The history of AstraZeneca can be broken down into four distinct strategic phases:

Phase 1: Foundations and Early Breakthroughs (1913-1998)

Before the merger, both companies established themselves as research powerhouses in their respective regions.

- Astra AB (Sweden, founded 1913): Originally founded by 400 doctors and apothecaries. They gained global fame in 1948 with Xylocaine, the first successful lidocaine local anesthetic. In 1988, they launched Losec (Prilosec), which became the world’s best-selling prescription drug for stomach acid.

- Zeneca Group (UK, demerged 1993): Formerly the pharmaceutical arm of the British industrial giant Imperial Chemical Industries (ICI). Zeneca was renowned for its strength in oncology (e.g., Tamoxifen) and cardiovascular medicine.

Core Strategy: Focus on fundamental scientific research in specific therapeutic areas, expanding from Nordic and British domestic markets to a global scale. The strategy relied on securing long-term patent protection for innovative small-molecule chemical drugs.

Core Products: Losec (the world’s first proton pump inhibitor for gastric ulcers), Xylocaine (the gold standard for local anesthesia), Diprivan (intravenous anesthetic), and Tamoxifen (a foundational breast cancer treatment).

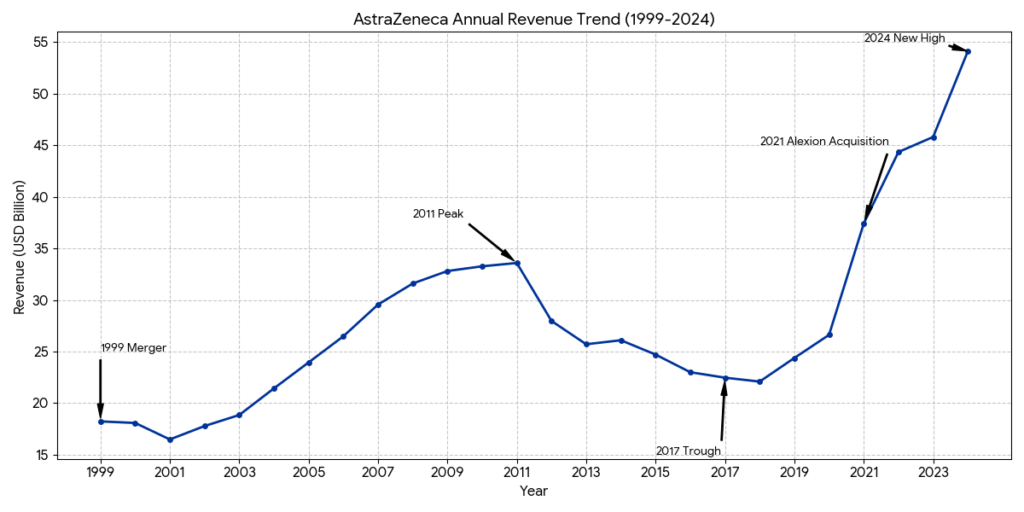

Revenue Level: On the eve of the merger in 1998, the combined revenue of both companies was approximately 17 billion to 18 billion USD.

Phase 2: The Mega-Merger and Blockbuster Era (1999-2011)

This period was defined by the integration of the two cultures and the maximization of high-volume primary care drugs.

- 1999: The Merger: Astra and Zeneca merged in a 67 billion dollar deal, creating one of the largest pharmaceutical entities in the world.

- The Blockbuster Strategy: The company dominated the market with massive hits like Nexium (the “purple pill” for acid reflux) and Crestor (for high cholesterol).

- 2007: Shift to Biotech: Recognizing the future lay in large molecules, they acquired MedImmune for 15.2 billion dollars, securing the foundation for their vaccine and biologics pipeline.

Core Strategy: Leveraging economies of scale created by the mega-merger to maximize market penetration of Primary Care medications. The focus was on the “Blockbuster” model—high-volume drugs for common conditions—while beginning the pivot to biologics with the 2007 acquisition of MedImmune.

