Toyota’s history can be divided into five defining eras, marking its evolution from a textile machinery manufacturer to a global leader in mobility.

1. The Textile Origins (Late 19th Century – 1937)

Toyota’s story began with Sakichi Toyoda, the “King of Japanese Inventors,” who developed Japan’s first power loom.

- 1924: Sakichi invented the Toyoda Model G Automatic Loom, which featured a system that stopped the machine if a thread broke—a concept later known as Jidoka (autonomation).

- 1933: His son, Kiichiro Toyoda, established an automobile department within Toyoda Automatic Loom Works, funded by the sale of loom patent rights.

- 1937: Toyota Motor Corporation was officially incorporated as an independent entity.

Core Technology: Jidoka (Autonomation). Inherited from the loom business, this allowed machines to stop automatically when a problem occurred, preventing the production of defective parts.

Core Strategy: Import Substitution. Replicating and improving upon American vehicle designs (Ford/Chevrolet) to establish a domestic Japanese automotive industry.

Revenue Level: Seed Stage. Revenue was negligible compared to the textile business, which funded the automotive department’s R&D.

2. Post-War Recovery & The Birth of TPS (1945 – 1960s)

After WWII, Toyota faced near bankruptcy and intense competition from American automakers.

- 1950: A severe financial crisis led to a labor strike and the resignation of Kiichiro Toyoda. The company split into Toyota Motor (manufacturing) and Toyota Motor Sales.

- 1950s: Taiichi Ohno developed the Toyota Production System (TPS), focusing on the elimination of waste and Just-in-Time production.

- 1955: The Toyopet Crown was launched, marking Toyota’s entry into the full-scale passenger car market.

- 1966: The Corolla debuted, eventually becoming the best-selling car in history.

Core Technology: Toyota Production System (TPS). The invention of Kanban and Just-In-Time (JIT) enabled high-efficiency manufacturing with minimal inventory.

Core Strategy: Lean Management & Quality. Facing capital shortages, Toyota focused on eliminating waste (Muda) and continuous improvement (Kaizen) to compete with Western giants.

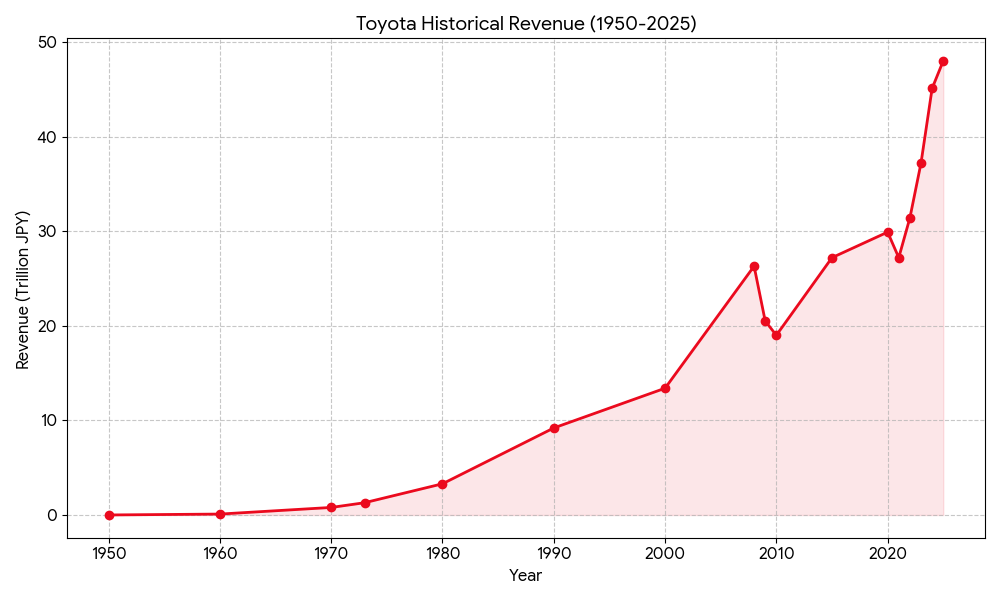

Revenue Level: High Growth. Revenue reached the hundreds of billions of Yen. By the late 1960s, the Corolla’s success propelled Toyota into a major industrial player.

3. Global Expansion & Luxury Success (1970s – 1990s)

The 1970s energy crises shifted global demand toward fuel-efficient Japanese cars, allowing Toyota to dominate international markets.

- 1982: Toyota Motor and Toyota Motor Sales merged to form the modern Toyota Motor Corporation.

- 1984: NUMMI, a joint venture with GM in California, began, teaching Toyota how to manage American labor and suppliers.

- 1989: Toyota launched the Lexus brand, proving that a Japanese manufacturer could compete in the high-end luxury segment.

- 1997: The Prius was introduced as the world’s first mass-produced hybrid electric vehicle.

