Evolution of Cisco Systems: A Strategic Overview

Cisco’s journey reflects the broader history of the internet, transitioning from a hardware pioneer to a software and AI-driven enterprise. Here are the five key stages of its development:

Phase 1: Foundations and Multi-Protocol Routing (1984–1989)

Founded in 1984 by Stanford University computer scientists Leonard Bosack and Sandy Lerner.

- Core Innovation: They developed the first commercially successful multi-protocol router, allowing disparate computers to communicate.

- Early Growth: The AGS (Advanced Gateway Server) became the bedrock of early campus and corporate networks. Professional management took over after venture capital investment from Don Valentine.

Core Technology: Advanced Gateway Server (AGS). This was the first commercially successful router capable of linking different networking protocols (IP, IPX, AppleTalk), which allowed disparate computer systems to communicate.

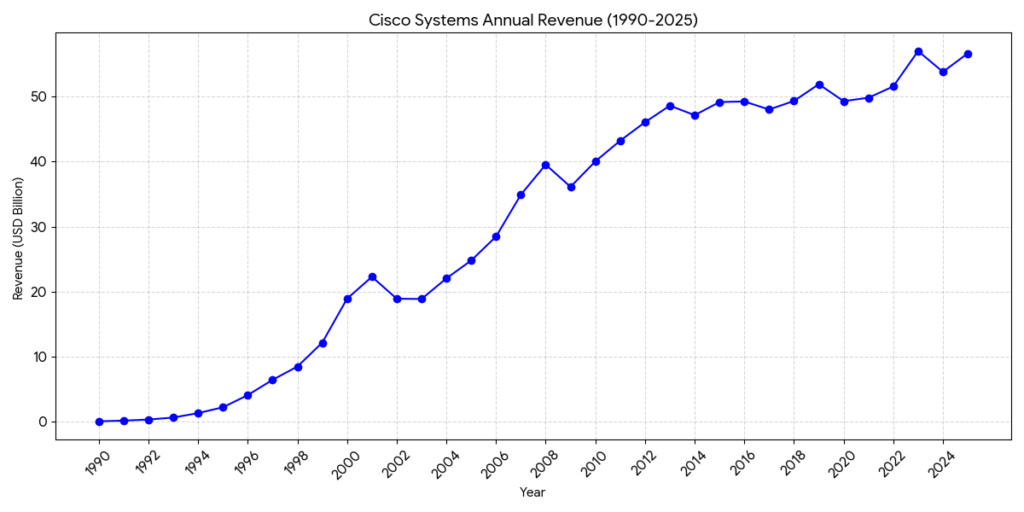

Revenue Level: Revenue was approximately $11 million in 1988, growing to $69 million by the time of its 1990 IPO.

Phase 2: Market Dominance and the Dot-Com Boom (1990–2000)

Cisco went public in 1990, just as the World Wide Web began to explode.

- The Chambers Era: Under CEO John Chambers (appointed 1995), Cisco adopted an aggressive acquisition strategy, buying dozens of companies to quickly dominate the switching and remote access markets.

- Market Peak: By March 2000, Cisco briefly became the most valuable company in the world, with a market capitalization exceeding $555 billion.

Core Technology: High-Performance Backbone Routers (7000 Series) and Enterprise Switches (Catalyst Series). Cisco’s hardware became the literal plumbing of the early public internet.

Revenue Level: Massive exponential growth. Revenue reached $1.9 billion in 1995 and peaked at $18.9 billion in 2000 during the height of the internet bubble.

Phase 3: Post-Bubble Diversification (2001–2014)

Following the 2001 market crash, Cisco pivoted from selling “pipes” to providing “intelligent platforms.”

- Portfolio Expansion: Cisco entered the VoIP (Voice over IP) market, acquired Linksys for home networking, and purchased Webex and Tandberg to lead in video collaboration.

- Data Center Entry: Launched the Unified Computing System (UCS), integrating computing, networking, and storage into a single system.

Core Technology: Unified Communications and Data Centers. Key products included IP Phones (VoIP), Webex (acquired for collaboration), and the Unified Computing System (UCS), which integrated servers with networking.