Core Products: Nexium (acid reflux), Crestor (statins for high cholesterol), Seroquel (schizophrenia and depression), and Symbicort (asthma control).

Revenue Level: Revenue climbed steadily during this period, peaking in 2011 at approximately 33.6 billion USD.

Phase 3: The Patent Cliff and Strategic Pivot (2012-2019)

Facing the loss of patent protection for its main earners, the company underwent a radical transformation under new leadership.

- 2012: New Leadership: Pascal Soriot became CEO. In 2014, he famously fended off a 117 billion dollar hostile takeover bid from Pfizer, betting on the company’s internal R&D instead.

- Focusing the Portfolio: They exited non-core areas to focus on three pillars: Oncology, Cardiovascular, Renal & Metabolism (CVRM), and Respiratory & Immunology (R&I).

- Oncology Leadership: This era saw the launch of game-changers like Tagrisso (lung cancer) and Lynparza (PARP inhibitor), turning the company into a leader in precision medicine.

Core Strategy: Navigating the revenue gap caused by the loss of patent protection for key blockbusters (the “Patent Cliff”). Under CEO Pascal Soriot, the company adopted a “Science-Led” strategy, divesting non-core assets to concentrate resources on Oncology, CVRM (Cardiovascular, Renal & Metabolism), and Respiratory & Immunology.

Core Products: Tagrisso (targeted lung cancer therapy), Lynparza (PARP inhibitor), and Farxiga (SGLT2 inhibitor for diabetes and kidney disease).

Revenue Level: Revenue experienced a significant decline, hitting a trough of approximately 22.5 billion USD in 2017, before rebounding to roughly 24.4 billion USD in 2019 as new launches began to scale.

Phase 4: Diversification and Rare Diseases (2020-Present)

The current phase is characterized by global health contributions and expansion into specialized medicine.

- 2020-2021: COVID-19 Response: Partnered with Oxford University to develop and distribute the Vaxzevria vaccine at cost during the pandemic, delivering billions of doses worldwide.

- 2021: Entering Rare Diseases: Completed the 39 billion dollar acquisition of Alexion Pharmaceuticals, creating a new growth engine focused on rare and orphan diseases.

- Future Frontiers: The company is now heavily invested in Antibody-Drug Conjugates (ADCs), cell therapies, and genomic medicines, aiming for 80 billion dollars in total revenue by 2030.

Core Strategy: Diversifying the portfolio through major acquisitions (e.g., Alexion) to enter the Rare Disease market. The strategy focuses on high-barrier technologies like Antibody-Drug Conjugates (ADCs) and cell therapies, aiming for a multi-pillar growth engine to reach ambitious 2030 targets.

Core Products: Enhertu (ADC for breast cancer), Soliris/Ultomiris (rare disease treatments), Imfinzi (immunotherapy), and Vaxzevria (COVID-19 vaccine).

Revenue Level: Revenue rebounded sharply due to new drug performance and M&A impact, surpassing 45 billion USD in 2023. The company has set a long-term revenue target of 80 billion USD by 2030.

Based on AstraZeneca’s full-year 2024 results (Total Revenue: $54,073 million), the top three products by revenue are Tagrisso, Farxiga, and Imfinzi. These three drugs are the pillars of the company’s Oncology and BioPharmaceuticals portfolios.

AstraZeneca Top 3 Products: Revenue and Competitive Landscape (FY 2024)

- 1. Tagrisso (Osimertinib)

- 2024 Revenue: $6,670 million (Approx.)

- Revenue Share: 12.3%

- Therapy Area: Oncology (EGFR-mutated Lung Cancer).

- Competitive Analysis:

- Market Position: Tagrisso is the global standard of care for 1st-line EGFRm non-small cell lung cancer (NSCLC). It continues to expand its lead through the ADAURA (adjuvant) and FLAURA2 (combination) trials.