Core Technology: Fuel Efficiency & Hybridization. Toyota mastered lean engines during the oil shocks and launched the Prius in 1997, the world’s first mass-produced hybrid.

Core Strategy: Market Diversification. Toyota expanded manufacturing to the U.S. (via NUMMI) and successfully launched Lexus to capture the high-margin luxury segment.

Revenue Level: Trillion-Yen Era. Annual revenue grew from roughly ¥5 trillion in the 1980s to over ¥15 trillion by the late 1990s.

4. Becoming No. 1 & The Recall Crisis (2000s – 2010s)

Toyota aggressively pursued global scale, eventually overtaking General Motors as the world’s largest automaker.

- 2008: Toyota became the global sales leader for the first time.

- 2009-2010: Rapid expansion led to quality control issues, resulting in massive global recalls related to “unintended acceleration.”

- Akio Toyoda’s Leadership: The grandson of the founder took over as President, steering the company back to its “Quality First” roots and emphasizing “making ever-better cars.”

Core Technology: TNGA (Toyota New Global Architecture). A standardized platform strategy designed to improve vehicle performance while drastically reducing costs through component sharing.

Core Strategy: Quantity to Quality Pivot. After the 2009-2010 recall crisis, Akio Toyoda shifted the strategy from “volume at any cost” back to “making ever-better cars.”

Revenue Level: ¥20-30 Trillion. Toyota became the world’s largest automaker by volume (2008), with revenues stabilizing in the mid-20 trillion Yen range despite the global financial crisis.

5. The Shift to Mobility & Carbon Neutrality (2020s – Present)

Toyota is currently transitioning from a traditional car manufacturer to a “Mobility Company” amid the CASE (Connected, Autonomous, Shared, and Electric) revolution.

- Multi-Pathway Strategy: Unlike competitors focusing solely on Battery Electric Vehicles (BEVs), Toyota continues to invest in Hybrids (HEVs), Hydrogen (FCEVs), and Plug-in Hybrids (PHEVs).

- 2021: Announced a major commitment to launch 30 BEV models by 2030.

- 2023: Koji Sato succeeded Akio Toyoda as CEO, accelerating the company’s digital transformation and electric vehicle architecture development.

Core Technology: Multi-Pathway Powertrains. Simultaneous development of Solid-State Batteries, Hydrogen Fuel Cells (FCEV), and advanced Software-Defined Vehicles (SDV).

Core Strategy: Mobility as a Service (MaaS). Transitioning from a car seller to a mobility provider, investing in AI, Woven City (smart city), and carbon neutrality across all energy types.

Revenue Level: Historical Peaks.

- FY2025 (Forecast): Revenue reaching approximately ¥48.04 trillion.

- Operating Profit: Currently at record highs (approx. ¥4.3-4.8 trillion), making Toyota the most profitable enterprise in Japanese history.

In 2026, Toyota remains the world’s largest automaker by volume, but it faces a landscape defined by a “two-front war”: defending its massive internal combustion and hybrid stronghold while racing to catch up in the pure electric vehicle (EV) sector.

1. Competitive Landscape & Market Share (2025-2026)

Toyota continues to lead global sales, primarily driven by its dominance in Hybrid Electric Vehicles (HEVs), which saw a surge in demand as the global “pure EV” transition slowed in some regions.

| Competitor | 2025 Sales (Est.) | Competitive Dynamic |

| Toyota Group | ~10.3M units | Global No.1. High profitability driven by strong HEV sales in North America and Japan. |

| Volkswagen Group | ~8.9M units | Main traditional rival. Struggling with high costs in Europe and declining share in China. |

| Hyundai-Kia | ~7.3M units | The most aggressive traditional challenger, excelling in EV design and software integration. |

| BYD (Build Your Dreams) | ~4.0M units | The Greatest Threat. Surpassed Tesla in pure EV sales in 2025. Rapidly eroding Toyota’s dominance in Southeast Asia. |

| Tesla | 1.64M units | The software and AI benchmark. Focusing on autonomous driving and “Robotaxis” to maintain premium margins. |

2. Core Competitive Advantages (2026)

Toyota’s resilience is built on three pillars that provide a “financial moat” while it transitions its technology.

- Toyota Production System (TPS): Remains the industry gold standard for lean manufacturing, allowing Toyota to maintain a best-in-class operating margin of ~10% (compared to Ford’s ~7.6%).

- Multi-Pathway Strategy: By offering HEV, PHEV, FCEV (Hydrogen), and BEV simultaneously, Toyota minimizes risk against fluctuating government subsidies and infrastructure readiness.

- Supply Chain & Reliability: 2026 models like the Camry and RAV4 continue to hold the highest resale values and reliability ratings, driving massive customer loyalty.

3. Core Strategy: The “2026 Pivot”

2026 is a critical “execution year” for Toyota’s long-term survival.