Revenue Level: Steady recovery and growth. Revenue rose to $24.8 billion in 2005 and reached $47.1 billion by 2014.

Phase 4: Transition to Software and Subscription (2015–2022)

Chuck Robbins became CEO in 2015, steering the company away from its reliance on one-time hardware sales toward recurring revenue.

- Subscription Model: Shifted focus to software-defined networking (SDN) and cloud-managed services (e.g., Cisco Meraki and DNA Center).

- Cybersecurity Focus: Acquired firms like Duo Security and Umbrella to build a “Security Cloud” architecture, protecting users regardless of their location.

Core Technology: Software-Defined Networking (SDN) and Cloud Security. Focus shifted to the Meraki cloud management platform, AppDynamics for monitoring, and Duo/Umbrella for cloud-based cybersecurity.

Revenue Level: Revenue stabilized in the $49 billion to $52 billion range. The primary goal during this phase was shifting from one-time hardware sales to recurring software subscriptions.

Phase 5: AI-Ready Infrastructure and Observability (2023–Present)

Cisco is currently integrating Artificial Intelligence into its core fabric to handle the massive data demands of the generative AI era.

- The Splunk Acquisition: In 2024, Cisco completed its $28 billion acquisition of Splunk, the largest in its history, to become a leader in security and digital observability.

- AI Fabric: Developing high-performance chips (Silicon One) and Ethernet fabrics designed specifically to handle AI workloads in massive data centers.

Core Technology: AI Fabric and Big Data Observability. This includes the Silicon One high-performance chips designed for AI workloads and the integration of Splunk for AI-driven security and data analysis.

Revenue Level: Reached a record high of $57 billion in 2023. Projections for 2025 remain strong at approximately $56.7 billion as software and service contributions continue to climb.

In 2026, Cisco’s competitive landscape has shifted from traditional hardware displacement to a battle for dominance in AI-Native Infrastructure, Unified Security, and Full-Stack Observability.

Below is a strategic analysis of Cisco’s competitors by sector:

1. Networking and AI Infrastructure (Data Center & Enterprise)

Cisco remains the market leader in switch and router market share, but faces intense pressure from high-growth specialists.

- Arista Networks (ANET): Cisco’s primary rival in the high-end data center market. Arista has historically outperformed Cisco among cloud giants (hyperscalers like Meta and Microsoft) due to its “single-image” EOS software and low-latency performance.

- HPE (Juniper Networks): Following HPE’s acquisition of Juniper, the combined entity poses a significant threat to Cisco’s enterprise business. Their Mist AI integration offers superior automated network management, which is highly attractive to IT departments looking for “self-healing” networks.

- NVIDIA: While primarily a chipmaker, NVIDIA’s InfiniBand networking technology is the current standard for connecting AI GPU clusters. Cisco is fighting back with its Silicon One chips and Ethernet-based AI fabrics to prove that Ethernet can handle AI workloads as well as InfiniBand.

2. Cybersecurity and Zero Trust

With the $28 billion acquisition of Splunk, Cisco has positioned itself as a security powerhouse, yet it faces “pure-play” security giants.

- Palo Alto Networks (PANW): The leader in Next-Generation Firewalls (NGFW) and cloud security (Prisma). Their “platformization” strategy competes directly with Cisco’s mission to provide an all-in-one security cloud.

- Fortinet (FTNT): Known for superior price-to-performance ratios and proprietary ASIC chips. Fortinet is a dominant force in SD-WAN and secure networking for branch offices, often undercutting Cisco on cost.

- CrowdStrike / Zscaler: These cloud-native firms lead in endpoint protection and secure web gateways (SSE), challenging Cisco’s legacy hardware-centric security approach.

3. Observability and Data Analytics

Post-Splunk, Cisco is the largest player in this space, aiming to provide “digital resilience” by analyzing every packet and log across a network.

- Datadog & Dynatrace: These firms are the preferred choice for DevOps and cloud-native developers. Their platforms are often viewed as more modern and easier to deploy than Cisco’s integrated legacy suites.

- Elastic: Competes directly with Splunk in log management and search-powered analytics, often offering more flexible pricing models for large data sets.