- Main Rivals: It faces competition from Johnson & Johnson’s Rybrevant (amivantamab), which is gaining traction in specific combination settings. Older generation TKIs from Roche (Tarceva) and Pfizer (Vizimpro) are largely relegated to later lines or specific niches.

- 2. Farxiga (Dapagliflozin)

- 2024 Revenue: $6,450 million (Approx.)

- Revenue Share: 11.9%

- Therapy Area: Cardiovascular, Renal & Metabolism (CVRM).

- Competitive Analysis:

- Market Position: A leading SGLT2 inhibitor for Type-2 Diabetes, Heart Failure, and Chronic Kidney Disease (CKD). Its label for CKD remains a significant competitive differentiator.

- Main Rivals: Its primary competitor is Eli Lilly/Boehringer Ingelheim’s Jardiance, which currently holds a slightly larger market share in the US. Johnson & Johnson’s Invokana is a secondary rival but has lost significant momentum.

- 3. Imfinzi (Durvalumab)

- 2024 Revenue: $4,810 million (Approx.)

- Revenue Share: 8.9%

- Therapy Area: Oncology (Immuno-Oncology).

- Competitive Analysis:

- Market Position: Dominates the “unresectable Stage III NSCLC” market (the PACIFIC regimen) and is expanding rapidly into biliary tract and liver cancers.

- Main Rivals: Faces intense competition from “the Big Three” PD-1/PD-L1 inhibitors: Merck’s Keytruda (the global leader), BMS’s Opdivo, and Roche’s Tecentriq. Imfinzi competes by carving out leadership in specific tumor types where Keytruda is not yet the standard.

Revenue Concentration & Outlook

| Product | 2024 Revenue ($M) | % of Total Revenue | Key Growth Driver |

| Tagrisso | ~$6,670 | 12.3% | Adjuvant setting (ADAURA) |

| Farxiga | ~$6,450 | 11.9% | Chronic Kidney Disease (CKD) |

| Imfinzi | ~$4,810 | 8.9% | Biliary Tract & Liver Cancers |

| Top 3 Combined | ~$17,930 | 33.1% | – |

Analyst Note: While these three are the current leaders, Enhertu (in partnership with Daiichi Sankyo) is the “rising star.” With a growth rate exceeding 45-50%, Enhertu is projected to overtake Imfinzi and potentially Farxiga within the next two years to become a top 3 revenue contributor.

In the field of 1st-line EGFR-mutated lung cancer, AstraZeneca’s Tagrisso is currently facing its most significant challenge from “combination therapies.” The competition now focuses on the “triple threat” of Tagrisso Monotherapy, Tagrisso + Chemotherapy (FLAURA2), and J&J’s Rybrevant + Lazcluze (MARIPOSA).

Here is the competitive analysis based on the latest 2025/2026 clinical data.

1. Clinical Efficacy Comparison (1L NSCLC)

The 2025 World Lung Cancer Conference (WCLC) and updated 2026 reports confirm that both combinations significantly extend survival over monotherapy.

| Metric | Tagrisso Mono (FLAURA) | Tagrisso + Chemo (FLAURA2) | Rybrevant + Lazcluze (MARIPOSA) |

| mPFS (Progression-Free) | 16.7 months | 29.4 months | 23.7 months |

| mOS (Overall Survival) | 37.6 months | 47.5 months (Record) | Not Reached (Proj. >49 months) |

| Death Risk Reduction (HR) | Baseline | 0.77 (23% reduction) | 0.75 (25% reduction) |

| CNS (Brain) Efficacy | Gold Standard | Strongest (PFS 24.9m) | High (icPFS 25.4m) |

- Key Insight: FLAURA2 set a new global record for survival in a Phase III EGFR trial (47.5 months). While MARIPOSA shows a slightly better hazard ratio (0.75), J&J’s combination is marketed as “chemo-free,” which is highly attractive to patients wanting to avoid chemotherapy’s systemic toxicity.