- BEV Acceleration: Toyota aims for 1.5 million BEV sales annually by 2026, launching 10 new dedicated EV models (e.g., the Urban Cruiser Ebella and the electric Hilux).

- Software-Defined Vehicles (SDV): Through its subsidiary Woven by Toyota, the company is deploying the Arene OS, attempting to match Tesla’s “computer on wheels” capability.

- Next-Gen Batteries: Intensive R&D into Solid-State Batteries, with a target for commercial introduction by 2027-2028, promising 1000km+ range and 10-minute charging.

4. Financial Comparison (FY2025-2026)

Toyota’s financial health is the strongest in the industry, providing the capital necessary for this massive transition.

- Revenue: Reached a record ¥48.04 trillion ($314B) in FY2025.

- Net Income: Remained robust at approximately ¥4.7 trillion, even as R&D spending on EVs and AI spiked.

- Valuation: Despite high profits, Toyota trades at a P/E ratio of ~7.2x and a P/B ratio of ~0.95x, suggesting it is currently undervalued relative to its assets and market position.

In 2026, the automotive technical landscape is defined by a fierce “triangular battle” between Toyota, Tesla, and BYD. While Tesla dominates software and BYD excels in cost-efficient hardware, Toyota is making its move to reclaim leadership through next-gen solid-state batteries and modular manufacturing.

1. Battery Technology: The “Solid-State” Counterattack

Toyota is attempting a “leapfrog” strategy, moving past current liquid-electrolyte batteries to gain a decisive advantage in range and charging.

| Feature | Toyota (Solid-State) | BYD (Gen-2 Blade) | Tesla (4680 Cybercell) |

| Chemistry | Sulfide-based Solid Electrolyte | Lithium Iron Phosphate (LFP) | High-Nickel NMC |

| Energy Density | ~500 Wh/kg (Target) | ~190 Wh/kg | ~240-260 Wh/kg |

| Max Range | 1,000km – 1,200km | 600km – 800km | 700km – 900km |

| Charge Time | < 10 mins (10-80%) | ~20-30 mins | ~15-25 mins |

| Verdict | Toyota wins on raw specs but faces scaling challenges in 2026. | BYD leads in cost/safety for mass-market. | Tesla leads in energy-to-weight for performance. |

2. Software & AI: Arene OS vs. FSD

Toyota is finally addressing its “software debt” with the deployment of Arene OS in 2026, aimed at closing the gap with Tesla’s Full Self-Driving (FSD).

- Toyota (Arene OS): Features a decentralized “zonal” architecture, allowing for monthly over-the-air (OTA) updates and a new developer ecosystem. It focuses on Predictive Safety (Guardian) rather than full hands-off autonomy.

- Tesla (FSD v12+): The industry benchmark. By 2026, Tesla utilizes End-to-End Neural Networks (AI that “sees” and “acts” without human-coded rules), maintaining a massive lead in real-world driving data.

- BYD (God’s Eye / Xuanji): Focuses heavily on In-Cabin Experience and predictive suspension (DiSus-Z) that adjusts 1,000 times per second using LiDAR.

3. Manufacturing: Giga Casting Evolution

To compete with Tesla’s margins, Toyota has implemented its own version of large-scale die-casting.

- Toyota’s 3-Part Modular Design: Unlike Tesla’s 2-part cast (front/rear), Toyota divides the 2026 BEV platform into Front, Center (Battery), and Rear.

- Self-Driving Assembly Lines: A unique Toyota innovation where cars drive themselves between stations, eliminating conveyor belts and reducing plant investment by 50%.

- Tesla’s Giga Press 2.0: Moving toward a “Unboxed Process” where sub-assemblies are completed in parallel and joined at the end, further reducing the factory footprint.

4. Hybrid Efficiency: The 48% Thermal Efficiency Wall

While the world moves toward EV, the 2026 hybrid market is a battle of extreme engine efficiency.

- China’s Dominance (BYD/Dongfeng): In early 2026, Dongfeng and BYD (DM-i 5.0) have pushed thermal efficiency to 46% – 48%, enabling “2,000km range” PHEVs.

- Toyota’s Counter: Toyota’s 2026 engines focus on Ultra-Compactness. By making the engine significantly smaller, they allow for lower hood lines and better aerodynamics (reducing drag), which compensates for a slightly lower thermal efficiency (around 41-42%) compared to Chinese rivals.

Technical Competitive Summary

- Toyota’s Strength: Reliability and Breakthrough Research. Their solid-state battery is the only technology that can fundamentally end “range anxiety.”

- Tesla’s Strength: AI Integration. Tesla is no longer just a car company; it’s an AI company that makes cars.

- BYD’s Strength: Vertical Integration. They own the entire supply chain, allowing them to iterate new hardware every 18 months, compared to Toyota’s 3-5 year cycle.

Sources:

Back to Toyota page