Competitive Summary Matrix (2026)

| Dimension | Cisco’s Standing | Key Competitor to Watch |

| Market Share | Dominant (approx. 43-45%) | Arista (growing in Cloud/AI) |

| AI Innovation | High (Ethernet for AI) | NVIDIA (InfiniBand dominance) |

| Automation | Strong | HPE/Juniper (Mist AI leads UX) |

| Security Portfolio | Extensive (Splunk + Duo) | Palo Alto Networks |

Strategic Analysis: Strengths vs. Risks

- The “Moat” (Strengths):

- Unrivaled Global Reach: Cisco’s massive partner ecosystem and support network are difficult for smaller rivals to replicate.

- Unified Portfolio: It is one of the few vendors that can provide the hardware (Silicon), the software (IOS), the security (Splunk), and the collaboration tools (Webex) in a single contract.

- The “Chokepoints” (Risks):

- Integration Complexity: Years of acquisitions have left Cisco with a complex web of products that can be difficult to manage compared to “cleaner” competitors like Arista or Datadog.

- White-Box Networking: Large cloud providers are increasingly designing their own hardware using open-source designs, bypassing traditional vendors like Cisco.

In 2026, the battle for AI Infrastructure has moved beyond hardware speeds to a war over “Technical Paths” and “Ecosystem Lock-in.” The critical challenge is solving the data bottleneck during the training and inference of Large Language Models (LLMs).

Here is a detailed competitive analysis of Cisco, NVIDIA, and Arista in the AI infrastructure domain:

1. The Great Architectural War: Ethernet vs. InfiniBand

This is the most significant technical divide in the industry, determining how GPU clusters are wired.

- NVIDIA (The InfiniBand Champion):

- Advantage: InfiniBand offers ultra-low latency and “lossless” data transfer, making it the gold standard for massive GPU clusters (e.g., training Llama 4 or GPT-5).

- Status: By integrating hardware with the CUDA software stack, NVIDIA holds over 70% of the AI training network market.

- Cisco & Arista (The Ethernet Rebels):

- Strategy: Leading the Ultra Ethernet Consortium (UEC) to evolve traditional Ethernet to match InfiniBand’s performance.

- Advantage: Ethernet is highly interoperable, cheaper, and ubiquitous. For the vast majority of enterprises doing “Fine-tuning” or “Inference,” Ethernet is easier to manage and integrate into existing data centers.

2. Strategic Positioning of the “Big Three” (2026)

| Company | Core AI Tech | 2026 Strategic Focus | Competitive Standing |

| Cisco | Silicon One G200 chips, Nexus 9000, Splunk Integration | “Secure AI Networking.” Using Silicon One to provide 51.2 Tbps bandwidth while using Splunk to monitor the safety and stability of AI data flows. | Enterprise & Telco Leader. While they trail in “hyperscale” training pods, their global sales channel and integration capabilities are unmatched for corporate AI adoption. |

| NVIDIA | Spectrum-X (Ethernet), BlueField DPU, Quantum-2 (InfiniBand) | Moving from a chipmaker to a systems provider. Their Spectrum-X is aggressively attacking the Ethernet market once owned by Cisco. | Technical Standard Setter. They define what AI computing needs, forcing network vendors to react to their roadmap. |

| Arista | EtherLink AI Platform, EOS Operating System | “Cloud-Native AI Networking.” Their EOS software is prized by Meta and Microsoft for its simplicity and automation in massive 800G deployments. | Hyperscaler Favorite. Currently leads in AI network efficiency (reaching up to 98% throughput), going head-to-head with NVIDIA in 400G/800G switching. |

3. Market Dynamics and 2026 Trends

A. Power Efficiency as a Competitive Edge

In 2026, AI energy consumption is a major concern.

- Cisco’s Play: The Silicon One architecture provides up to an 80% improvement in energy efficiency compared to previous generations. This is a massive selling point for Fortune 500 companies with ESG (Environmental, Social, and Governance) mandates.

B. The “Neutrality” vs. “Vertical” Strategy

- Vertical (NVIDIA): A “closed” ecosystem where the GPU, the cable, and the switch all come from one vendor for maximum performance.