2. Safety and Side Effect Profile

While efficacy has improved, the “Toxic Burden” has increased significantly for both combination regimens.

| Metric | Tagrisso Mono | Tagrisso + Chemo (FLAURA2) | Rybrevant + Lazcluze (MARIPOSA) |

| Grade > 3 AEs (Severe) | 34% (Safest) | 64% – 70% | 75% – 80% (Heaviest) |

| Primary Toxicities | Rash, Diarrhea | Hematological (Anemia, Neutropenia) | Vascular (37% VTE risk), Infusions |

| Patient Convenience | Once-daily oral | Requires regular IV chemo | Requires IV infusions + blood thinners |

| Treatment Discontinuation | ~3% | ~11% | ~10% |

3. Mechanism of Action (MoA)

- Tagrisso (Osimertinib):

- Action: A 3rd-generation, irreversible TKI that enters the cell and binds covalently to the mutated EGFR receptor.

- Advantage: High selectivity for mutated vs. wild-type EGFR, resulting in fewer skin/GI issues and superior brain penetrance.

- Rybrevant (Amivantamab) + Lazcluze (Lazertinib):

- Action: Rybrevant is a bispecific antibody that targets the EGFR and MET receptors on the cell surface; Lazcluze is an intracellular TKI.

- Advantage: By blocking the MET pathway, it preemptively addresses one of the most common ways lung cancer becomes resistant to Tagrisso.

4. 2026 Market Strategic Outlook

- AstraZeneca’s Defense: AZ uses the FLAURA2 “OS Record” (nearly 4 years) to dominate high-risk patients, especially those with brain metastases. For older or frail patients, Tagrisso Monotherapy remains the untouchable standard due to its 10-year safety track record.

- J&J’s Challenge: The MARIPOSA regimen is gaining ground in academic centers. With the 2025/2026 approval of a subcutaneous (SC) version of Rybrevant and better management of blood clots (VTE), J&J is actively trying to replace Tagrisso as the “new standard of care.”

- Revenue Impact: Tagrisso remains a blockbuster, with global 2026 revenue projected to exceed $7.8 billion, but its growth rate is slowing as combinations become the preferred choice in major US and European markets.

Based on AstraZeneca’s 2024 results, Farxiga (Dapagliflozin) is the company’s second-highest-grossing product, generating approximately $6.45 billion (11.9% of total revenue). Its primary competitor is Jardiance (Empagliflozin), co-developed by Eli Lilly and Boehringer Ingelheim.

The competition between these two SGLT2 inhibitors is centered on their massive clinical trials in Heart Failure (HF) and Chronic Kidney Disease (CKD).

1. Detailed Clinical Efficacy Comparison

While both drugs share similar indications, their landmark trials show slight nuances in protective strength.

| Metric | Farxiga (DAPA-HF / DAPA-CKD) | Jardiance (EMPEROR / EMPA-KIDNEY) |

| HFrEF (Reduced Ejection Fraction) | 26% reduction in CV death or HF hospitalization (HR 0.74). | 25% reduction in CV death or HF hospitalization (HR 0.75). |

| HFpEF (Preserved Ejection Fraction) | 18% reduction in worsening HF (DELIVER trial). | 21% reduction in worsening HF (EMPEROR-Preserved). |

| Chronic Kidney Disease (CKD) | 44% reduction in renal decline/ESKD risk. | 28% reduction in renal decline/CV death risk. |

| HbA1c Reduction | Approx. 0.5% – 1.0%. | Approx. 0.7% – 1.1% (Slightly higher). |

| All-Cause Mortality | Significant reduction observed in DAPA-HF. | Reduction not statistically significant in EMPEROR, but strong hospital reduction. |

- Key Efficacy Insight: Farxiga remains the “Gold Standard” for kidney protection due to its staggering 44% risk reduction in the DAPA-CKD trial. Jardiance holds a slight edge in HFpEF (the harder-to-treat heart failure) and slightly more potent blood sugar control.

