The history of JPMorgan Chase & Co. is incredibly long and complex, formed through the merger of over 1000 predecessor institutions. Its development can be divided into the following key stages:

Phase 1: Origins and Early Foundations (1799-1870)

The earliest roots of JPMorgan Chase date back to the late 18th century, a period that laid the foundation for its two primary branches:

- 1799: The Manhattan Company was founded by American politician Aaron Burr. Originally a water company, Burr included a clause in the charter allowing surplus capital to be used for financial activities, secretly establishing the Bank of the Manhattan Company.

- 1824: The New York Chemical Manufacturing Company was founded, and in 1824, its charter was amended to conduct banking business, becoming Chemical Bank.

Most Important Business Development: Securing a banking charter. The Manhattan Company exploited a legal loophole in its water supply contract to successfully launch banking operations in New York, breaking the financial monopoly of the time.

Revenue/Asset Level: The founding capital in 1799 was 2million dollars. By the 1850s, it had become one of the primary clearing banks in New York.

Phase 2: The Rise of the Morgan Family and “Morganization” (1871-1913)

This was the era of John Pierpont (J.P.) Morgan’s peak personal influence:

- 1871: J.P. Morgan and Anthony Drexel partnered to form Drexel, Morgan & Co., the predecessor of J.P. Morgan & Co.

- 1895: The firm was renamed J.P. Morgan & Co.

- Financial Savior: During the financial crises of 1893 and 1907, J.P. Morgan used his personal prestige to organize banking syndicates to provide gold and liquidity to the government, averting economic collapse.

- Industrial Restructuring: Morgan led the reorganization of the railroad system and the 1901 formation of U.S. Steel, the world’s first billion-dollar corporation.

Most Important Business Development: Morganization. Through financing and mergers, J.P. Morgan dominated the integration of the American railroad system and facilitated the formation of U.S. Steel in 1901, the world’s first 1billion dollar corporation.

Revenue/Asset Level: In 1895, the firm provided 62million dollars in gold assistance to the U.S. government to rescue the national treasury. By 1912, Morgan and his partners held directorships in 112 corporations.

Phase 3: Regulatory Constraints and Divestiture (1914-1990)

During this period, the bank faced strict regulations but also experienced a massive expansion in scale:

- 1933: Due to the Glass-Steagall Act, J.P. Morgan & Co. was forced to spin off its investment banking business (which later became Morgan Stanley) to focus exclusively on commercial banking.

- 1955: The Bank of the Manhattan Company acquired Chase National Bank to form the Chase Manhattan Bank. Under David Rockefeller’s leadership, it became a global financial powerhouse.

- 1959: J.P. Morgan & Co. merged with the Guaranty Trust Company of New York to form the Morgan Guaranty Trust Company.

Most Important Business Development: Internationalization and retail banking transformation. The 1955 merger between Chase National Bank and the Bank of the Manhattan Company created one of the largest retail banks in the U.S. Under Rockefeller’s leadership, the bank began massive expansion of overseas branches.

Revenue/Asset Level: The asset scale after the 1955 merger was approximately 7.6billion dollars. In the 1970s, Chase’s revenue began to show a strong international growth trend.

Phase 4: Mega-Mergers and the Modern Map (1991-2008)

Through a series of global-scale acquisitions, the modern giant was formed:

- 1991-1996: Chemical Bank acquired Manufacturers Hanover and subsequently merged with Chase Manhattan Bank, retaining the “Chase” name.

- 2000: Chase Manhattan Bank acquired J.P. Morgan & Co. for approximately 30billion dollars, officially forming JPMorgan Chase & Co.

- 2004: The bank merged with Bank One Corporation, bringing current CEO Jamie Dimon into the company.

- 2008: Amidst the subprime mortgage crisis, JPMorgan Chase acquired the failing investment bank Bear Stearns and Washington Mutual under government mediation.

Most Important Business Development: The establishment of the Universal Banking model. Through consecutive mergers of Chemical Bank, Chase, J.P. Morgan, and Bank One, the bank integrated commercial banking, investment banking, and retail banking into one entity.

Revenue/Asset Level: When Chase and J.P. Morgan merged in 2000, assets were approximately 660billion dollars. Before the 2008 financial crisis, assets exceeded 1.5trillion dollars.

Phase 5: Digital Transformation and Global Expansion (2009-Present)

- Post-Crisis Resilience: Under Jamie Dimon’s leadership, JPMorgan Chase was one of the few major banks to remain profitable during the financial crisis.