- Neutral (Cisco): Cisco is positioning itself as the “Switzerland of AI.” Their infrastructure supports not just NVIDIA, but also AMD (Pensando) and Intel chips, giving enterprises flexibility to avoid vendor lock-in.

In 2026, Cisco’s strategy in the cybersecurity sector has shifted toward “Digital Resilience”—a concept that moves beyond simple defense to ensuring business continuity through massive data analysis. The $28 billion acquisition of Splunk is now the centerpiece of this transformation.

1. The Strategic Pivot: Splunk as the “Security Operating System”

The core of Cisco’s 2026 security roadmap is the full integration of Splunk into the Cisco Security Cloud.

- Unified AI Assistant: By early 2026, Cisco launched a unified AI assistant that spans both networking and security. It uses Splunk’s data lake to correlate network traffic with security logs, allowing for “Agentic AI” that can automatically quarantine infected devices without human intervention.

- The “Whole Business” Visibility: Cisco argues that while competitors see “security events,” Cisco + Splunk see the “entire business.” This includes monitoring application performance (AppDynamics), network paths (ThousandEyes), and security threats in a single “Virtual War Room.”

2. Competitive Landscape: Cisco vs. The Specialists

| Segment | Key Competitors | Cisco’s 2026 Competitive Edge |

| Network Security (NGFW/SASE) | Palo Alto Networks (PANW), Fortinet | Bundling Advantage: For customers refreshing their Catalyst switches or Wi-Fi 7 gear, Cisco can bundle the security layer at a significant discount, often positioning it as “built-in” rather than an “add-on.” |

| Security Operations (SIEM/XDR) | Microsoft (Sentinel), Palo Alto (XSIAM) | Data Sovereignty: With Splunk, Cisco remains the leader in the Gartner SIEM Magic Quadrant. They compete with Microsoft by offering better hybrid-cloud visibility for enterprises that aren’t 100% on Azure. |

| Zero Trust (SSE) | Zscaler, Netskope | Infrastructure Integration: Unlike Zscaler (which is pure cloud), Cisco’s SSE (Secure Access) integrates directly with on-premise hardware, making it more stable for massive, complex global estates. |

3. Financial and Market Performance (FY 2025/2026)

- Revenue Growth: Cisco’s security segment saw mid-single-digit growth in late 2025, but total revenue for FY 2026 is projected to jump to $60-$61 billion as Splunk’s subscription revenue is fully recognized.

- High Margins: The shift toward software subscriptions has pushed Cisco’s non-GAAP gross margins to a robust 67.5% – 68.5%.

- Market Share: Cisco remains one of the “Star Players” alongside Microsoft and Palo Alto Networks, with a particularly strong hold on Government/Defense (36% market share) and Finance sectors due to its “Hypershield” AI-native protection.

4. Strengths & Vulnerabilities

- The Moat: Talos Intelligence. One of the world’s largest commercial threat-intelligence teams. In 2026, Talos feeds real-time data into Splunk, giving Cisco customers faster “Zero-Day” protection than smaller rivals.

- The Weakness: Complexity & Overlap. Cisco still struggles with product overlap. For some customers, the choice between Cisco Secure Firewall and Meraki Security remains confusing, allowing more focused rivals like Fortinet to win on simplicity and price-to-performance.

Summary for 2026

Cisco is no longer just a “firewall vendor.” It is now a Data and Security Platform. If an enterprise values visibility and vendor consolidation, Cisco + Splunk is the 2026 market leader. If an enterprise prioritizes pure cloud-native agility, Palo Alto Networks remains its fiercest technical rival.

Source:

- Cisco Systems | History & Facts | Britannica

- Cisco Innovation Timeline (Official)

- Timeline of Cisco Systems – History Wiki

- Cisco Reports Fourth Quarter and Fiscal Year 2025 Earnings

- Cisco Revenue 2012-2025 | Macrotrends

- Cisco vs Arista vs NVIDIA Ethernet Switch Market Analysis | IDC / ETTelecom

- Cisco 2026 Outlook and AI Infrastructure | Morgan Stanley (via Seeking Alpha)

- Cisco Completes Acquisition of Splunk (Official)

- Cisco Systems vs Palo Alto Networks 2026 Comparison | Gartner Peer Insights

Back to Cisco page