in Western markets (Marine Midland in the US, Midland Bank in the UK); relocation of headquarters to London.

Revenue Characteristics: Revenue doubled following the Midland Bank acquisition; transformed into one of the world’s most profitable banking groups with substantial income from Europe and the Americas.

Phase 5: Modern Challenges and Pivot to Asia (2000-Present)

The 21st century has seen HSBC focus on digital banking, sustainability, and returning to its Asian roots.

- The Subprime Crisis: The 2003 acquisition of Household International in the US led to significant losses during the 2008 financial crisis.

- Strategic Pivot: Over the last decade, HSBC has divested non-core assets in the West (e.g., selling Canada and France operations) to reinvest in the “Pivot to Asia,” specifically targeting wealth management in the Pearl River Delta and Southeast Asia.

- ESG and Technology: The current focus is on achieving net-zero carbon emissions in its financing portfolio and upgrading digital infrastructure for retail and corporate clients.

Core Strategy: “Asset Optimization” post-financial crisis; divestment of non-core, low-return businesses (e.g., selling operations in Canada, France, and Brazil); reinvesting capital into “Wealth and Personal Banking” in Asia.

Revenue Characteristics: Total revenue recorded at approximately $62.4 billion in 2024; Asia (led by Hong Kong) now contributes over 50% of group profit; targeting a Return on Tangible Equity (ROTE) of 15%.

In 2026, HSBC’s competitive strategy is anchored in its “Pivot to Asia” and digital transformation. Having shed lower-performing Western assets, the bank now faces a specialized set of rivals across four primary domains.

1. Emerging Markets & Trade Finance: HSBC vs. Standard Chartered

This remains a duel between “Global Network” and “Local Specialization.”

- HSBC’s Edge: As of 2026, HSBC is ranked as a leading provider in trade finance globally by Euromoney. Its massive $3 trillion asset base allows it to dominate high-volume trade corridors, especially the Asia-Europe route.

- The Competitor (Standard Chartered): While smaller, StanChart excels in “Frontier Markets” (e.g., Vietnam, parts of Africa). In 2026, it is more agile in adopting DLT (Distributed Ledger Technology) for trade settlements in niche markets where HSBC’s legacy systems are still catching up.

- Key Advantage: HSBC wins on sheer liquidity and its ability to serve the largest Tier-1 multinational corporations.

2. Corporate & Investment Banking: HSBC vs. JPMorgan Chase

A battle between “Regional Intimacy” and “Technological Dominance.”

- HSBC’s Edge: In Asia, particularly the Greater Bay Area, HSBC holds an “insider” advantage. Its 2026 strategy focuses on the “Asia AI ecosystem,” supporting tech leaders in South Korea, Taiwan, and Mainland China.

- The Competitor (JPMorgan): JPM remains the 2026 “Gold Standard” for capital efficiency. With an unmatched AI budget, JPM’s predictive analytics for treasury management often outperform HSBC’s offerings in the US and European markets.

- Key Advantage: HSBC wins on Asian regulatory knowledge and its historical role as a primary bridge for Chinese capital.

3. Digital Transformation & Retail: HSBC vs. DBS Bank

The “Digital Arms Race” for the future of Asian retail.

- HSBC’s Edge: HSBC has transitioned to “Digital-First” banking, launching AI-driven security and hyper-personalized onboarding. Its “Global View” feature, allowing clients to manage accounts in 60+ countries via one app, is a unique moat for internationally mobile professionals.

- The Competitor (DBS): Often ranked as the “World’s Best Digital Bank,” DBS has a deeper integration into the daily lifestyle of Asian consumers (travel, property, and energy ecosystems). In 2026, DBS is a fierce rival for SME (Small-to-Medium Enterprise) trade finance in Singapore and Taiwan.

- Key Advantage: HSBC wins on International Portability—DBS cannot match the ease of moving money between Hong Kong and London.

4. Global Wealth Management: HSBC vs. Citigroup (Citi)

Two giants pivoting to the same “Wealth Engine.”

- HSBC’s Edge: By 2026, HSBC has fully integrated Citi’s former China consumer wealth portfolio. It now offers a “Mass Affluent” to “Private Bank” ladder that is difficult for pure-play private banks to replicate.

- The Competitor (Citi): Following its 2024-2025 retail exit, Citi has focused exclusively on the Ultra-High-Net-Worth (UHNW) and Global Family Offices. Citi’s platform for clients with $10M+ is arguably more specialized.

- Key Advantage: HSBC wins on Client Lifecycle Management, capturing wealth as clients grow from retail to private banking.

Competitive Summary: 2026 Outlook

| Domain | Key Rival | HSBC Defensive Moat | Rival’s “Killer Feature” |

| Trade Finance | Standard Chartered | Largest Global Corridor Network | Agility in Frontier Markets |

| Corp. Banking | JPMorgan Chase | Deepest Roots in Asia-China | AI-Driven Capital Efficiency |

| Digital/Retail | DBS Bank | Multi-Market Connectivity | Ecosystem/Lifestyle Integration |

| Wealth Mgmt | Citigroup | Huge Mass-Affluent Client Base | Exclusive Focus on Family Offices |

Source:

- https://www.hsbc.com/who-we-are/our-strategy-and-values/our-history/history-timeline

- https://history.hsbc.com/history/timeline

- https://www.hsbc.com/investors/results-and-announcements/all-reporting/annual-results-2024-quick-read

- https://www.hsbc.com/-/files/hsbc/investors/hsbc-results/2025/interim/pdfs/hsbc-holdings-plc/250730-hsbc-holdings-plc-interim-report-2025.pdf

- https://www.macrotrends.net/stocks/charts/HSBC/hsbc/revenue

- https://www.dbs.com.sg/treasures/aics/sector-thematics/templatedata/article/generic/data/en/CIO/122025/251210CIOP.xml

- https://news.futunn.com/en/post/68457839/jp-morgan-forecasts-normalized-rote-for-hsbc-and-standard-chartered

Back to HSBC page