- Digital Leadership: The bank has invested billions in fintech, AI, and cloud migration to ensure its dominance in the digital finance era.

- 2023: The bank acquired First Republic Bank after its collapse, further expanding its asset base.

Most Important Business Development: Digital transformation and distressed acquisitions. The 2023 acquisition of First Republic Bank solidified its role as the financial lender of last resort. The bank now invests over 15billion dollars annually in technology R&D.

Revenue/Asset Level:

- 2023 Revenue: 158.1billion dollars.

- 2024 Revenue: 177.6billion dollars.

- 2025 (Estimated): Asset scale officially surpassed 4trillion dollars, with revenue maintaining a historical high above 270billion dollars (including total interest income).

Although the ticker JPM traces back to the 1969 listing of The Chase Manhattan Corporation, the modern revenue scale was primarily forged through a series of massive strategic mergers after 2000.

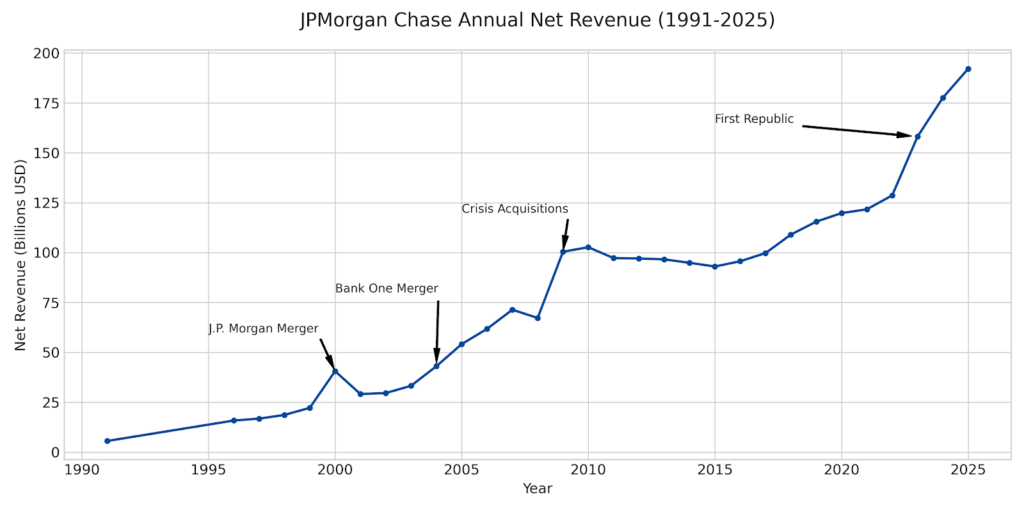

JPMorgan Chase Annual Net Revenue Trend (1991–2025)

- 1991: 5.6billion dollars (Chemical Bank era; merger with Manufacturers Hanover followed).

- 1996: 15.9billion dollars (Chemical Bank acquired Chase Manhattan and adopted the Chase brand).

- 2000: 40.6billion dollars (Chase Manhattan merged with J.P. Morgan & Co.).

- 2004: 43.1billion dollars (Acquisition of Bank One, diversifying the revenue mix).

- 2008: 67.3billion dollars (The onset of the Global Financial Crisis).

- 2009: 100.4billion dollars (The impact of acquiring Bear Stearns and Washington Mutual).

- 2015: 93.5billion dollars (Fluctuations due to a low-interest-rate environment and regulatory costs).

- 2019: 115.7billion dollars (Pre-pandemic peak).

- 2023: 158.1billion dollars (Acquisition of First Republic Bank + high interest income).

- 2024: 177.6billion dollars (Record high based on the full-year 2024 report).

- 2025: 192.1billion dollars (Estimated based on trailing twelve-month (TTM) data as of early 2026).

Data Insights

- Step-Function Growth: The revenue line exhibits sharp upward shifts in 2000, 2009, and 2023. Each jump corresponds to a “crisis acquisition” or a transformative merger that expanded the bank’s scale.

- Revenue Engines: Prior to 2000, the bank relied heavily on commercial interest. Post-2000, investment banking fees and trading revenue became major contributors. Since 2023, the Net Interest Income (NII) driven by Fed rate hikes has been the primary growth engine.

- Asset Dominance: This revenue growth aligns with the expansion of the balance sheet. With total assets now surpassing 4trillion dollars, JPM remains the largest bank in the United States.

Data Sources: