The history of Morgan Stanley can be categorized into five distinct phases, tracing its evolution from a spinoff investment bank to a global powerhouse in wealth management.

Phase 1: The Spinoff and Early Dominance (1935-1949)

Morgan Stanley was born out of regulatory necessity following the Glass-Steagall Act of 1933, which mandated the separation of commercial and investment banking.

- 1935: Henry S. Morgan and Harold Stanley left J.P. Morgan & Co. to establish the firm. In its first year, it achieved a 24% market share in public offerings.

- 1938: Led the landmark 100 million dollar bond issuance for U.S. Steel, solidifying its position as a top-tier underwriter for major corporations.

Core Strategy:

- Pure-play Investment Banking: Leveraged the prestige of the Morgan heritage to focus exclusively on underwriting and issuing bonds for top-tier corporations.

- Regulatory Compliance: Operated as a lean, elite partnership to comply with the Glass-Steagall Act’s separation of commercial and investment banking.

Revenue & Scale:

- Market Dominance: Achieved a 24% market share in public offerings within its first year.

- Boutique Efficiency: Revenue was highly concentrated in high-margin underwriting fees for industrial giants like U.S. Steel.

Phase 2: The Blue-Chip Era (1950-1969)

During the post-war economic boom, the firm became the primary gatekeeper for blue-chip companies entering the capital markets.

- 1956: Managed the historic IPO of Ford Motor Company, which was the largest offering of its time.

- Culture: Known as the ultimate “White Shoe” firm, it maintained a prestigious and exclusive partnership structure, focusing on elite corporate relationships.

Core Strategy:

- Advisory-Led Model: Deepened long-term relationships with “Blue Chip” companies (e.g., Ford, Mobil), establishing itself as the premier “White Shoe” firm.

- Conservative Growth: Maintained a private partnership structure, prioritizing prestige and client loyalty over aggressive volume.

Revenue & Scale:

- Steady Expansion: Revenue grew in tandem with the post-war American industrial expansion, primarily driven by massive underwriting syndicates (e.g., the 1956 Ford IPO).

Phase 3: Globalization and Public Listing (1970-1989)

As financial markets integrated globally, Morgan Stanley expanded its footprint and changed its capital structure to compete on a larger scale.

- International Expansion: Established a presence in London (1977) and Tokyo (1970), positioning itself as a global intermediary.

- 1986: The firm went public (IPO) on the New York Stock Exchange. This transition from a private partnership to a public corporation provided the capital necessary for aggressive growth and trading activities.

Core Strategy:

- Capitalization: Went public in 1986 to transition from a “consultant” model to a “principal” model, using its own balance sheet to facilitate large-scale trades.

- Geographic Footprint: Built infrastructure in London and Tokyo to capture the rise of cross-border capital flows.

Revenue & Scale:

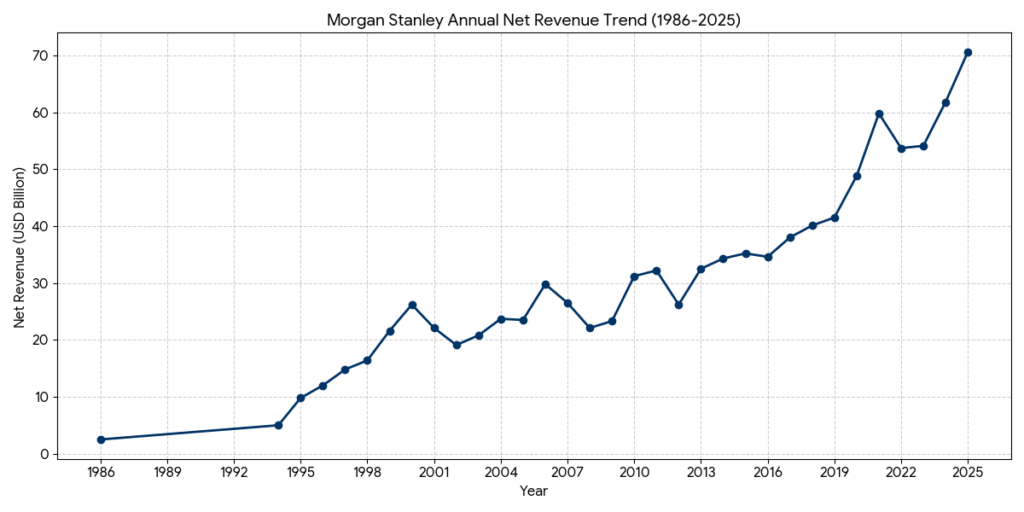

- Accelerated Growth: Revenue reached the multi-billion dollar level as the firm began earning from both advisory fees and trading spreads.

Phase 4: Diversification and Technology Focus (1990-2007)

The firm pivoted toward technology and retail distribution, playing a pivotal role in the dot-com era.

- 1997: Merged with Dean Witter Discover & Co. This was a strategic move to combine Morgan Stanley’s institutional prowess with Dean Witter’s massive retail brokerage network and credit card business.

- Tech Leadership: Became the lead underwriter for many high-profile tech IPOs, including Netscape and Google (2004).

Core Strategy:

- Retail Distribution: Merged with Dean Witter Discover & Co. (1997) to gain a massive retail brokerage network, moving beyond purely institutional clients.

- Tech Sector Leadership: Positioned itself as the dominant underwriter for the Silicon Valley boom (e.g., Netscape, Google).

Revenue & Scale:

- High Volatility, High Reward: Revenue peaked in the $20B–$30B range. However, income was highly sensitive to market cycles and IPO volumes.