2. Safety and Side Effect Profile

As SGLT2 inhibitors, both drugs share a “Class Effect” profile, though clinical experience has highlighted specific areas of focus.

- Common Side Effects:

- Genitourinary Infections: Due to increased glucose in urine, fungal and bacterial infections occur in roughly 3-5% of patients (higher risk in females).

- Volume Depletion: Increased urination can lead to dehydration or low blood pressure in about 5% of patients.

- Specific Safety Comparisons:

- Amputation/Fracture Risk: Early concerns existed for the SGLT2 class, but long-term real-world data in 2025/2026 have confirmed that both Farxiga and Jardiance are safe with no significant increase in these risks.

- Ketoacidosis (DKA): A rare but serious risk (<0.1%) for both drugs, usually triggered by illness or major surgery.

- eGFR Thresholds: Farxiga is approved for initiation down to an eGFR of 25, while Jardiance (following EMPA-KIDNEY) is approved in some regions down to 20, allowing for use in more advanced kidney disease stages.

3. Mechanism of Action (MoA)

- Primary Action: Both drugs inhibit the Sodium-Glucose Cotransporter 2 (SGLT2) in the proximal tubules of the kidney.

- The “Sugar-Dumping” Effect: By blocking the reabsorption of glucose and sodium, they force the body to excrete excess sugar via urine.

- Organ Protection: This process leads to “osmotic diuresis” and “natriuresis,” which reduces the preload on the heart and decreases intraglomerular pressure in the kidneys, effectively “resting” these organs and preventing long-term damage.

4. 2026 Strategic Market Outlook

- The Patent Cliff: Farxiga is approaching its loss of exclusivity (LOE) in major markets between 2025 and 2026. AstraZeneca is countering this by launching fixed-dose combinations with newer metabolic agents.

- GLP-1 Competition: The meteoric rise of GLP-1/GIP agonists (like Zepbound and Wegovy) has shifted some market focus. However, SGLT2 inhibitors like Farxiga remain indispensable because they provide direct renal protection that GLP-1s are only beginning to prove in newer trials (like FLOW).

Conclusion: If the clinical goal is maximal renal protection, Farxiga’s data remains the benchmark. If the goal is HFpEF management or more aggressive glucose lowering, Jardiance currently leads the market share.

Based on AstraZeneca’s 2024 financial results, Imfinzi (Durvalumab) is the company’s third-largest product by revenue, bringing in approximately $4.81 billion. It is a cornerstone of their Oncology franchise, particularly dominating the treatment landscape for Stage III Non-Small Cell Lung Cancer (NSCLC).

The primary competitors for Imfinzi are Merck’s Keytruda (Pembrolizumab) and Roche’s Tecentriq (Atezolizumab).

1. Detailed Clinical Data Comparison (Efficacy)

Imfinzi has carved out a unique position by dominating “niche” segments where competitors lack long-term data.

A. Stage III Unresectable NSCLC (The “PACIFIC” Standard)

This is Imfinzi’s most fortified “moat.” It is used as consolidation therapy after concurrent chemoradiotherapy (cCRT).

| Metric | Imfinzi (PACIFIC Trial) | Competitors (Keytruda/Tecentriq) |

| mPFS (Progression-Free) | 16.9 months | No comparable Phase III data |

| mOS (Overall Survival) | 47.5 months | N/A |

| 5-Year OS Rate | 42.9% (vs. 33.4% placebo) | N/A |

| Brain Met Risk Reduction | New lesions in only 6.3% (vs. 11.8%) | N/A |

B. Extensive-Stage Small Cell Lung Cancer (ES-SCLC)

In this highly aggressive cancer, Imfinzi competes directly with Roche’s Tecentriq.

| Clinical Trial | Imfinzi + EP (CASPIAN) | Tecentriq + CP/E (IMpower133) |

| mOS (Overall Survival) | 12.9 – 13.0 months | 12.3 months |

| Hazard Ratio (HR) | 0.73 | 0.70 |

| 24-Month Survival Rate | 22.9% | 22.0% |

| Clinical Flexibility | Allows Cisplatin or Carboplatin | Only approved with Carboplatin |

C. Advanced Biliary Tract Cancer (BTC) & Liver Cancer (uHCC)

AstraZeneca uses a “Dual-Immunotherapy” strategy (Imfinzi + Imjudo) for liver cancer.

| Clinical Trial | Imfinzi + Chemo (TOPAZ-1) | Keytruda + Chemo (KEYNOTE-966) |

| Indication | Biliary Tract Cancer (BTC) | Biliary Tract Cancer (BTC) |

| mOS (Overall Survival) | 12.9 months | 12.7 months |

| HR (Death Risk) | 0.76 | 0.83 |

| Trial Impact | First IO to break a 10-year SOC gap | Validated IO efficacy in BTC |

2. Mechanism of Action (MoA)

The fundamental difference lies in PD-L1 (Imfinzi) versus PD-1 (Keytruda) inhibition.

- Imfinzi (Durvalumab): PD-L1 Inhibitor

- Action: Binds to the PD-L1 protein on cancer cells.

- Effect: Blocks the interaction between PD-L1 and the PD-1/CD80 receptors on T-cells, “unleashing” the immune response.

- Specific Advantage: By targeting PD-L1, it leaves the interaction between PD-1 and PD-L2 intact. Some studies suggest this helps maintain immune homeostasis, potentially leading to fewer severe immune-related side effects.

- Keytruda (Pembrolizumab): PD-1 Inhibitor

- Action: Binds to the PD-1 receptor on T-cells.

- Effect: Directly blocks both PD-L1 and PD-L2 pathways. This generally creates a more robust immune response but can lead to slightly higher rates of immune-related adverse events.

3. Safety and Tolerability Comparison

Safety is critical when combining immunotherapy with radiation, as is the case in Stage III lung cancer.

- Immune-Related Adverse Events (irAEs): PD-L1 inhibitors like Imfinzi generally show a Grade 3/4 AE rate of 4–10%, which is often slightly lower than that of PD-1 inhibitors in similar settings.

- Pneumonitis (Lung Inflammation):

- Imfinzi: In the PACIFIC trial, the rate of Grade 3/4 pneumonitis was only 3.4%. This is vital because radiation also causes lung inflammation; Imfinzi’s tolerability makes it the only safe choice for post-radiation consolidation.

- Comparison: Clinical observations suggest PD-L1 inhibitors typically have a pneumonitis rate of 2–5%, while PD-1 inhibitors range from 3–7%.

- Organ-Specific Toxicity: Imfinzi shows lower rates of severe liver toxicity and colitis (<1%) compared to Keytruda (approx. 2–3%).

4. 2026 Strategic Outlook

- PACIFIC Moat: Imfinzi’s 5-year survival data remains the “Gold Standard” in Stage III NSCLC. Even by 2026, no other drug has challenged this leadership with comparable long-term evidence.

- Expansion into ADCs: AstraZeneca is currently testing Imfinzi + Enhertu and other ADCs. This “IO + ADC” combination is expected to be the next major revenue driver through 2030.

- Hepatobiliary Dominance: Imfinzi is the first immunotherapy to establish a dominant lead in biliary tract cancer, a market previously ignored by larger competitors.

Source:

- https://www.astrazeneca.com/investor-relations/results-and-reporting.html

- https://www.astrazeneca.com/media-centre/press-releases.html

- https://clinicaltrials.gov/

- https://www.wclc2025.org/

- https://www.asco.org/

- https://www.esmo.org/

Back to AstraZeneca page