Phase 5: Post-Crisis Transformation (2008-Present)

The 2008 financial crisis reshaped the firm’s identity, moving it away from high-risk trading toward stable, fee-based revenue.

- 2008: Converted to a bank holding company during the height of the crisis and secured a 9 billion dollar investment from Mitsubishi UFJ Financial Group (MUFG).

- Wealth Management Pivot: Under James Gorman’s leadership, the firm executed a series of massive acquisitions to de-risk:

- 2009-2013: Acquired Smith Barney from Citigroup.

- 2020: Acquired E*TRADE to capture the digital retail market.

- 2021: Acquired Eaton Vance to bolster its asset management arm.

- Current Status: Today, Morgan Stanley is recognized less as a volatile trading house and more as a global leader in wealth and asset management, with trillions of dollars in assets under management (AUM).

Core Strategy:

- Asset-Light Pivot: De-risked the business by aggressively acquiring wealth management firms (Smith Barney, E*TRADE, Eaton Vance).

- Stability First: Focused on generating recurring, fee-based income rather than relying on volatile trading profits.

Revenue & Scale:

- Record Levels: Annual revenue has reached approximately $50B–$60B.

- Structural Shift: Wealth Management now accounts for roughly 50% of total revenue, providing a “cushion” that allows the firm to outperform competitors during market downturns.

In the global financial landscape of 2025–2026, Morgan Stanley (MS) operates as part of the “Big Three” investment banking powerhouses alongside Goldman Sachs (GS) and JPMorgan Chase (JPM).

While these firms often compete for the same clients, their business models have diverged significantly, with Morgan Stanley positioning itself as the “Stability Leader.”

Competitive Landscape Comparison (FY 2025)

| Metric | Morgan Stanley (MS) | Goldman Sachs (GS) | JPMorgan Chase (JPM) |

| Core Identity | Wealth Management Giant | Pure-Play Investment Bank | Diversified Universal Bank |

| 2025 Net Revenue | $70.6 Billion | ~$50-55 Billion (Est.) | ~$170+ Billion (Est.) |

| Revenue Stability | High: ~50% from fees. | Low: High trading beta. | High: Retail & Commercial base. |

| Key Advantage | Dominant in Wealth Mgmt. | #1 in M&A/IPO Advisory. | Massive Balance Sheet/Scale. |

| P/TBV Ratio | ~3.0x (Market Premium) | ~2.1x | ~2.3x |

Strategic Competitive Analysis

1. Wealth Management: The Decoupling Strategy

- Asset Dominance: Morgan Stanley managed over $7 trillion in client assets by the end of 2025. This scale, bolstered by E*TRADE and Eaton Vance, allows MS to generate steady fee income even when the stock market is volatile.

- The “Gorman-Pick” Legacy: Unlike Goldman Sachs, which recently retreated from its consumer banking efforts (Marcus), Morgan Stanley successfully integrated its retail and institutional arms, creating a “virtuous cycle” of client referrals.

2. Institutional Securities: Challenging the King

- Equity Derivatives Surge: In 2025, Morgan Stanley’s equity trading desk frequently outperformed Goldman Sachs, particularly in Equity Derivatives and Prime Brokerage. In Q3 2025, MS equity revenue hit $4.12 billion, surpassing Goldman’s $3.74 billion.

- M&A Rankings: While Goldman Sachs remains the #1 global advisor for M&A by deal value ($1.66 trillion in 2025), Morgan Stanley holds a firm #3 position ($1.1 trillion), specializing in tech-heavy and cross-border mandates.

3. Financial Performance & Valuation

- Return on Equity (ROE): Morgan Stanley reported a strong ROTCE (Return on Tangible Common Equity) of 21.6% for the full year 2025, significantly outperforming the industry average.

- The Valuation Premium: Investors award Morgan Stanley a higher Price-to-Tangible Book Value (P/TBV) than Goldman Sachs. This “Stability Premium” reflects the market’s preference for MS’s predictable wealth management earnings over Goldman’s volatile trading-driven profits.

Emerging Rivalries & 2026 Outlook

- Digital Wealth: MS is increasingly competing with Charles Schwab and Robinhood for the “next generation” of investors. The integration of E*TRADE’s digital platform into MS’s elite advisory services is their primary weapon here.

- The AI Arms Race: Morgan Stanley is ahead in deploying generative AI (through its partnership with OpenAI) to assist its 15,000+ financial advisors, a key competitive differentiator in service speed and personalization.

Source:

- https://www.morganstanley.com/about-us-ir/shareholder/4q2025.pdf

- https://www.morganstanley.com/about-us-ir

- https://www.sec.gov/edgar/browse/?CIK=895421

- https://www.nasdaq.com/articles/ms-wealth-asset-management-moat-recurring-revenue-engine

- https://www.euromoney.com/article/2du1z8j5j6

- https://www.tradingview.com/news/zacks:fb30c131e094b:0-goldman-vs-morgan-stanley-which-stock-has-stronger-upside/

- https://www.morganstanley.com/about-us/history

- https://www.researchgate.net/publication/375551374_Morgen_Stanleys_Acquisition_of_Etrade

- https://www.investmentnews.com/wirehouses/inside-morgan-stanleys-7-billion-deal-for-eaton-vance/197895

- https://www.oliverwyman.com/our-expertise/insights/2025/oct/mergers-and-acquisitions-fueling-wealth-and-asset-management.html

- https://en.wikipedia.org/wiki/Morgan_Stanley

Back to Morgan Stanley page